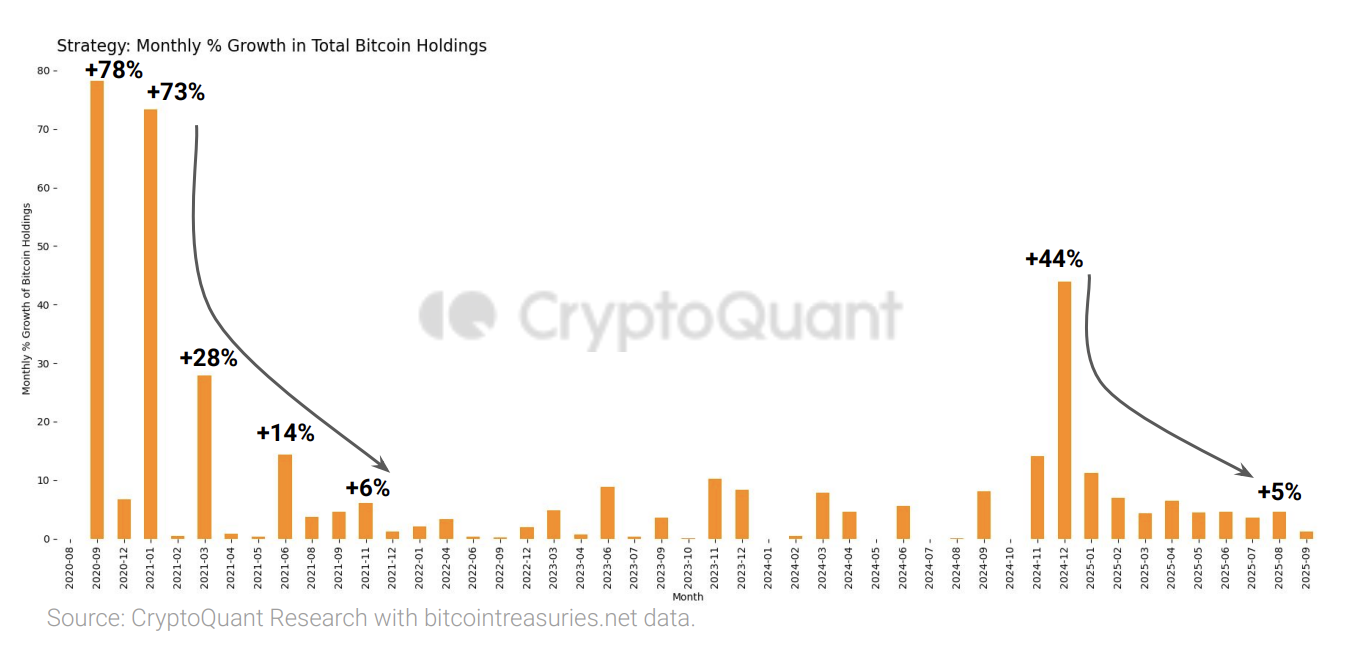

Bitcoin treasury holdings have been hitting new highs recently, with various companies and institutions adding the digital currency to their balance sheets. However, a closer look reveals that the average purchase size of these holdings has seen a significant drop. This trend suggests a potential weakening of institutional appetite for Bitcoin, even as some entities continue to show enthusiasm for the cryptocurrency.

One notable development in the crypto space is Taiwan's Sora Ventures preparing to launch a $1 billion Bitcoin Treasury fund. This move comes at a time when institutional interest in Bitcoin and other digital assets is at a crossroads. While some companies have been actively increasing their exposure to Bitcoin, others seem to be scaling back their purchases.

The decrease in the average purchase size of Bitcoin holdings among institutions may indicate a shift in sentiment or strategy. It could suggest that some institutions are becoming more cautious in their approach to investing in cryptocurrencies. This could be due to regulatory uncertainties, market volatility, or other factors influencing their decision-making process.

On the other hand, the launch of a $1 billion Bitcoin Treasury fund by Sora Ventures signals continued confidence in the long-term potential of Bitcoin. The fund aims to provide institutional investors with a convenient way to gain exposure to the digital asset while leveraging Sora Ventures' expertise in the crypto space.

The contrasting trends in institutional Bitcoin investments highlight the complexity of the current market environment. While some institutions are doubling down on their crypto holdings, others are taking a more measured approach. This diversity in strategies reflects the evolving nature of the cryptocurrency market and the differing risk appetites among institutional investors.

As the crypto industry continues to mature, institutional interest in digital assets is expected to grow. However, regulatory developments, market dynamics, and macroeconomic factors will continue to influence institutional decision-making regarding Bitcoin and other cryptocurrencies.

Overall, the rise of Bitcoin treasury holdings and the launch of new investment products like Sora Ventures' $1 billion Bitcoin Treasury fund underscore the increasing mainstream acceptance of cryptocurrencies. Despite some signs of caution in the market, the overall trend points towards a growing institutional presence in the crypto space. This ongoing evolution highlights the importance of staying informed and adaptable in the rapidly changing world of digital assets.

Leave a Reply