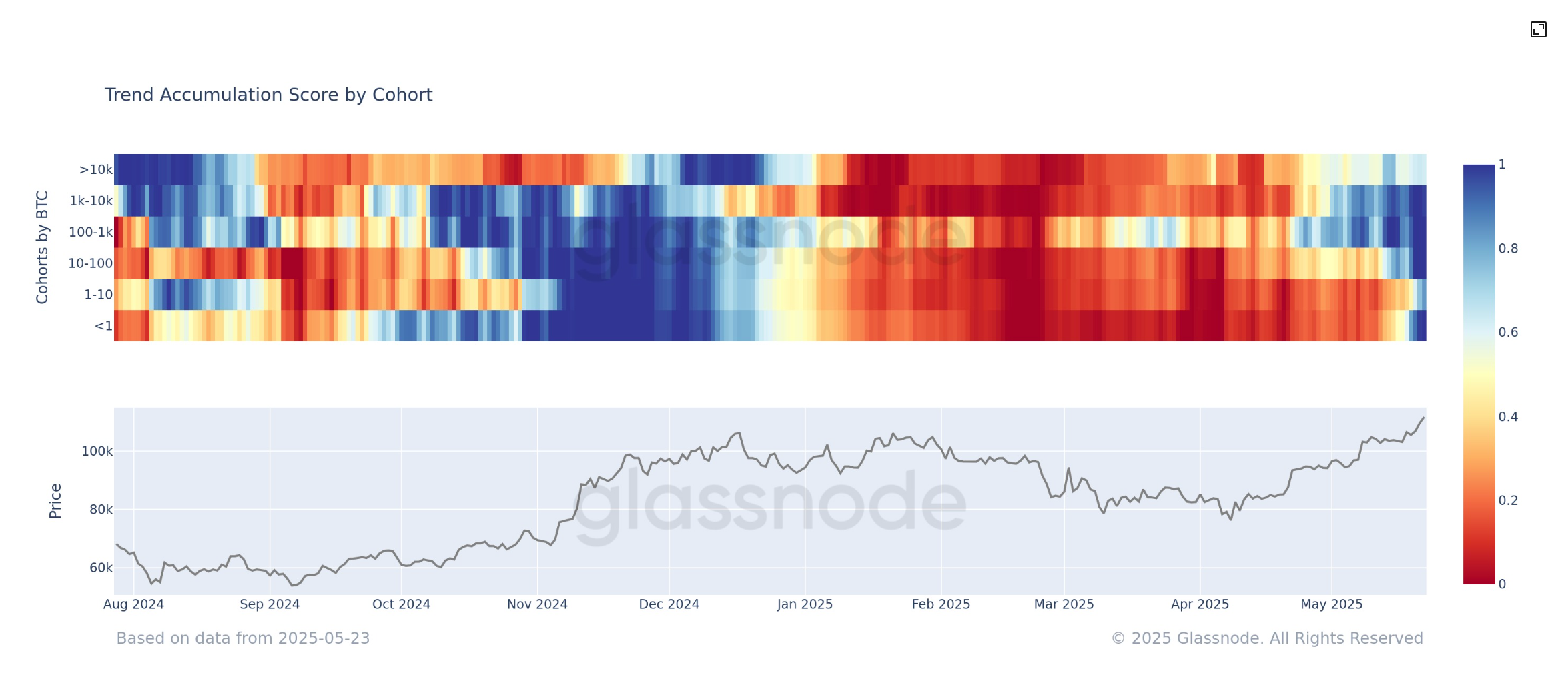

According to recent data from Glassnode, a leading on-chain analytics platform, all wallet cohorts in the crypto market are now in the accumulation phase. This trend suggests that investors across different holding sizes are actively acquiring more digital assets, indicating a positive sentiment towards the market.

The accumulation pattern across all wallet cohorts is a significant development as it demonstrates a widespread belief among investors in the potential long-term value of cryptocurrencies. This behavior is often seen as a bullish indicator for the market, as it signifies confidence in the future performance of digital assets.

In addition to the accumulation trend, options markets are also showing optimism for the price of Bitcoin. Market participants are pricing in potential upside beyond $200,000 for Bitcoin by June, indicating a strong belief in the possibility of significant price appreciation in the coming months.

Options markets are financial derivatives that give traders the right, but not the obligation, to buy or sell an asset at a specified price within a set timeframe. The pricing of options contracts can provide valuable insights into market sentiment and expectations for future price movements.

The fact that options markets are pricing in such high levels of potential upside for Bitcoin suggests that traders and investors are positioning themselves for a significant price rally. This optimistic outlook could be driven by a variety of factors, including growing institutional adoption, increased mainstream acceptance, and ongoing macroeconomic uncertainty.

The convergence of data from Glassnode indicating widespread accumulation across all wallet cohorts and the bullish sentiment in options markets paints a positive picture for the future of the crypto market. While short-term price fluctuations are always possible, the overall trend towards accumulation and optimistic price expectations bode well for the long-term outlook of digital assets like Bitcoin.

It is important to note that the crypto market is highly volatile and unpredictable, and investors should always exercise caution and conduct thorough research before making investment decisions. However, the current data from Glassnode and options markets suggest that there is a growing sense of confidence and optimism among market participants, which could potentially lead to further price appreciation in the coming months.

Leave a Reply