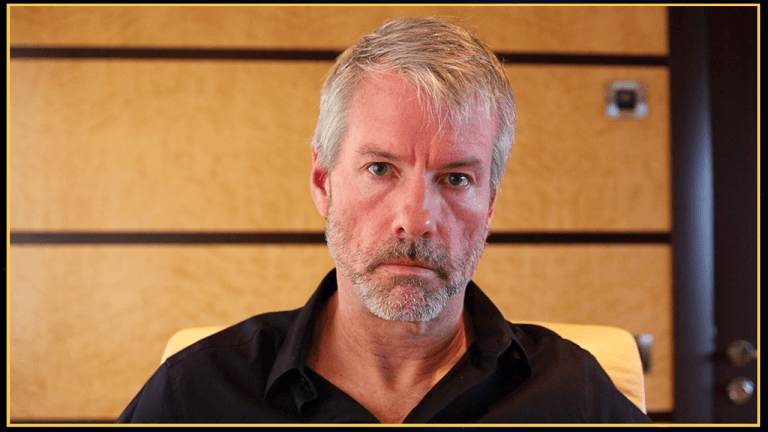

As the countdown to the Bitcoin 2025 conference in Las Vegas begins, the crypto community has been abuzz with discussions on various aspects of the industry. One notable conversation that has sparked debate is the concept of proof-of-reserves, with Strategy founder Michael Saylor taking a firm stance against it.

When asked for his opinion on proof-of-reserves, Saylor did not hold back, categorically dismissing the idea as detrimental to security. He bluntly stated that implementing proof-of-reserves would dilute the security of the system and labeled it a "bad idea" in no uncertain terms.

Saylor's strong stance on reserve transparency has ignited a clash within the crypto community, with opinions divided on the matter. Proponents of proof-of-reserves argue that it is essential for ensuring trust and accountability in the crypto space. By requiring exchanges and other platforms to provide proof that they hold the assets they claim to have, proof-of-reserves aims to prevent fraud and protect investors.

On the other hand, critics like Saylor believe that implementing proof-of-reserves could have unintended consequences. They argue that such a requirement could expose exchanges to security risks by making their reserves a target for hackers. Additionally, they claim that the added complexity and costs associated with maintaining proof-of-reserves systems could outweigh the benefits.

The debate over reserve transparency is not new to the crypto industry. In recent years, there have been several high-profile cases of exchanges collapsing due to insolvency or mismanagement of funds. These incidents have underscored the need for greater transparency and accountability in the sector.

As the industry continues to mature, questions around security and trust will remain at the forefront of discussions. Finding a balance between transparency and security is crucial for building a sustainable and trustworthy crypto ecosystem.

The clash over Saylor's "bad idea" comment on reserve transparency serves as a reminder of the diverse perspectives within the crypto community. While some advocate for stricter measures to ensure accountability, others caution against the potential risks and trade-offs involved.

As the Bitcoin 2025 conference approaches, it is likely that the debate on proof-of-reserves and other key issues facing the crypto industry will continue to evolve. Ultimately, finding common ground and solutions that prioritize both security and transparency will be essential for the long-term success of the sector.

Source: https://news.bitcoin.com/saylor-slams-proof-of-reserves-its-like-publishing-your-kids-bank-accounts/

Leave a Reply