As the cryptocurrency market continues to evolve, regulatory clarity has become a key factor influencing the decisions of firms looking to adopt digital assets. According to a recent survey, 54% of firms are planning to incorporate stablecoins into their operations within the next year, signaling a growing interest in these types of cryptocurrencies.

Stablecoins are a type of digital asset designed to minimize price volatility by pegging their value to a stable asset, such as a fiat currency like the US dollar or a commodity like gold. This stability makes them an attractive option for businesses looking to streamline their financial transactions and reduce the risks associated with traditional cryptocurrencies.

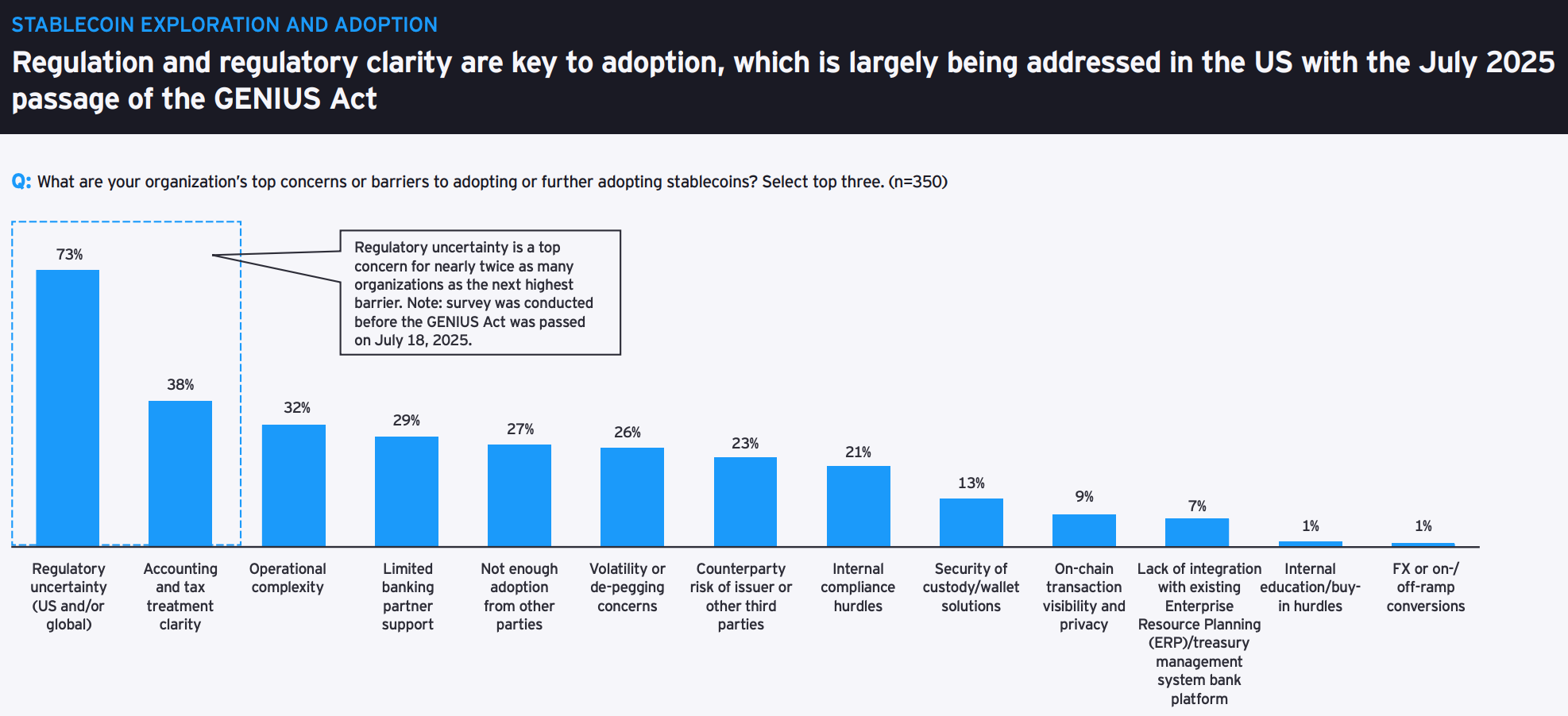

One of the main reasons behind the increasing adoption of stablecoins is the regulatory clarity that has emerged in recent years. Government agencies and financial regulators around the world have started to provide guidelines and regulations for the use of digital assets, giving firms more confidence to explore these technologies.

By opting for stablecoins, companies can benefit from faster and cheaper cross-border transactions, as well as improved transparency and security in their financial operations. These features make stablecoins particularly appealing for businesses involved in international trade or those looking to enhance their payment systems.

Furthermore, stablecoins offer a bridge between traditional finance and the world of cryptocurrencies, allowing firms to access the benefits of blockchain technology without being exposed to the extreme price fluctuations often associated with other digital assets like Bitcoin or Ethereum.

The survey results reflect a growing recognition among businesses of the potential advantages that stablecoins can offer in terms of efficiency, cost-effectiveness, and risk management. By embracing these digital assets, firms can position themselves at the forefront of the digital economy and gain a competitive edge in an increasingly interconnected world.

As the adoption of stablecoins continues to gain momentum, it is likely that more businesses will follow suit in the coming years. With the support of clear regulatory frameworks and the growing maturity of the cryptocurrency market, stablecoins are poised to play an increasingly important role in the global financial system.

In conclusion, the survey findings highlight the shifting attitudes towards stablecoins within the business community and indicate a growing acceptance of these digital assets as a viable tool for enhancing financial operations. With regulatory clarity paving the way for increased adoption, it is clear that stablecoins are set to become a mainstream feature of the modern financial landscape.

Leave a Reply