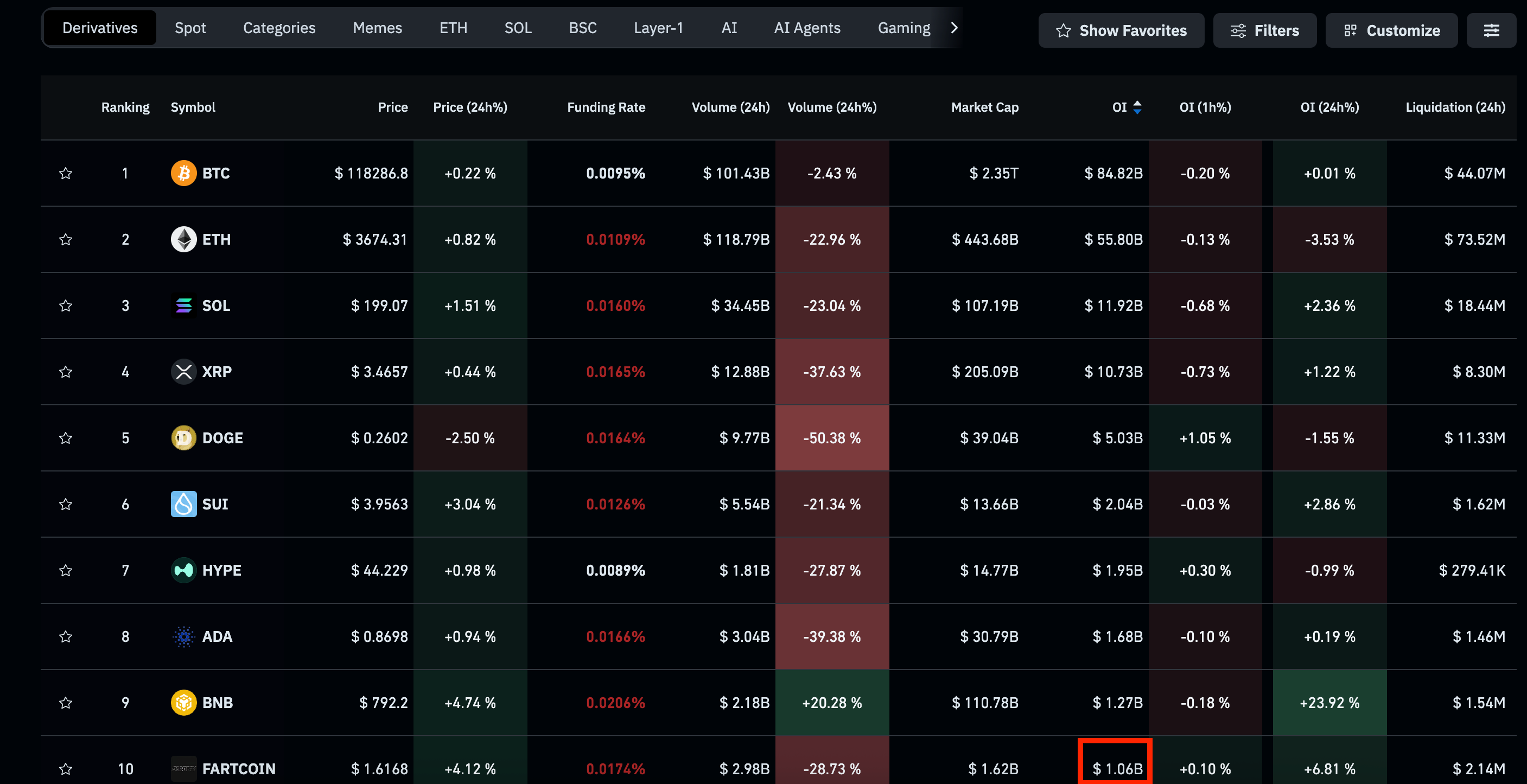

The cryptocurrency market has been a hotbed of activity in recent years, with a plethora of smaller cryptocurrencies gaining traction alongside the more well-known ones like Bitcoin and Ethereum. However, a recent trend has emerged that has caught the attention of market analysts and traders alike: smaller cryptocurrencies are showing disproportionately high open interest compared to their market capitalization.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. In the context of cryptocurrencies, high open interest indicates a high level of trading activity and interest in a particular asset. Market capitalization, on the other hand, is a measure of the total value of a cryptocurrency in circulation and is often used as an indicator of its overall size and popularity in the market.

When smaller cryptocurrencies exhibit a high open interest relative to their market capitalization, it can signal potential risks for traders. This disparity suggests that a significant amount of trading activity is concentrated in a relatively small number of tokens, which can lead to increased volatility and price manipulation. In extreme cases, it could also indicate that a particular cryptocurrency is being artificially inflated through trading activity, creating a potential bubble that may burst in the future.

Traders and investors should be cautious when dealing with cryptocurrencies that exhibit this imbalance between open interest and market capitalization. While high open interest can present opportunities for profit, it also carries a higher level of risk due to the potential for sudden price swings and market manipulation. It is essential for traders to conduct thorough research and due diligence before investing in smaller cryptocurrencies with disproportionately high open interest.

One possible explanation for this phenomenon is the speculative nature of the cryptocurrency market, where traders are drawn to smaller tokens in the hopes of striking it rich quickly. The use of leverage and derivative products in cryptocurrency trading can further amplify this trend, as traders seek to maximize their profits through risky trading strategies.

Regulators and industry watchdogs have also raised concerns about the potential risks associated with high open interest in smaller cryptocurrencies. Market manipulation, insider trading, and other illicit activities can thrive in an environment where trading volume is concentrated in a few select tokens. As a result, authorities are increasingly scrutinizing the cryptocurrency market to ensure fair and transparent trading practices.

In conclusion, the disproportionate relationship between open interest and market capitalization in smaller cryptocurrencies should serve as a warning sign for traders. While the potential for high returns may be tempting, it is crucial to approach these assets with caution and to be aware of the risks involved. By staying informed and conducting thorough research

Leave a Reply