In recent regulatory developments, authorities have taken steps that could potentially pave the way for a significant influx of new cryptocurrency products entering the market. While this development has sparked excitement within the crypto community, analysts are quick to caution that the mere introduction of these products may not necessarily translate into a surge in demand.

The regulatory landscape surrounding cryptocurrencies has been a topic of much debate and scrutiny over the years. In many jurisdictions, regulators have grappled with how to effectively oversee and govern the rapidly evolving and often opaque world of digital assets. However, recent moves by regulators suggest a growing acceptance and willingness to engage with the crypto industry, which could open the doors for a wave of new products to hit the market.

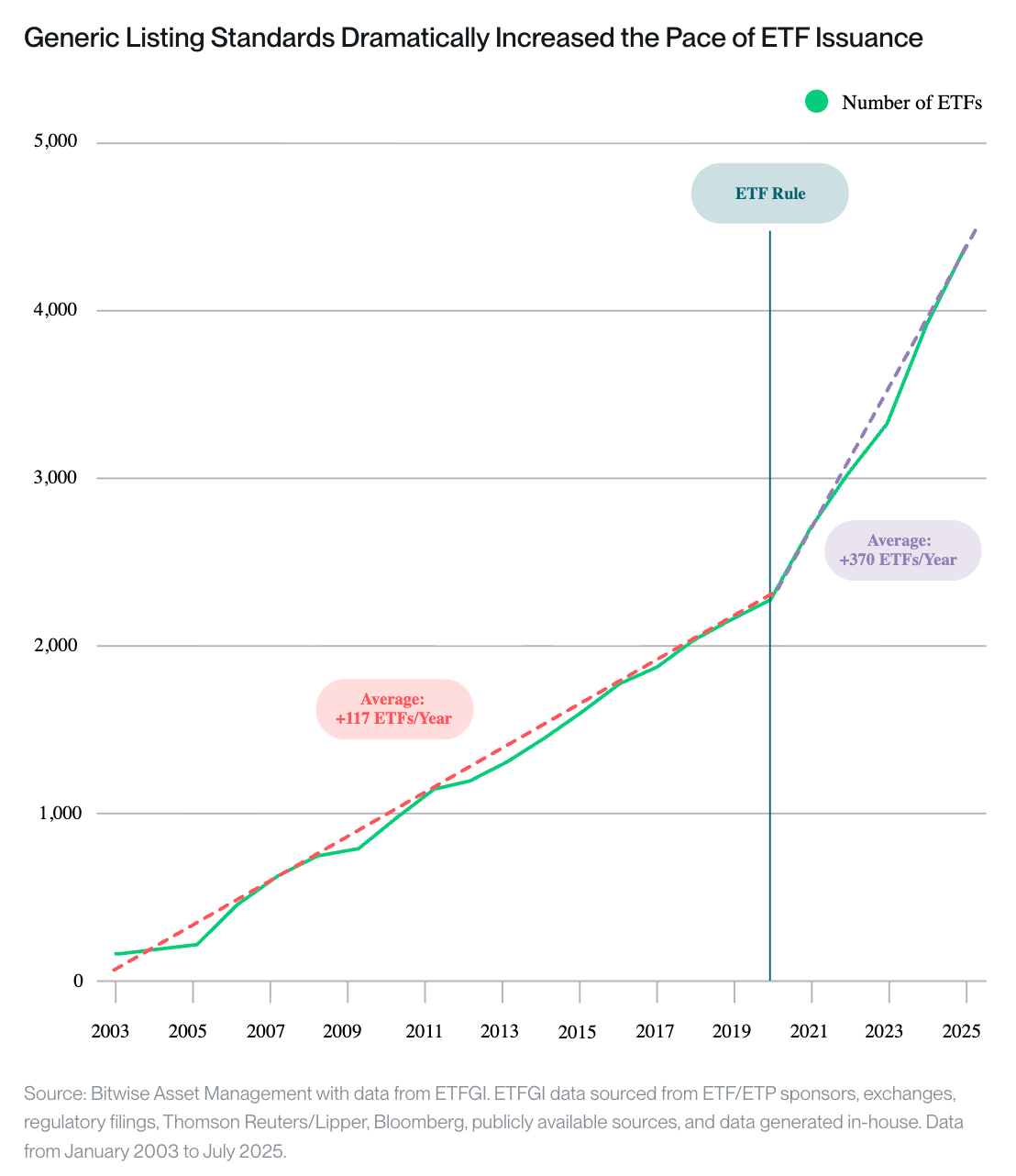

The approval or introduction of new crypto products, such as exchange-traded funds (ETFs) or other investment vehicles, can provide investors with more avenues to gain exposure to digital assets. This increased accessibility may attract a broader range of investors, including institutional players who have thus far been cautious about diving into the crypto space.

While the emergence of new products is undoubtedly a positive development for the crypto industry, analysts are quick to point out that the success of these products will ultimately depend on a variety of factors beyond regulatory approval. Market demand, investor sentiment, and overall market conditions will all play a crucial role in determining the adoption and success of these new offerings.

One key consideration is whether there is a genuine appetite for these products among investors. While the crypto market has seen significant growth and interest in recent years, there is still a degree of skepticism and uncertainty surrounding digital assets. Convincing traditional investors to allocate capital to these new products may require a concerted effort to educate them about the potential benefits and risks associated with cryptocurrencies.

Moreover, the broader market environment can also impact the success of new crypto products. Factors such as market volatility, regulatory changes, and macroeconomic conditions can all influence investor behavior and appetite for risk. As such, the success of new crypto products may hinge on the ability of market participants to navigate these uncertainties and adapt to changing conditions.

In conclusion, while the regulatory approval of new crypto products is a positive step for the industry, it is important to recognize that this alone may not be sufficient to drive demand. The success of these products will depend on a combination of factors, including market demand, investor sentiment, and overall market conditions. As the crypto industry continues to evolve and mature, it will be crucial for market participants to carefully monitor these developments and adapt their strategies accordingly.

Leave a Reply