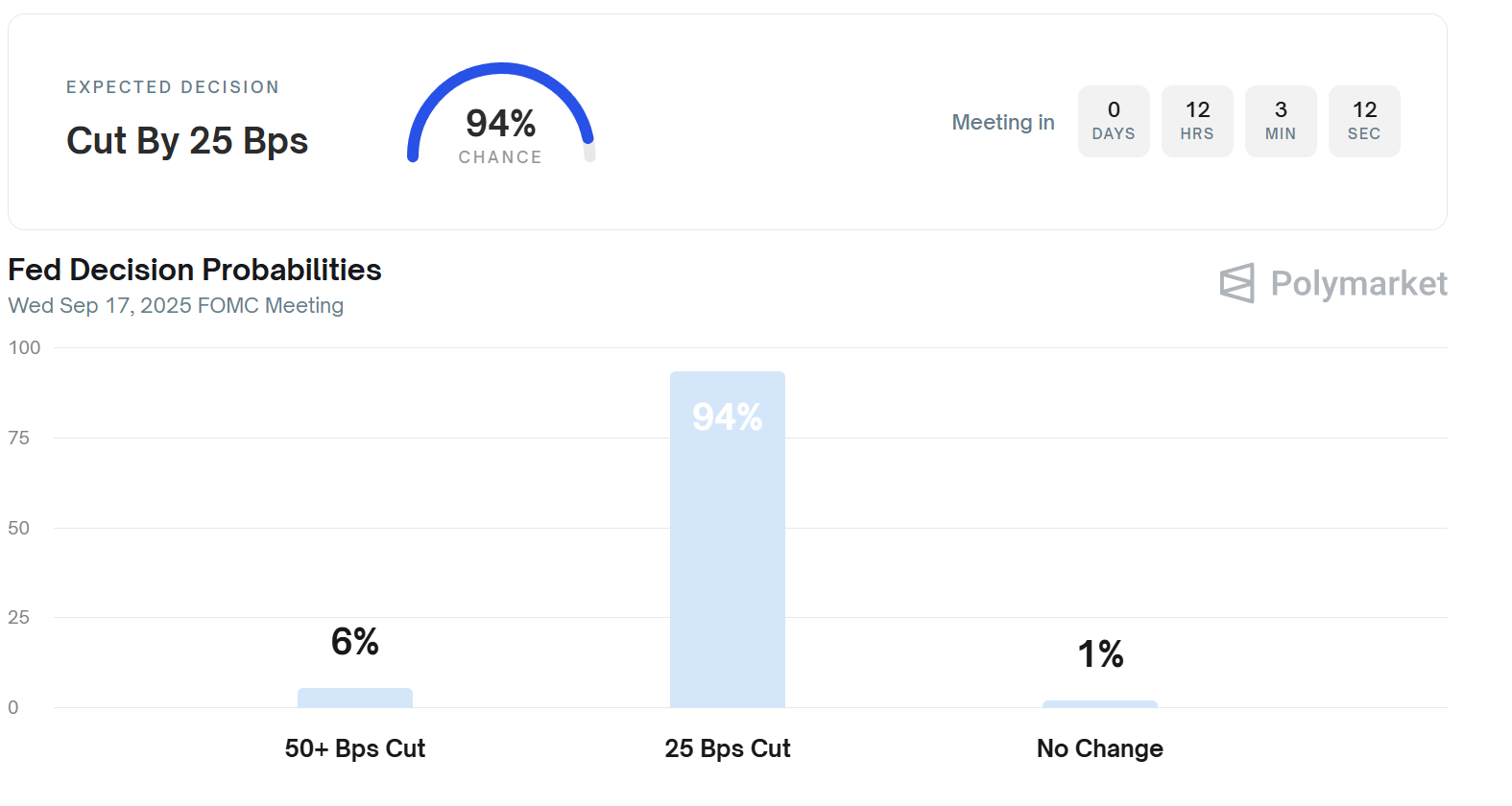

As the cryptocurrency market eagerly awaits the potential impact of a 25 basis point (bps) cut, experts are warning of potential challenges that could test the resilience of the market. Gracie Lin, a representative from OKX, a leading cryptocurrency exchange, has pointed out that while the anticipated rate cut may already be factored into market expectations, other factors such as token unlocks and liquidity shocks could have a significant impact on market dynamics.

Token unlocks refer to the release of previously locked or restricted tokens, often associated with initial coin offerings (ICOs) or token sales. When these tokens become available for trading, they can introduce additional supply into the market, potentially leading to price fluctuations and volatility. This influx of tokens can create liquidity shocks, where sudden changes in supply and demand dynamics cause rapid and sometimes unpredictable price movements.

According to Gracie Lin, these events have the potential to greatly impact the cryptocurrency market, making it essential for market participants to be prepared for potential disruptions. In such scenarios, the ability to maintain resilient liquidity will be crucial in determining which market players emerge as winners and which ones face setbacks.

Liquidity is a key factor in any financial market, including the cryptocurrency space. It refers to the ease with which assets can be bought or sold without causing significant price changes. In times of high volatility or unexpected events like token unlocks, having access to deep and stable liquidity can help investors navigate market uncertainties and avoid potential losses.

As the crypto market continues to evolve and mature, the importance of liquidity management becomes increasingly apparent. Exchanges and trading platforms play a critical role in providing liquidity to market participants, ensuring that trading can occur smoothly and efficiently even during periods of heightened volatility.

In this context, OKX stands out as a platform that prioritizes liquidity resilience and stability. By offering a robust trading infrastructure and a wide range of trading pairs, OKX aims to provide its users with access to deep liquidity pools and a seamless trading experience. This focus on liquidity management can help traders and investors navigate potential market shocks and capitalize on opportunities that arise.

As the cryptocurrency market braces for potential challenges like token unlocks and liquidity shocks, the ability to maintain resilient liquidity will be a key differentiator for market participants. By staying vigilant and prepared for unexpected events, traders and investors can position themselves to weather market fluctuations and emerge stronger in the long run.

Leave a Reply