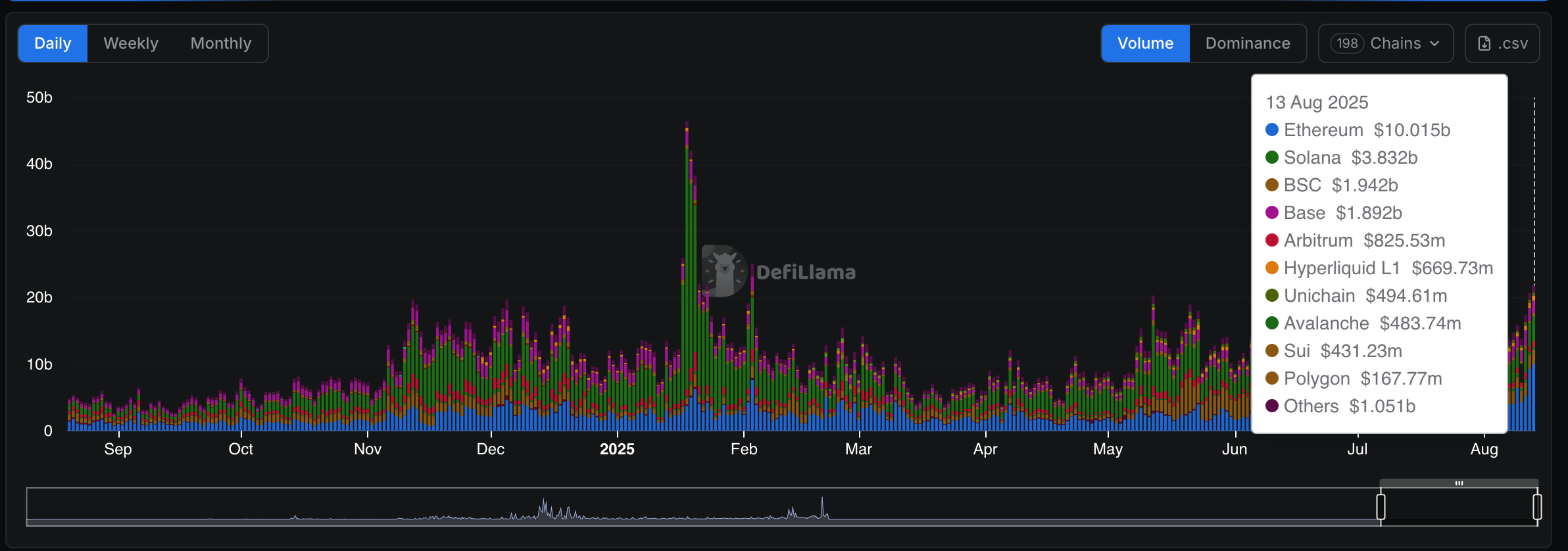

Decentralized exchanges (DEXs) operating on the Ethereum blockchain have recently achieved a significant milestone by surpassing Solana in trading volume. This development marks the first time since April that Ethereum-based DEXs have outperformed Solana, a popular blockchain platform known for its high-speed transactions and low fees.

The surge in trading volume on Ethereum-based DEXs can be attributed to several key factors, including a record influx of funds into spot exchange-traded funds (ETFs) and a notable increase in institutional demand for decentralized finance (DeFi) products and services.

One of the primary drivers behind this shift is the growing popularity of Ethereum's decentralized finance ecosystem, which offers users a wide range of financial services without the need for traditional intermediaries. DeFi protocols built on Ethereum enable users to trade, lend, borrow, and stake cryptocurrencies directly from their digital wallets, providing a more efficient and decentralized alternative to traditional financial systems.

Furthermore, the recent increase in spot ETF inflows has injected additional liquidity into the cryptocurrency markets, leading to higher trading volumes on Ethereum-based DEXs. Spot ETFs are investment vehicles that track the performance of a specific asset or index, allowing investors to gain exposure to various cryptocurrencies without directly holding them.

Institutional interest in DeFi has also played a significant role in driving trading activity on Ethereum-based DEXs. As more institutional investors seek exposure to digital assets and decentralized protocols, they are turning to DeFi platforms on Ethereum to access innovative financial products and services. The influx of institutional capital into the DeFi space has contributed to the overall growth and development of the Ethereum ecosystem.

The competition between Ethereum and Solana in the decentralized exchange space reflects the ongoing evolution of blockchain technology and its applications. While Solana is known for its high throughput and low transaction fees, Ethereum remains the dominant platform for DeFi due to its established network effects and robust developer community.

As Ethereum-based DEXs continue to gain traction and attract more users, it is likely that trading volumes will continue to rise, further solidifying Ethereum's position as a leading blockchain platform for decentralized finance. With ongoing advancements in scalability and interoperability, Ethereum is well-positioned to maintain its competitive edge in the rapidly evolving DeFi landscape.

In conclusion, the recent surge in trading volume on Ethereum-based DEXs signals a growing interest in decentralized finance and highlights the platform's resilience and adaptability in the face of increasing competition. As the DeFi ecosystem continues to mature, Ethereum is poised

Leave a Reply