A long straddle strategy is a popular option trading technique that allows investors to capitalize on significant price movements in an underlying asset, regardless of whether the price goes up or down. This strategy involves purchasing both a call option and a put option with the same strike price and expiration date.

When an investor employs a long straddle strategy, they are essentially betting on volatility in the market. Volatility refers to the degree of fluctuation in the price of an asset over a certain period of time. In the context of options trading, higher volatility can lead to larger price swings, which can be advantageous for traders looking to profit from significant market movements.

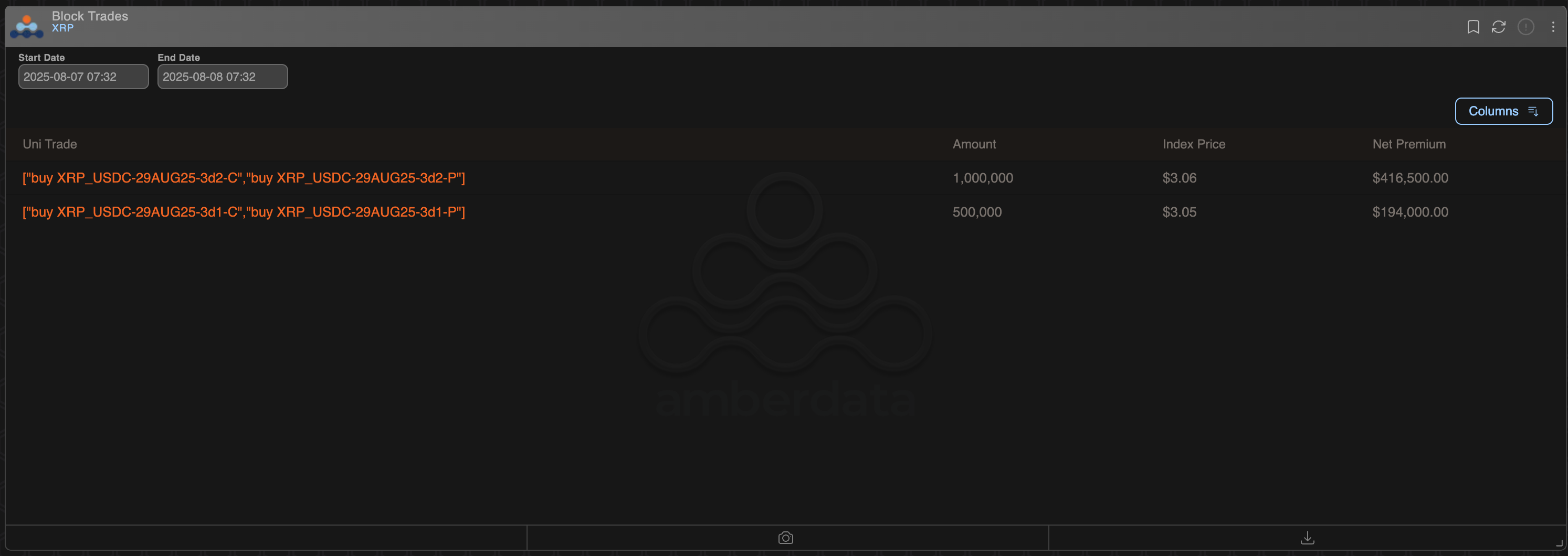

By purchasing both a call and a put option simultaneously, the investor is essentially creating a "straddle" position that allows them to benefit from sharp price movements in either direction. If the price of the underlying asset moves significantly up or down before the options expire, the investor stands to make a profit. The potential for profit is maximized when the price movement is strong enough to offset the cost of purchasing both options.

One of the key advantages of a long straddle strategy is that it offers unlimited profit potential while limiting the downside risk. If the price of the underlying asset remains relatively stable and does not experience significant volatility, the investor's losses are limited to the initial cost of purchasing the options.

However, it is important to note that long straddle strategies can be costly, as they involve purchasing two options instead of just one. Additionally, timing is crucial when implementing this strategy, as the investor needs to anticipate a significant price movement within a specific time frame to realize a profit.

Overall, a long straddle represents a bullish bet on volatility, as investors who employ this strategy are essentially speculating on increased price fluctuations in the market. While it can be a high-risk strategy, it can also offer substantial rewards for traders who correctly predict and capitalize on market volatility. As with any trading strategy, investors should conduct thorough research and analysis before implementing a long straddle to ensure they fully understand the risks and potential rewards involved.

Leave a Reply