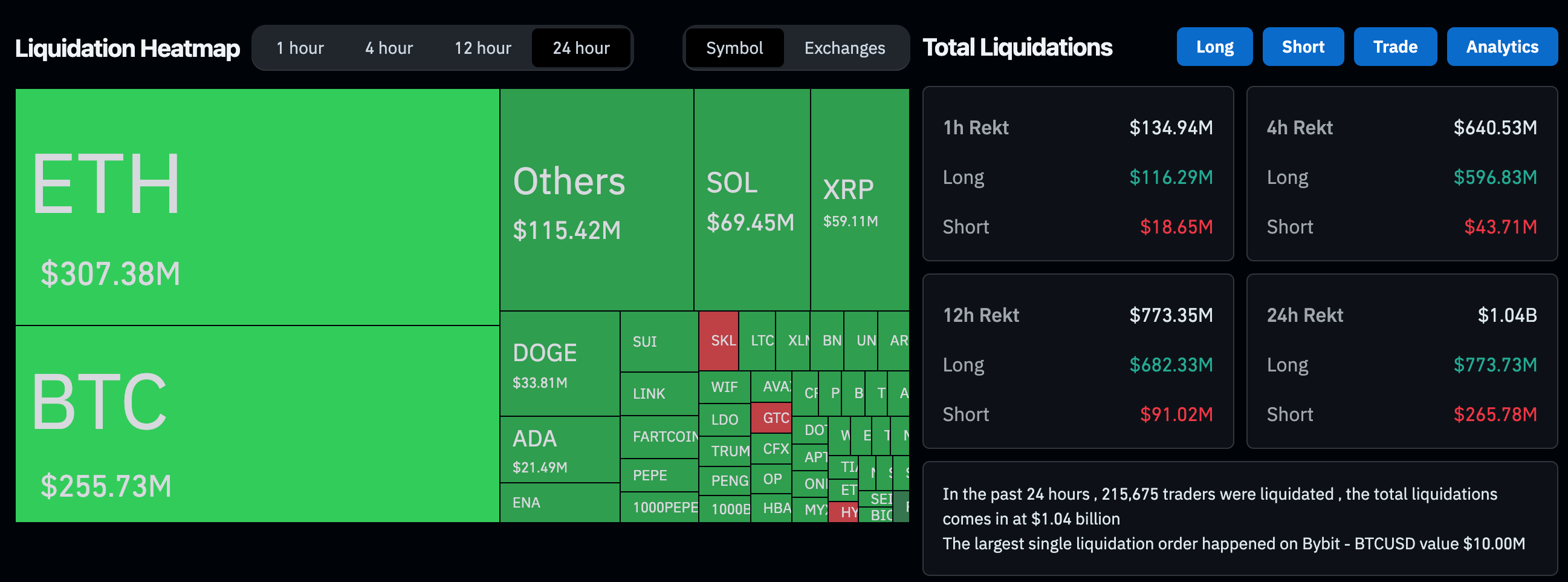

Cryptocurrency market analysts and strategists have recently commented on the current state of the crypto market, noting that despite the occurrence of the largest long liquidations since early August, the broader outlook for the crypto rally remains positive.

Long liquidations refer to the forced closure of long positions in the market, often triggered by significant price drops or volatility. In the context of cryptocurrency trading, long positions are investments in which traders bet on the price of an asset increasing over time. When these positions are liquidated, it means that traders are forced to sell their holdings at a loss, typically leading to a cascading effect that can exacerbate market downturns.

The recent wave of long liquidations in the crypto market has raised concerns among some investors and traders. However, market strategists are quick to point out that this phenomenon is not necessarily indicative of a broader negative trend. In fact, many experts believe that the overall outlook for the crypto market remains positive despite these short-term fluctuations.

One of the key reasons for this optimism is the growing mainstream adoption of cryptocurrencies and blockchain technology. Over the past year, we have seen a significant increase in institutional interest in digital assets, with major companies and financial institutions investing in Bitcoin and other cryptocurrencies. This influx of institutional capital has helped to legitimize the crypto market and has paved the way for further growth and development.

Additionally, the ongoing development of decentralized finance (DeFi) projects and non-fungible tokens (NFTs) has added new layers of utility and value to the crypto ecosystem. These innovative applications of blockchain technology have the potential to revolutionize traditional finance and create new opportunities for investors and users alike.

Furthermore, regulatory developments in the crypto space have also been largely positive in recent months. While there are still challenges and uncertainties surrounding cryptocurrency regulation, many governments and regulatory bodies around the world are taking a more nuanced and collaborative approach to overseeing the industry. This growing regulatory clarity is expected to foster greater confidence among investors and further drive adoption of cryptocurrencies.

In conclusion, while the recent long liquidations in the crypto market may have caused some short-term turbulence, the broader outlook for the industry remains positive. With increasing mainstream adoption, ongoing technological innovation, and improving regulatory clarity, the fundamentals of the crypto market remain strong. As such, many market strategists believe that the recent setbacks are likely to be temporary and that the long-term trajectory for cryptocurrencies remains promising.

Leave a Reply