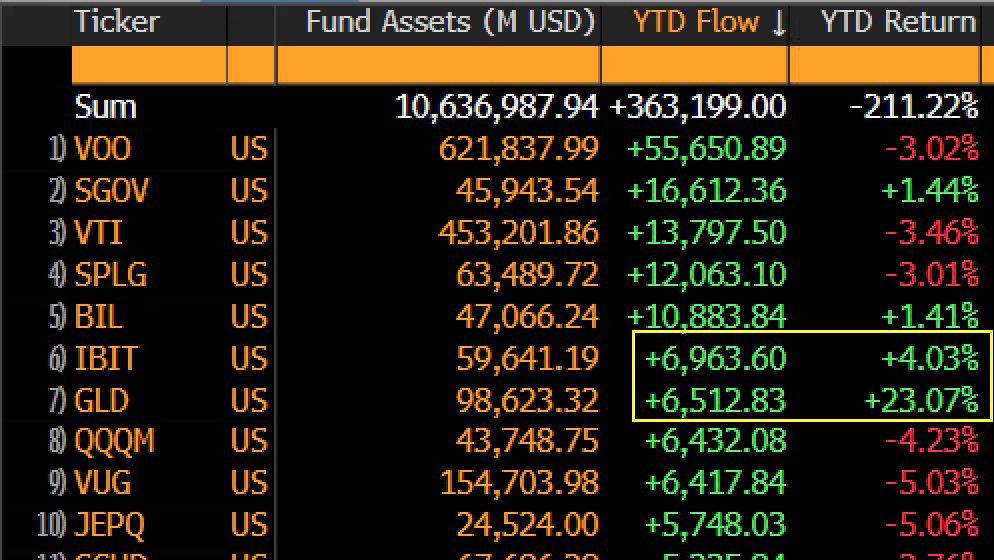

In the world of cryptocurrencies, bitcoin has long been considered a bellwether for the industry as a whole. Despite its relatively lackluster price performance in recent times, there are signs that institutional investors remain confident in its long-term potential. One such indicator is the outperformance of the Bitcoin Tracker One (IBIT) compared to the overall cryptocurrency market.

IBIT is an exchange-traded note (ETN) that tracks the price of bitcoin. Unlike traditional exchange-traded funds (ETFs), ETNs are debt instruments issued by financial institutions and their value is linked to the performance of an underlying asset, in this case, bitcoin. The fact that IBIT has been outperforming the broader cryptocurrency market suggests that institutional investors are showing a strong interest in bitcoin despite its recent price struggles.

One possible explanation for this outperformance is the growing acceptance of bitcoin and other cryptocurrencies by mainstream financial institutions. Over the past few years, major banks and investment firms have started to offer cryptocurrency-related products and services to their clients. This increased institutional involvement has helped to legitimize bitcoin as an asset class and has likely contributed to the growing confidence in its long-term prospects.

Another factor that may be driving institutional interest in bitcoin is the current macroeconomic environment. With central banks around the world engaging in unprecedented levels of monetary stimulus, investors are increasingly turning to alternative assets like bitcoin as a hedge against inflation and currency devaluation. The finite supply of bitcoin – capped at 21 million coins – makes it an attractive store of value in times of economic uncertainty.

Despite its recent price volatility, many analysts remain bullish on bitcoin's long-term outlook. Some believe that the recent pullback in price is a healthy correction after the rapid gains seen earlier in the year. Others point to the increasing adoption of bitcoin as a means of payment and investment, as well as its potential as a digital gold-like asset.

In conclusion, the outperformance of IBIT relative to the broader cryptocurrency market is a positive sign for bitcoin and the wider industry. It indicates that institutional investors are increasingly viewing bitcoin as a legitimate investment opportunity with long-term potential. As the cryptocurrency market continues to mature and evolve, it is likely that we will see even greater institutional involvement in bitcoin and other digital assets in the years to come.

Leave a Reply