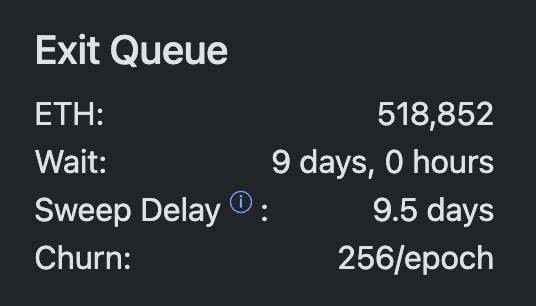

The recent exodus of Ethereum (ETH) from exchanges has caused a significant backlog, with waiting times stretching to over 9 days. This surge in withdrawals has been attributed to various factors, including increased staking demand from Ethereum treasury firms and recent regulatory clarity from the U.S. Securities and Exchange Commission (SEC).

Staking has become a popular trend in the cryptocurrency space, allowing investors to earn rewards by participating in the network validation process. Many Ethereum holders have chosen to stake their tokens rather than leaving them on exchanges, leading to a decrease in available supply on trading platforms. This trend has contributed to the extended waiting times for withdrawals as exchanges struggle to keep up with the high demand.

In addition to the staking demand, recent regulatory developments have also played a role in the exodus of Ethereum from exchanges. The SEC's recent statements regarding the classification of cryptocurrencies have provided some clarity to market participants, potentially easing concerns around compliance and regulatory risks. This increased clarity may have encouraged more investors to withdraw their Ethereum holdings from exchanges and store them in secure wallets.

Despite the backlog and extended waiting times, the strong staking demand from Ethereum treasury firms and the regulatory clarity provided by the SEC may help keep sell pressure in check. As more Ethereum is staked and taken out of circulation, the supply available for trading on exchanges could decrease, potentially leading to a reduction in selling pressure.

It is worth noting that the exodus of Ethereum from exchanges reflects a broader trend in the cryptocurrency market towards self-custody and decentralized finance (DeFi). Many investors are choosing to hold their assets in secure wallets or participate in staking and DeFi protocols rather than keeping them on centralized exchanges. This shift towards self-custody is seen as a way to increase security and control over one's assets, as well as to earn additional rewards through staking and other passive income opportunities.

Overall, the exodus of Ethereum from exchanges highlights the growing interest in staking and self-custody within the cryptocurrency community. As more investors choose to stake their tokens and withdraw them from exchanges, the dynamics of the market are likely to shift, potentially impacting supply and demand dynamics for Ethereum and other cryptocurrencies.

Leave a Reply