In the ever-evolving world of cryptocurrency, last week brought a mix of stability, innovation, and introspection to the markets. While headline-driven volatility took a backseat, the trend of institutional bitcoin accumulation continued to make waves. Alongside this, the emerging trend of tokenized equities made a notable debut, signaling a potential shift in how traditional financial assets are being digitized and traded on blockchain platforms.

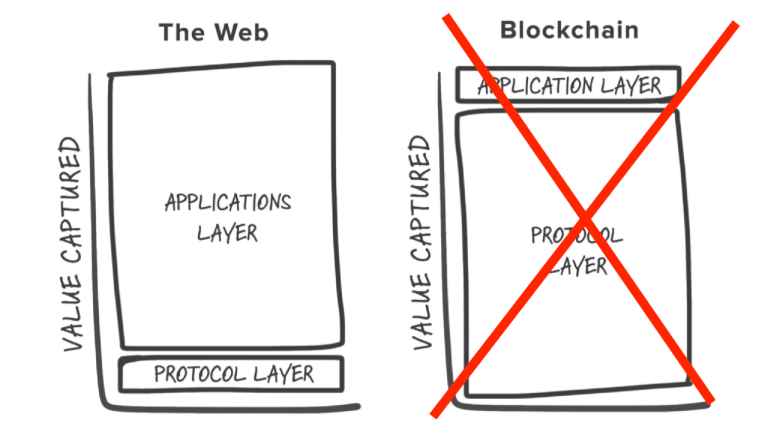

Despite the relative calm in the markets, a broader conversation is underway as investors begin to question the longstanding Fat Protocol thesis. This thesis, coined by venture capitalist Joel Monegro in 2016, posits that value in the crypto space accrues at the protocol layer (the underlying blockchain network) rather than at the application layer (individual projects or tokens). The recent scrutiny around this theory reflects a growing awareness of the complexities and nuances within the crypto ecosystem, as well as a recognition of the evolving dynamics shaping the industry.

Institutional interest in bitcoin continued to be a key theme last week, with reports of major financial players increasing their exposure to the leading cryptocurrency. This ongoing accumulation by institutional investors is seen as a bullish sign for the market, as it indicates growing confidence in bitcoin as a store of value and a hedge against inflation. The trend also underscores the gradual mainstream acceptance of digital assets within traditional financial circles.

On the innovation front, the debut of tokenized equities marked a significant milestone in the intersection of traditional finance and blockchain technology. Tokenized equities are digital representations of shares in traditional companies, issued and traded on blockchain networks. This innovation has the potential to streamline the trading of traditional assets, offering increased liquidity, transparency, and accessibility to a global investor base.

Amidst these developments, the crypto community is engaging in a critical reassessment of the Fat Protocol thesis. As the industry matures and new use cases emerge, questions are being raised about the distribution of value within the ecosystem and the role of protocols versus applications in driving innovation and adoption. This introspection signals a maturation phase for the industry, where deeper analysis and scrutiny are shaping the narrative around the future of blockchain technology and decentralized finance.

In conclusion, last week's activities in the crypto space reflect a dynamic landscape where stability, innovation, and introspection are driving the evolution of the industry. From institutional bitcoin accumulation to the rise of tokenized equities and the ongoing debate around the Fat Protocol thesis, the past week offered a glimpse into the multifaceted nature of the crypto ecosystem and the exciting possibilities

Source: https://news.bitcoin.com/fat-protocols-are-out-fat-apps-are-in/

Leave a Reply