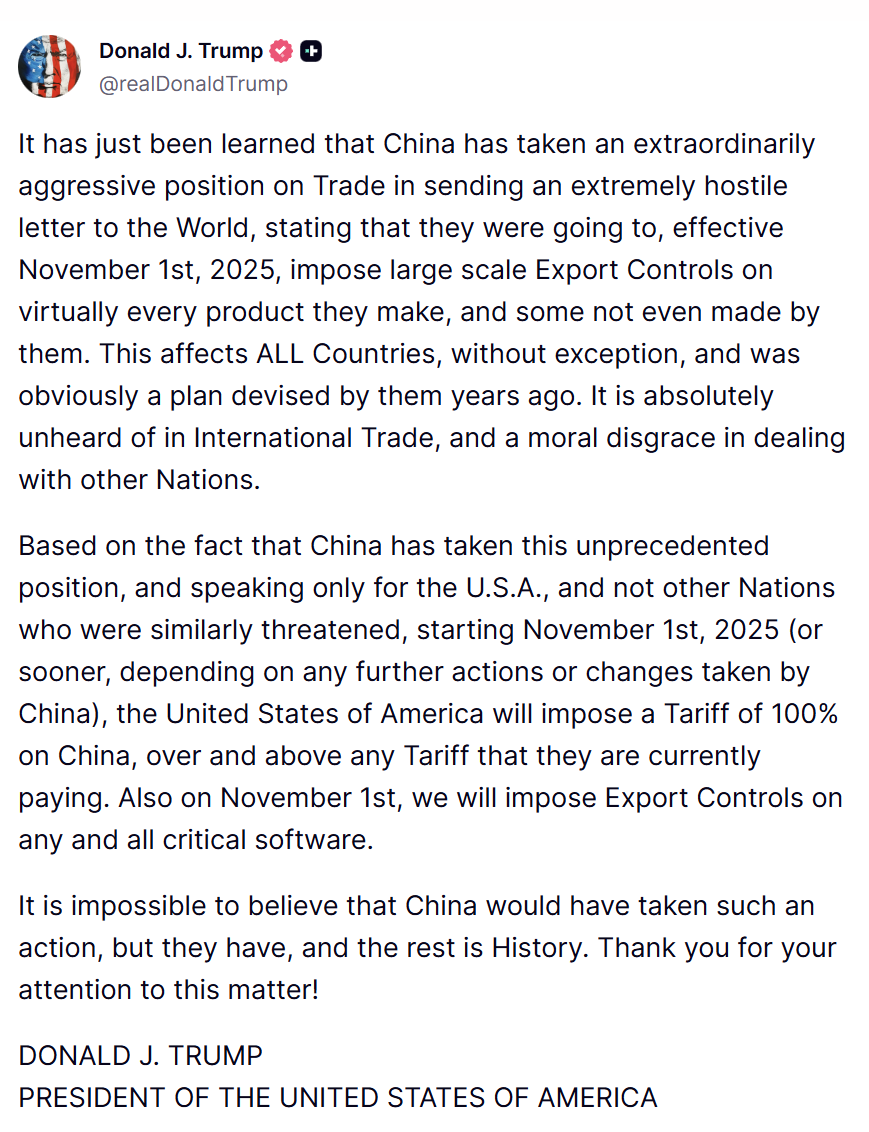

The recent announcement by former US President Donald Trump regarding the possibility of imposing a 100% tariff on imports from China has sent shockwaves across global markets, triggering a significant sell-off. This move not only impacted traditional financial assets but also had a profound effect on the cryptocurrency market, leading to the liquidation of leveraged long positions worth a staggering $16 billion.

The sharp decline in market sentiment following Trump's warning caused investors to reassess their risk exposure, resulting in a mass exodus from leveraged positions in the crypto market. As a result, the value of numerous cryptocurrencies plummeted, with Ethena's stablecoin USDe dropping to a rare sub-$1 level.

The impact of Trump's tariff threat on China reverberated throughout the crypto industry, highlighting the interconnected nature of global financial markets. The volatility caused by such geopolitical events serves as a reminder of the inherent risks associated with investing in cryptocurrencies, which are often more susceptible to external influences compared to traditional assets.

The sudden downturn in the market also underscored the importance of risk management strategies for crypto investors, particularly those engaging in leveraged trading. While leverage can amplify profits during favorable market conditions, it also exposes traders to significant losses in times of market turbulence.

In response to the sell-off triggered by Trump's tariff warning, market participants scrambled to adjust their positions and mitigate potential losses. The liquidation of $16 billion in leveraged longs underscored the swift and unforgiving nature of the crypto market, where price movements can be amplified by leveraged trading activities.

As investors grappled with the fallout from the sell-off, discussions around the resilience and stability of stablecoins like USDe came to the forefront. The rare sub-$1 print of Ethena's stablecoin served as a stark reminder of the challenges faced by stablecoin issuers in maintaining their peg to the US dollar during periods of extreme market volatility.

Overall, the events following Trump's tariff warning shed light on the complex dynamics at play in the crypto market and the broader financial landscape. As global geopolitical tensions continue to influence market sentiment, investors are reminded of the importance of staying informed, implementing risk management strategies, and remaining vigilant in the face of unexpected developments that can impact their investment portfolios.

Leave a Reply