The cryptocurrency market is currently experiencing a period of consolidation and uncertainty as capital rotation from alternative cryptocurrencies, known as altcoins, has led to a surge in Bitcoin's market dominance to a level not seen in four years.

Altcoins are any cryptocurrencies other than Bitcoin, such as Ethereum, Litecoin, and Ripple. These coins have gained popularity in recent years due to their innovative technologies and potential for high returns. However, the market dynamics are constantly shifting, and investors are constantly reallocating their funds based on various factors such as market trends, news events, and regulatory developments.

Bitcoin, as the first and most well-known cryptocurrency, has always been a key player in the market. Its dominance is measured by its market share relative to the total market capitalization of all cryptocurrencies. When investors move their funds from altcoins to Bitcoin, it generally indicates a flight to safety or a belief that Bitcoin will outperform other cryptocurrencies in the short term.

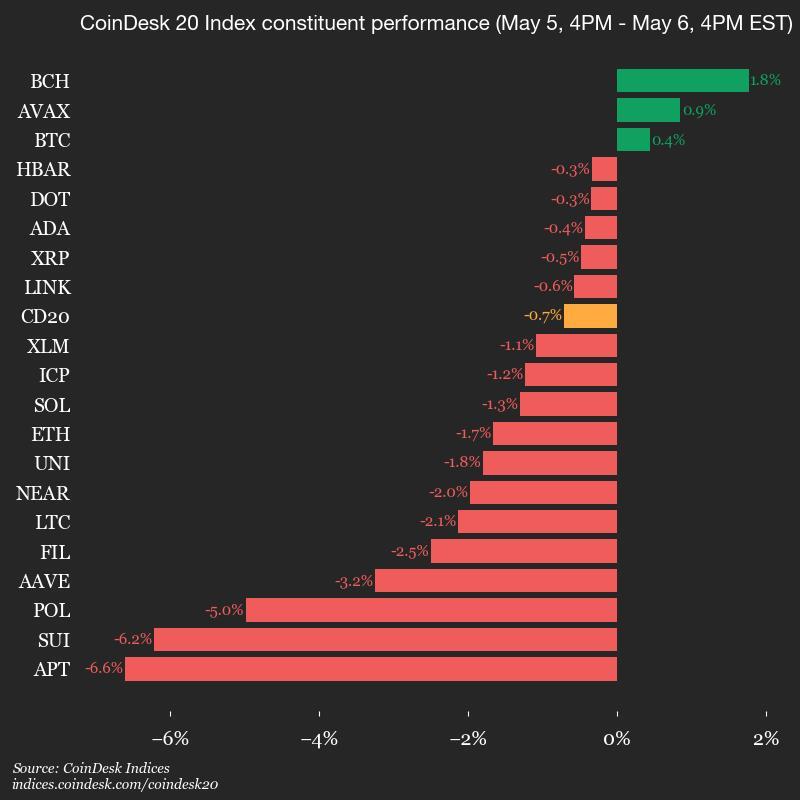

The recent increase in Bitcoin's market share to a four-year high suggests that investors are becoming more cautious and are favoring the stability and long-term potential of Bitcoin over the higher volatility of altcoins. This capital rotation can have a significant impact on the prices of both Bitcoin and altcoins, as it affects the overall demand and supply dynamics in the market.

This shift in market dynamics highlights the importance of closely monitoring market trends and understanding the factors driving investor behavior in the cryptocurrency space. While altcoins can offer exciting opportunities for growth and innovation, they also come with higher risks due to their lower liquidity and market capitalization compared to Bitcoin.

It is important for investors to diversify their cryptocurrency portfolios and carefully assess the risk-return profiles of different assets. While Bitcoin remains a key player in the market, it is also essential to consider the potential of altcoins and their unique value propositions.

As the cryptocurrency market continues to evolve, investors should stay informed about the latest developments and be prepared to adapt their investment strategies accordingly. By staying vigilant and proactive, investors can navigate the market shifts and position themselves for long-term success in the fast-paced world of cryptocurrencies.

Leave a Reply