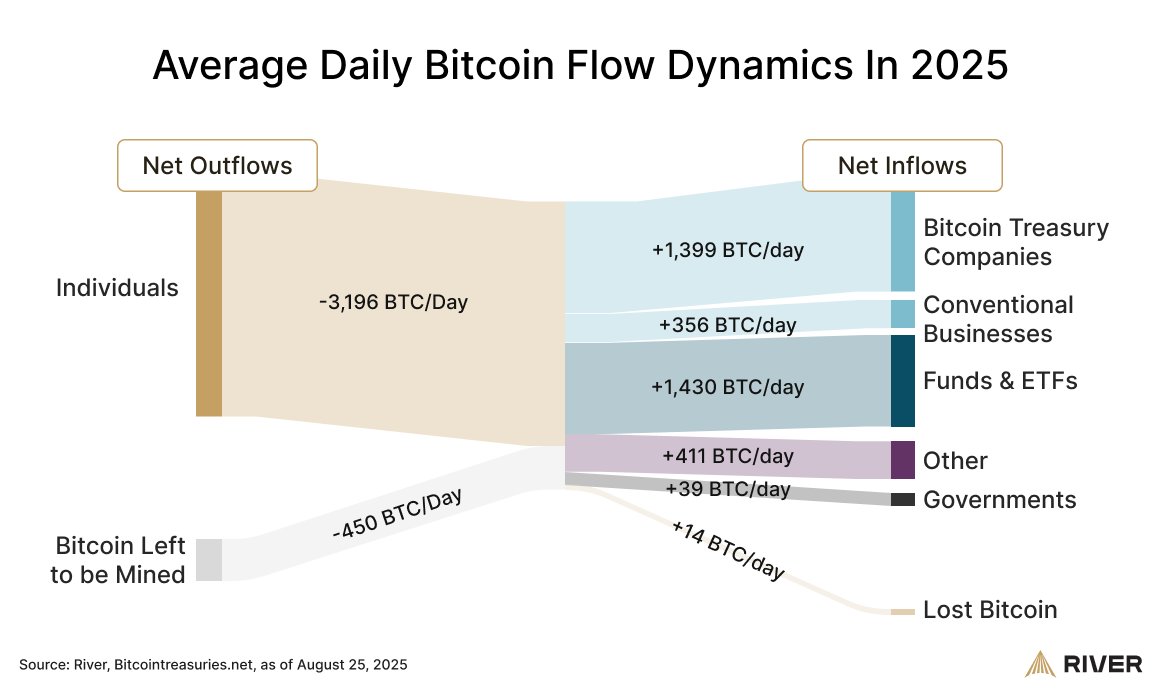

River Financial, a Bitcoin financial services firm, has recently released a new flow map indicating a significant increase in the amount of Bitcoin being absorbed by companies daily. According to the map, companies are currently absorbing approximately 1,755 BTC per day, compared to the approximate 450 BTC that are being mined daily. This data highlights a growing trend where more Bitcoin is being acquired and held by companies, indicating a bullish sentiment towards the digital asset.

The surge in Bitcoin absorption by companies is attributed to various factors, including the increasing adoption of Bitcoin as a store of value and an inflation hedge. As traditional financial markets face uncertainty due to factors such as inflation and economic instability, more companies are turning to Bitcoin as a safe haven asset to protect their capital.

In addition to companies, the flow map also suggests that funds and exchange-traded funds (ETFs) are contributing to the growing demand for Bitcoin. These investment vehicles are providing institutional and retail investors with exposure to Bitcoin, further driving up demand for the cryptocurrency.

The data provided by River Financial's flow map underscores the growing mainstream acceptance of Bitcoin as a legitimate asset class. As more companies and institutional investors allocate funds towards Bitcoin, the overall market capitalization of the cryptocurrency is expected to continue rising.

This influx of institutional and corporate interest in Bitcoin is a significant development for the cryptocurrency market. It signals a shift towards broader adoption and acceptance of Bitcoin as a valuable asset with long-term potential. The increased demand from companies, funds, and ETFs also suggests a growing recognition of Bitcoin's role as a hedge against traditional financial risks.

The implications of this trend extend beyond the immediate market dynamics. As more companies and institutions embrace Bitcoin, it could lead to further integration of the cryptocurrency into the global financial system. This could potentially pave the way for greater regulatory clarity and institutional support for Bitcoin, which in turn could drive further growth and stability in the cryptocurrency market.

Overall, River Financial's flow map provides valuable insights into the evolving landscape of Bitcoin adoption among companies and institutional investors. The data reflects a growing trend of Bitcoin being recognized as a valuable asset class with significant potential for long-term growth and stability in the financial markets.

Leave a Reply