On May 6, 2025, the cryptocurrency market is showing signs of potential volatility as various factors come into play. Investors and traders are closely monitoring key developments in the industry to make informed decisions about their investments.

One of the factors influencing the market is the ongoing regulatory scrutiny faced by cryptocurrencies. Governments around the world are increasingly focusing on regulating the digital asset space to ensure investor protection and financial stability. Any new regulatory announcements or actions could impact market sentiment and prices.

Another factor to consider is the overall economic environment. Global economic indicators, such as inflation rates, interest rates, and geopolitical events, can all influence investor behavior and market trends. In times of economic uncertainty, investors may flock to cryptocurrencies as a hedge against traditional assets.

Furthermore, technological advancements and adoption rates play a significant role in shaping the cryptocurrency market. Developments in blockchain technology, new use cases for cryptocurrencies, and increased institutional adoption can all contribute to market movements.

Bitcoin, as the leading cryptocurrency, often sets the tone for the rest of the market. Traders will be keeping a close eye on Bitcoin's price action and market dominance to gauge the overall health of the cryptocurrency market.

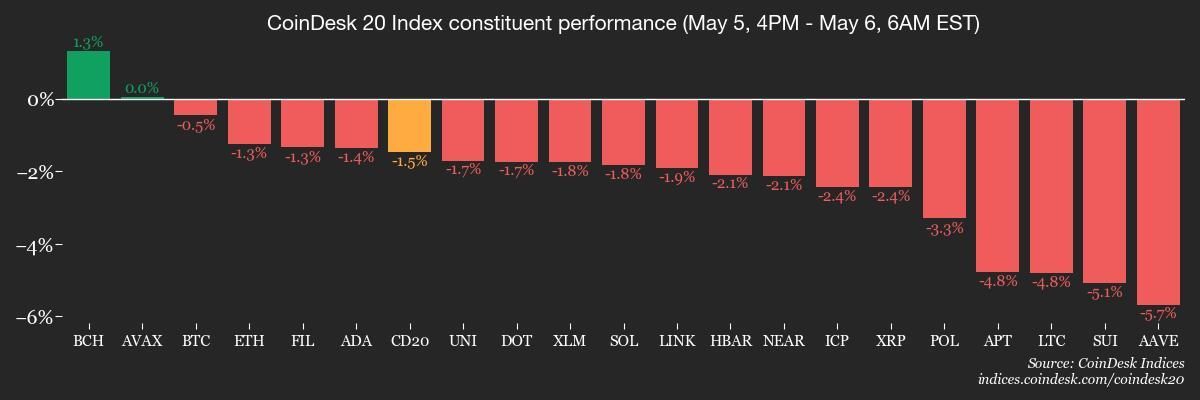

Altcoins, or alternative cryptocurrencies, may also experience significant price movements based on their individual developments and market trends. Some altcoins may outperform Bitcoin, while others may struggle to maintain their value.

In addition to market factors, traders should also consider technical analysis indicators to make informed trading decisions. Chart patterns, trading volumes, and moving averages can provide valuable insights into potential price movements.

Overall, May 6, 2025, presents a mix of opportunities and risks for cryptocurrency investors. Keeping a close watch on regulatory developments, economic indicators, technological advancements, and market trends can help traders navigate the dynamic cryptocurrency market.

As always, it is essential for investors to conduct thorough research, diversify their portfolios, and exercise caution when trading cryptocurrencies. The market's inherent volatility and speculative nature require a disciplined approach to risk management to ensure long-term success in the digital asset space.

Leave a Reply