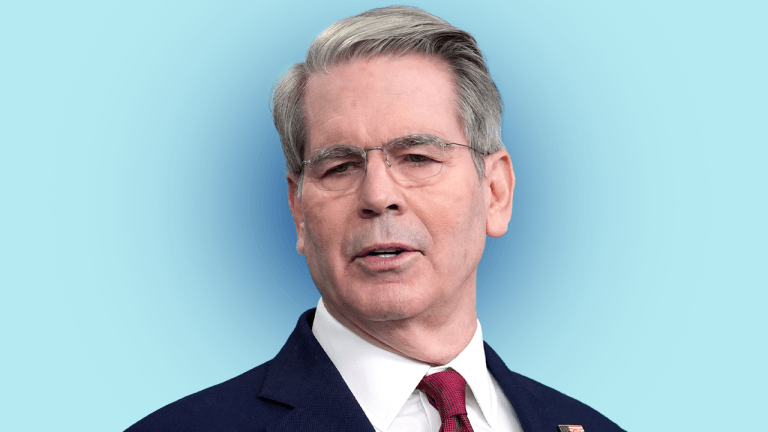

In a recent announcement, U.S. Treasury Secretary Scott Bessent revealed that the Trump Administration is planning to make significant strides in the realm of digital assets, particularly focusing on crypto tokens linked to the U.S. dollar. This move signals a clear intention to embrace and capitalize on the growing trend of cryptocurrencies and blockchain technology.

Bessent's emphasis on stablecoins, which are cryptocurrencies designed to maintain a stable value by pegging them to a fiat currency like the U.S. dollar, is strategic. He believes that stablecoins have the potential to stimulate interest in U.S. Treasury bonds, essentially transforming a market that has been described as "starved" into one that is "supercharged."

Stablecoins have gained popularity in the crypto space due to their ability to minimize the price volatility that is commonly associated with other cryptocurrencies like Bitcoin and Ethereum. By offering stability and reliability, stablecoins have emerged as a bridge between traditional finance and the digital asset ecosystem.

The Treasury Secretary's endorsement of stablecoins as a means to promote U.S. Treasury bonds underscores the administration's recognition of the transformative power of blockchain technology. By integrating stablecoins into the financial landscape, the government aims to tap into a new avenue for attracting investment in U.S. debt securities.

Furthermore, Bessent's vision aligns with the broader trend of central banks and governments worldwide exploring the potential of digital currencies. The rise of central bank digital currencies (CBDCs) and the increasing acceptance of cryptocurrencies by traditional financial institutions indicate a shifting paradigm in the global monetary system.

The Trump Administration's proactive stance on digital assets reflects a growing awareness of the need to adapt to the evolving financial landscape. By embracing stablecoins and leveraging their potential to drive demand for U.S. Treasury bonds, the government is positioning itself to harness the benefits of blockchain technology and cryptocurrencies.

As the world of finance continues to evolve, the integration of digital assets into mainstream economic activities is becoming increasingly inevitable. The endorsement of stablecoins by the U.S. Treasury Secretary not only highlights the government's commitment to innovation but also sets the stage for a new era of financial interconnectedness where traditional and digital assets coexist harmoniously.

In conclusion, Scott Bessent's announcement regarding the Trump Administration's focus on digital assets, particularly stablecoins tied to the U.S. dollar, marks a significant step towards embracing the future of finance. By recognizing the potential of blockchain technology and cryptocurrencies, the government is laying the groundwork for a more dynamic and inclusive financial ecosystem.

Leave a Reply