As the financial markets eagerly anticipate the Federal Reserve's upcoming decision on September 17 regarding a potential interest rate cut, investors are preparing for potential fluctuations in the markets. Historically, when the Fed has announced rate cuts, there has been a pattern of short-term volatility followed by longer-term positive outcomes for risk assets and gold.

The Federal Reserve plays a crucial role in shaping the economic landscape by adjusting interest rates to control inflation and stimulate economic growth. A rate cut is generally seen as a measure to boost economic activity by reducing the cost of borrowing, which can lead to increased consumer spending and investment. However, the impact of a rate cut on financial markets can be complex and unpredictable.

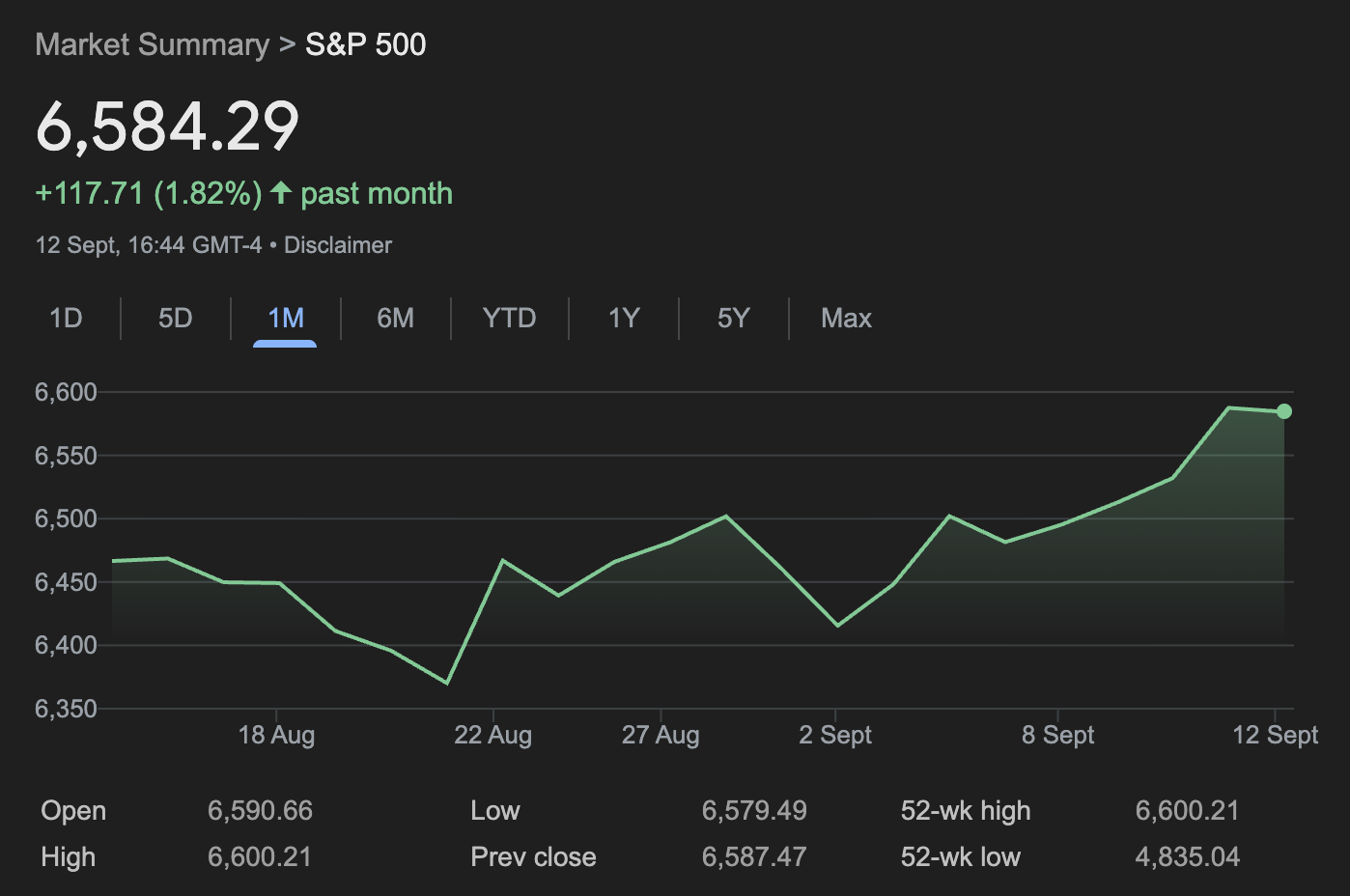

In the short term, the announcement of a rate cut can lead to increased market volatility as investors react to the news and adjust their strategies accordingly. Stock prices may experience fluctuations as market participants digest the implications of the Fed's decision. Similarly, the value of the dollar and other currencies may also be affected by the rate cut announcement.

Despite the short-term turbulence that rate cuts can trigger in the markets, historical data suggests that risk assets such as stocks tend to perform well in the aftermath of rate cuts. Lower interest rates can make equities more attractive to investors seeking higher returns, leading to potential gains in the stock market over the longer term. Additionally, rate cuts can support economic growth, which can further boost corporate earnings and stock prices.

In addition to stocks, gold is another asset that has historically benefited from rate cuts. As a traditional safe-haven asset, gold tends to perform well in times of economic uncertainty or market volatility. Lower interest rates can weaken the value of the dollar, making gold more attractive to investors seeking a hedge against inflation and currency depreciation.

Overall, while the announcement of a rate cut by the Federal Reserve may initially lead to market volatility, the longer-term outlook for risk assets and gold appears positive. Investors should carefully monitor the Fed's decision and consider the potential implications for their investment portfolios. By staying informed and being prepared for market fluctuations, investors can navigate the impact of rate cuts and position themselves for potential opportunities in the financial markets.

Leave a Reply