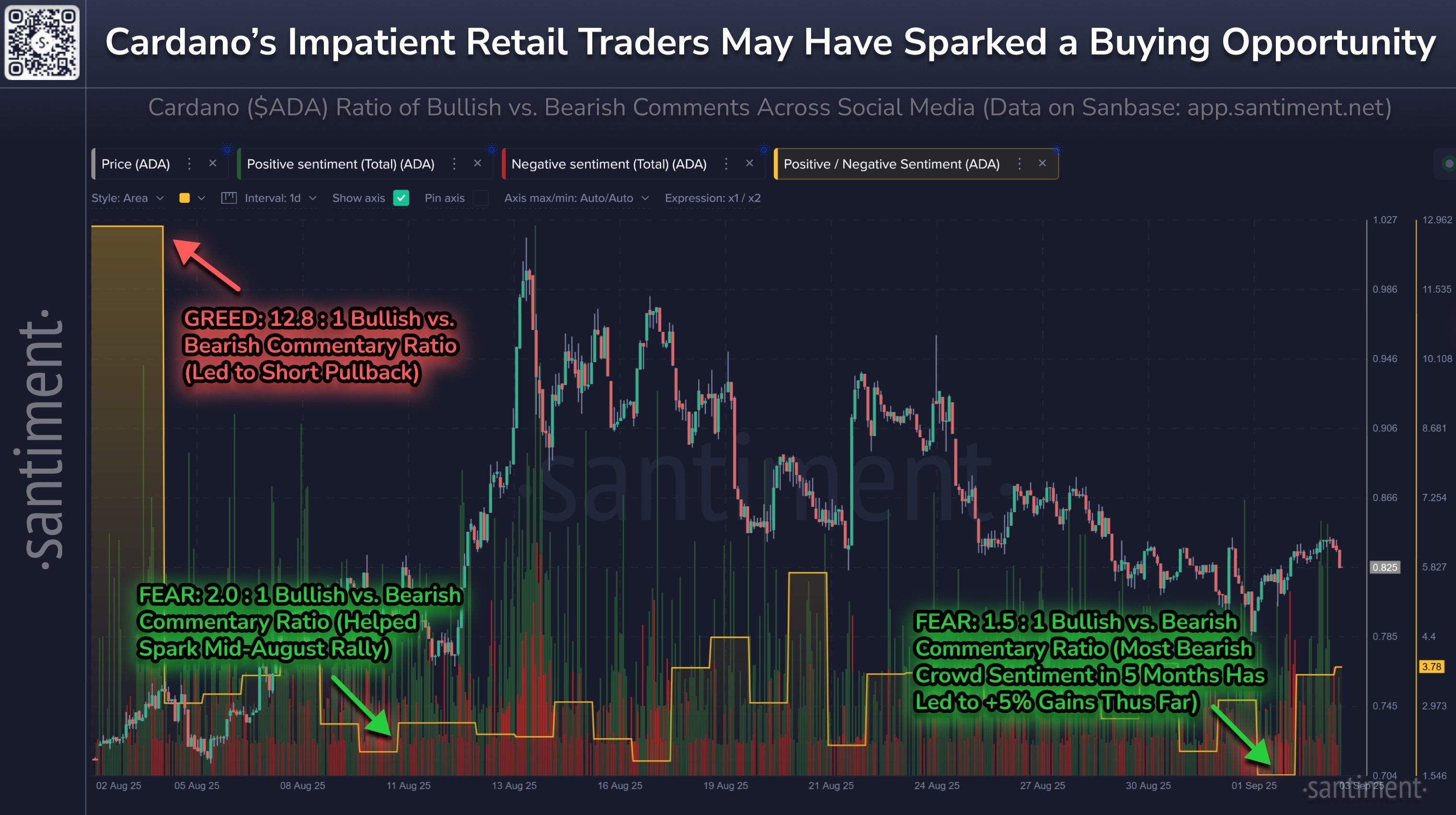

The recent fluctuations in the cryptocurrency market have left many traders on edge. One notable occurrence was a sentiment dip that coincided with a 5% rebound in prices. This rebound hinted at the possibility that traders who had sold in frustration may have inadvertently helped to establish a temporary bottom in the market.

Market sentiment plays a crucial role in determining the direction of asset prices, especially in the volatile world of cryptocurrencies. When sentiment is low, it often leads to panic selling as traders rush to offload their holdings in fear of further losses. This can create a self-reinforcing cycle where selling pressure drives prices down even further.

However, the sudden rebound following the sentiment dip suggests that some traders may have overreacted to the market conditions. By selling out of frustration, they may have unintentionally contributed to the stabilization of prices. This phenomenon is not uncommon in the cryptocurrency market, where emotions can run high and knee-jerk reactions are common.

It is important for traders to maintain a level head and not let emotions dictate their investment decisions. While market volatility can be unnerving, it is crucial to take a step back and assess the situation rationally. Selling into panic can often lead to missed opportunities for gains, as the market has a tendency to bounce back after periods of extreme pessimism.

In this case, the rebound following the sentiment dip serves as a reminder that market bottoms can be difficult to predict. While it is tempting to try and time the market, it is often more prudent to stick to a long-term investment strategy based on solid research and analysis.

As the cryptocurrency market continues to mature, it is likely that we will see more instances of sentiment-driven price movements. Traders should be prepared for these fluctuations and develop strategies to navigate them effectively. By staying informed and maintaining a disciplined approach to trading, investors can weather the ups and downs of the market with greater confidence.

In conclusion, the recent sentiment dip and subsequent rebound in cryptocurrency prices highlight the importance of emotional resilience in trading. By keeping emotions in check and focusing on sound investment principles, traders can position themselves for success in the dynamic world of cryptocurrencies.

Leave a Reply