Bitcoin accumulation is on the rise among both retail and institutional investors, reaching new highs in recent weeks. This trend has caught the attention of analysts, who believe that it could potentially set the stage for a major breakout in the cryptocurrency's price.

As Bitcoin continues to hover around the $109,000 mark, there is a growing sense of stability in the market. Retail investors, who are individual traders and small-time investors, are increasingly acquiring Bitcoin as they see the potential for long-term value appreciation. On the other hand, institutional investors, such as hedge funds, family offices, and corporations, are also ramping up their accumulation of the digital asset.

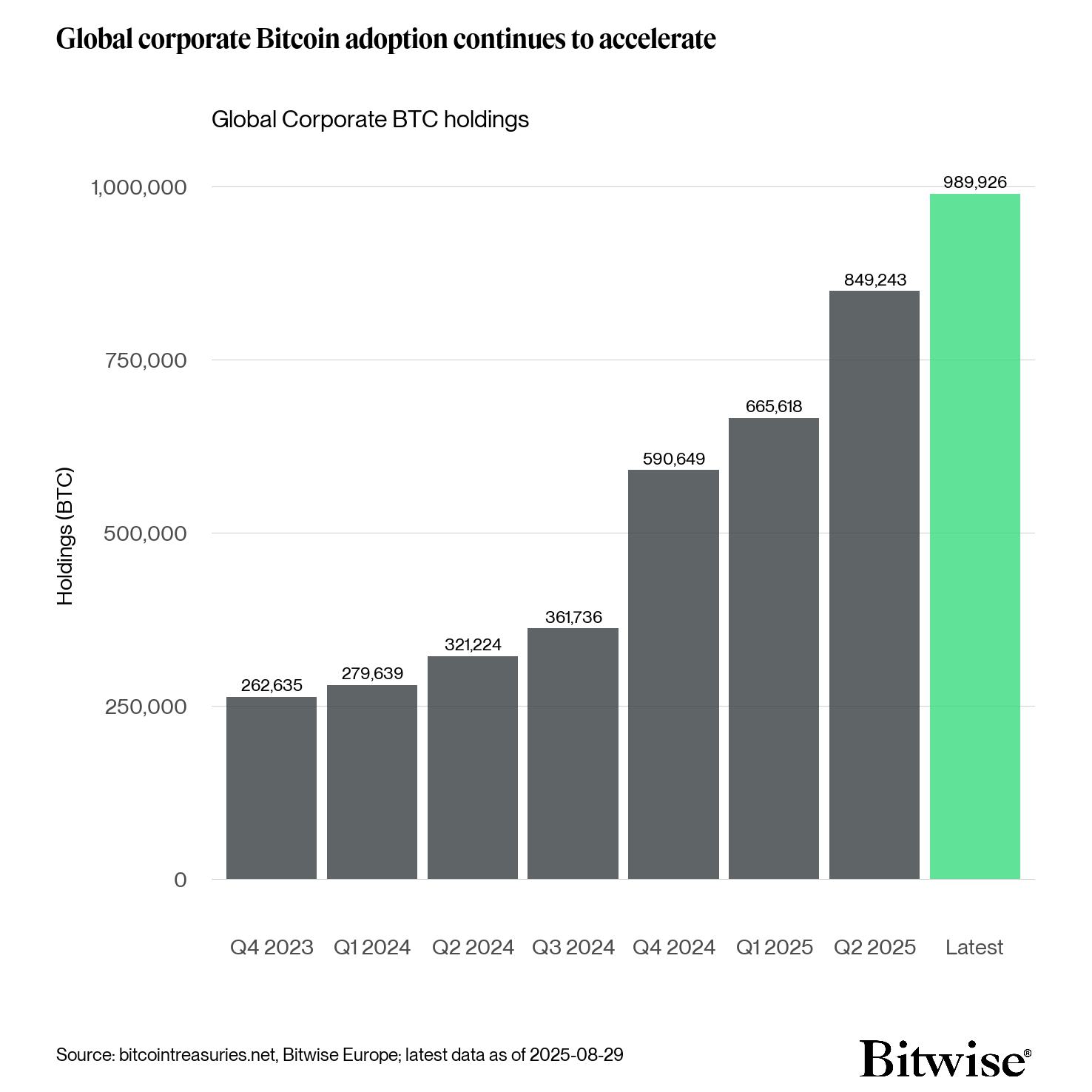

One of the key factors driving this increased accumulation is the growing acceptance and adoption of Bitcoin as a legitimate asset class. Institutional players, in particular, are recognizing the potential of Bitcoin as a store of value and a hedge against inflation. With traditional financial markets facing uncertainty and central banks continuing to print money at unprecedented rates, Bitcoin is increasingly being seen as a safe haven asset.

Analysts believe that the combination of retail and institutional accumulation could lead to a significant price breakout for Bitcoin in the near future. As more investors hold onto their Bitcoin rather than selling it, the scarcity of the asset increases, which could drive up its price. This phenomenon is often referred to as a "supply squeeze," where demand outstrips supply, leading to a surge in prices.

In addition to the increased accumulation of Bitcoin, there are other factors at play that could contribute to a potential price breakout. The recent approval of Bitcoin exchange-traded funds (ETFs) in some countries, such as Canada and Brazil, has provided further legitimacy to the cryptocurrency and opened up new avenues for investment. Furthermore, the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) has brought more attention to the broader cryptocurrency ecosystem.

While the price of Bitcoin has been relatively stable in recent weeks, there is a sense of anticipation in the market as investors wait to see if this accumulation trend will indeed lead to a major breakout. Analysts are closely monitoring key technical indicators and market sentiment to gauge the likelihood of a significant price movement.

In conclusion, the increased accumulation of Bitcoin by both retail and institutional investors is seen as a positive sign for the cryptocurrency's future. As market participants continue to hold onto their Bitcoin holdings, the stage is set for a potential price breakout that could propel Bitcoin to new highs. Investors are advised to stay informed and monitor market developments

Leave a Reply