NYDIG Research, a leading provider of investment and technology solutions for Bitcoin, recently released a report highlighting a potentially lucrative strategy for traders looking to capitalize on low volatility in the cryptocurrency market. The report suggests that utilizing Bitcoin options could offer a cost-effective way for directional traders to benefit from market movements.

Bitcoin, known for its price volatility, can present challenges for traders seeking to profit from price fluctuations. However, NYDIG Research proposes that using Bitcoin options can provide a more affordable and efficient means of participating in the market without the need to directly buy or sell the underlying asset.

Options are financial instruments that give traders the right, but not the obligation, to buy or sell an asset at a specified price within a set timeframe. By purchasing Bitcoin options, traders can potentially profit from price movements in the cryptocurrency without having to take on the full risk of holding the asset itself.

According to NYDIG Research, playing the low volatility of Bitcoin through options could offer a relatively inexpensive trade for directional traders. This strategy allows traders to take a position on the future price movement of Bitcoin while limiting their potential losses to the premium paid for the option.

One of the key advantages of using options to trade Bitcoin is the ability to leverage capital more efficiently. Traders can control a larger position in the market with a smaller amount of capital by purchasing options, compared to buying or selling the actual cryptocurrency. This can help traders maximize their potential returns while managing their risk exposure.

Additionally, Bitcoin options provide flexibility in trading strategies, allowing traders to implement various approaches based on their market outlook. Whether bullish, bearish, or neutral on Bitcoin's price direction, traders can use options to tailor their positions accordingly and potentially profit from different market scenarios.

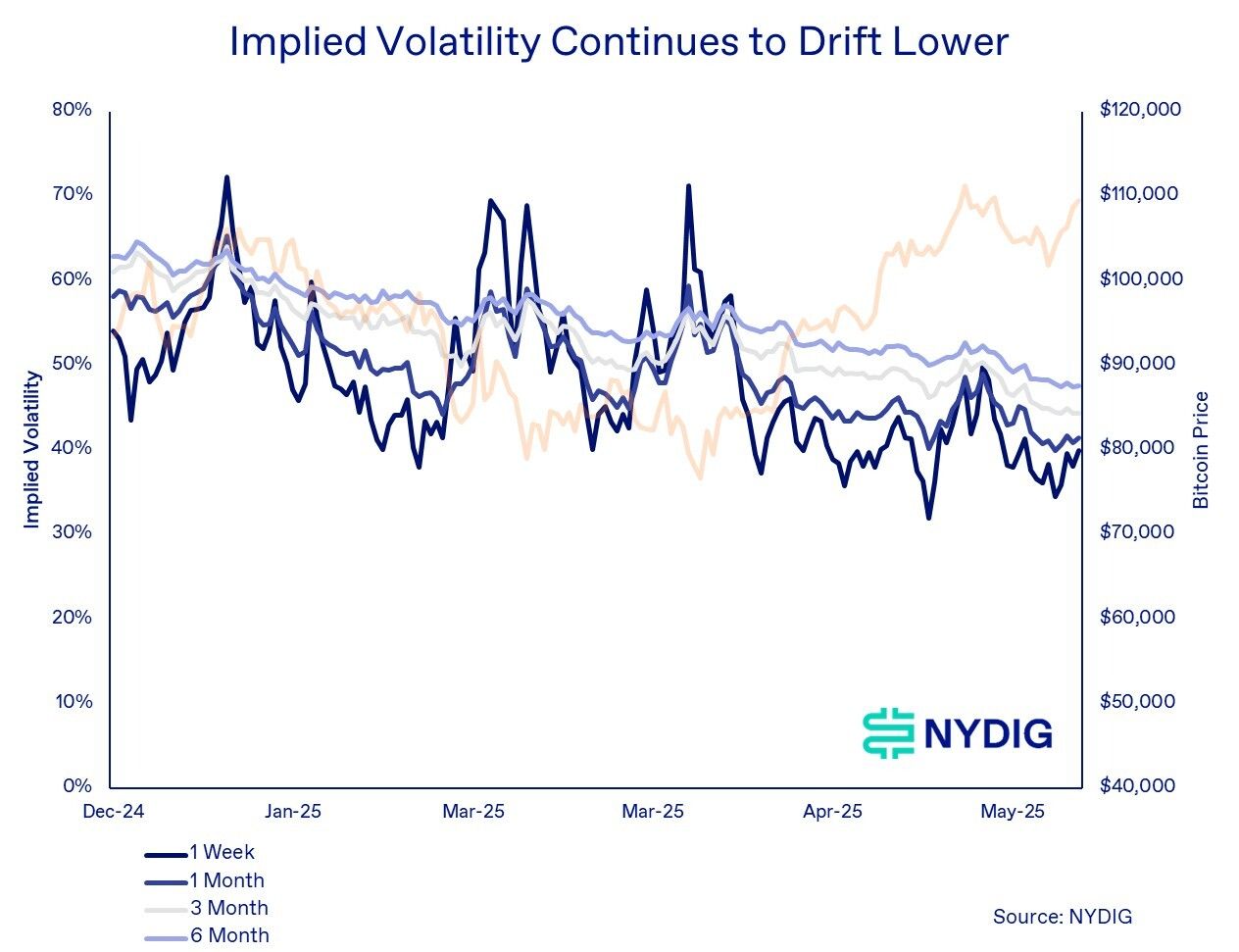

While Bitcoin options can offer a cost-effective way to trade low volatility, it is essential for traders to understand the risks involved. Options trading carries its own set of complexities, including factors such as time decay and implied volatility, which can impact the value of the options contract.

As the cryptocurrency market continues to evolve, innovative trading strategies like utilizing Bitcoin options can provide traders with alternative ways to participate in the market and potentially generate profits. By leveraging the benefits of options trading, traders can navigate the volatility of Bitcoin more effectively and capitalize on market opportunities with reduced capital requirements.

Leave a Reply