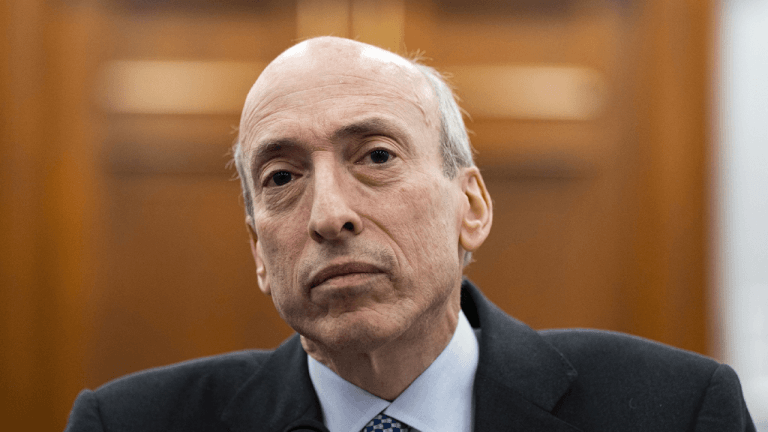

The cryptocurrency industry is up in arms after the U.S. Securities and Exchange Commission (SEC) confirmed that nearly a year's worth of text messages from former Chair Gary Gensler's government phone have been irretrievably lost due to "avoidable errors." This revelation has sparked outrage and accusations of a double standard within the SEC, with many in the crypto sector criticizing the agency's handling of sensitive information.

The SEC's Office of Inspector General recently released a report highlighting the loss of Gensler's text messages, pointing to avoidable mistakes as the cause. The report has raised concerns about the SEC's data retention policies and its ability to safeguard important communications. The loss of Gensler's text messages has also fueled suspicions within the crypto community about the transparency and accountability of the regulatory agency.

In response to the controversy, the SEC has agreed to implement fixes to prevent similar data loss incidents in the future. However, the damage has already been done in the eyes of many in the crypto industry, who view this incident as indicative of a broader issue of inconsistency and negligence within the regulatory body.

Critics argue that if a private company were to lose crucial electronic communications in a similar manner, it would likely face severe repercussions. The fact that a government agency like the SEC can mishandle sensitive data without facing significant consequences has raised concerns about the unequal treatment of different entities in the regulatory landscape.

The loss of Gensler's text messages is particularly concerning given the increasing scrutiny of the cryptocurrency industry by regulatory bodies like the SEC. As the SEC continues to ramp up its oversight of crypto-related activities, the industry is calling for more transparency and accountability from the regulatory agency.

This incident has also highlighted the challenges of regulating a fast-paced and rapidly evolving sector like cryptocurrency. With new technologies and innovations constantly emerging, regulators like the SEC must adapt their strategies to effectively oversee the industry while also ensuring the protection of sensitive data and communications.

In conclusion, the loss of Gary Gensler's text messages has sparked a heated debate within the cryptocurrency industry about the SEC's transparency, accountability, and data management practices. As regulators and industry players navigate the complexities of the evolving crypto landscape, incidents like this serve as a reminder of the need for robust regulatory frameworks and stringent data protection measures to safeguard against potential breaches and information losses.

Leave a Reply