Interest rates have hit a three-year low, leading to a surge in investment activity within the cryptocurrency market. The latest data from CoinDesk Indices reveals that there has been a significant influx of $18 billion into Exchange-Traded Funds (ETFs), indicating a growing interest in digital assets.

The current economic landscape, with interest rates at historically low levels, has created a favorable environment for investors seeking alternative assets to diversify their portfolios. This trend has been particularly beneficial for cryptocurrencies, with Bitcoin (BTC) and altcoins poised for significant gains in the coming months.

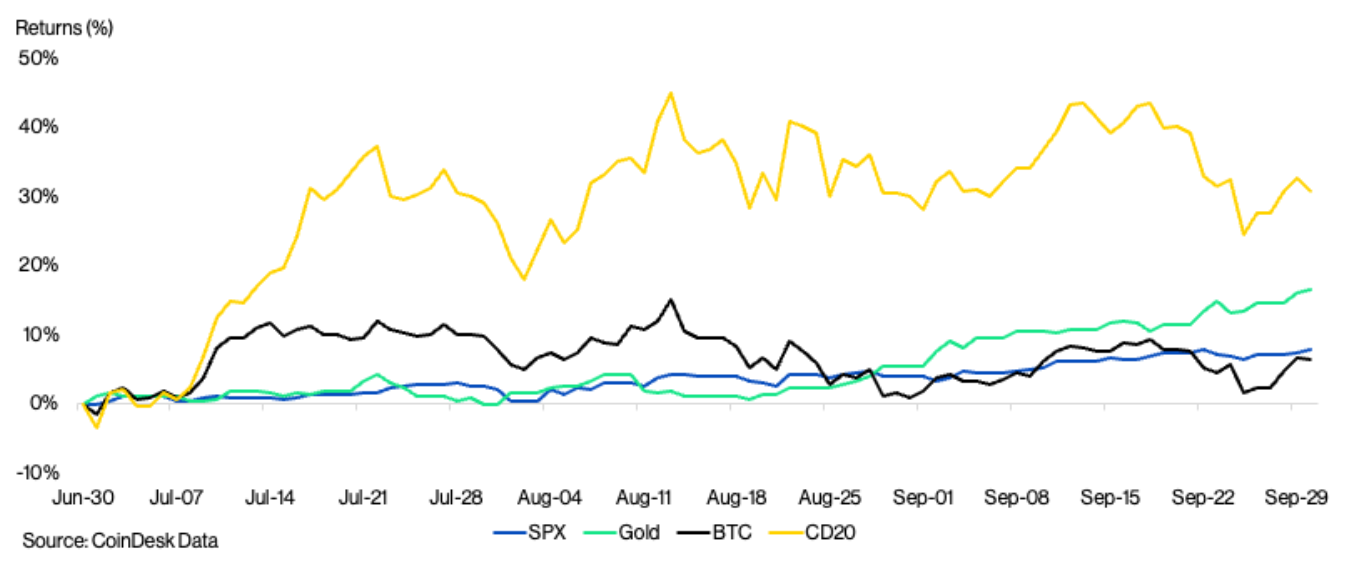

The CoinDesk Indices report highlights the strong setup for continued growth in both BTC and alternative cryptocurrencies. As traditional investment options offer diminished returns due to low interest rates, many investors are turning to digital assets as a way to capitalize on the potential for higher yields.

Bitcoin, the leading cryptocurrency, has been the primary beneficiary of this trend, with its price steadily climbing in recent weeks. Altcoins, or alternative cryptocurrencies, have also experienced notable gains as investors seek to capitalize on the broader market momentum.

The $18 billion inflow into ETFs underscores the increasing acceptance of cryptocurrencies among institutional and retail investors alike. ETFs provide a convenient and regulated way for investors to gain exposure to digital assets without directly holding them, further fueling the growth of the market.

The positive outlook for cryptocurrencies is supported by a combination of factors, including increased adoption, improved regulatory clarity, and growing interest from institutional players. As the global economy continues to grapple with uncertainty, digital assets are increasingly being viewed as a viable hedge against inflation and economic instability.

Moreover, the recent surge in ETF inflows is a clear indicator of the growing mainstream acceptance of cryptocurrencies as a legitimate asset class. This influx of capital is expected to further drive up prices and market activity, paving the way for continued gains in the coming months.

In conclusion, the convergence of low interest rates, increased investment inflows, and favorable market conditions bodes well for the future of cryptocurrencies. As investors seek out alternative opportunities to traditional investments, digital assets like Bitcoin and altcoins are likely to see sustained growth and heightened interest from a broader range of market participants.

Leave a Reply