The cryptocurrency market is currently experiencing a dynamic shift in investor behavior and network activity. As capital continues to flow into Exchange-Traded Funds (ETFs) and custodial services, there is a noticeable surge in interest in the Solana blockchain, particularly from retail investors. However, amidst these developments, concerns are mounting over the stagnant on-chain demand for Bitcoin and the implications this may have on the network's sustainability.

ETFs and custodial services are becoming increasingly popular among traditional investors looking to gain exposure to the cryptocurrency market. These investment vehicles offer a more familiar and regulated way for investors to participate in the crypto space, attracting significant capital inflows. The growing interest in ETFs and custodial services underscores the mainstream acceptance and integration of cryptocurrencies into the broader financial ecosystem.

On the other hand, the Solana blockchain has been gaining traction as retail investors flock to the network, drawn by its high-speed transactions and low fees. Solana's growing popularity among retail traders and developers is positioning it as a strong competitor to established blockchains like Ethereum. The influx of retail traffic into Solana highlights the network's potential for scalability and innovation, making it a key player in the rapidly evolving DeFi landscape.

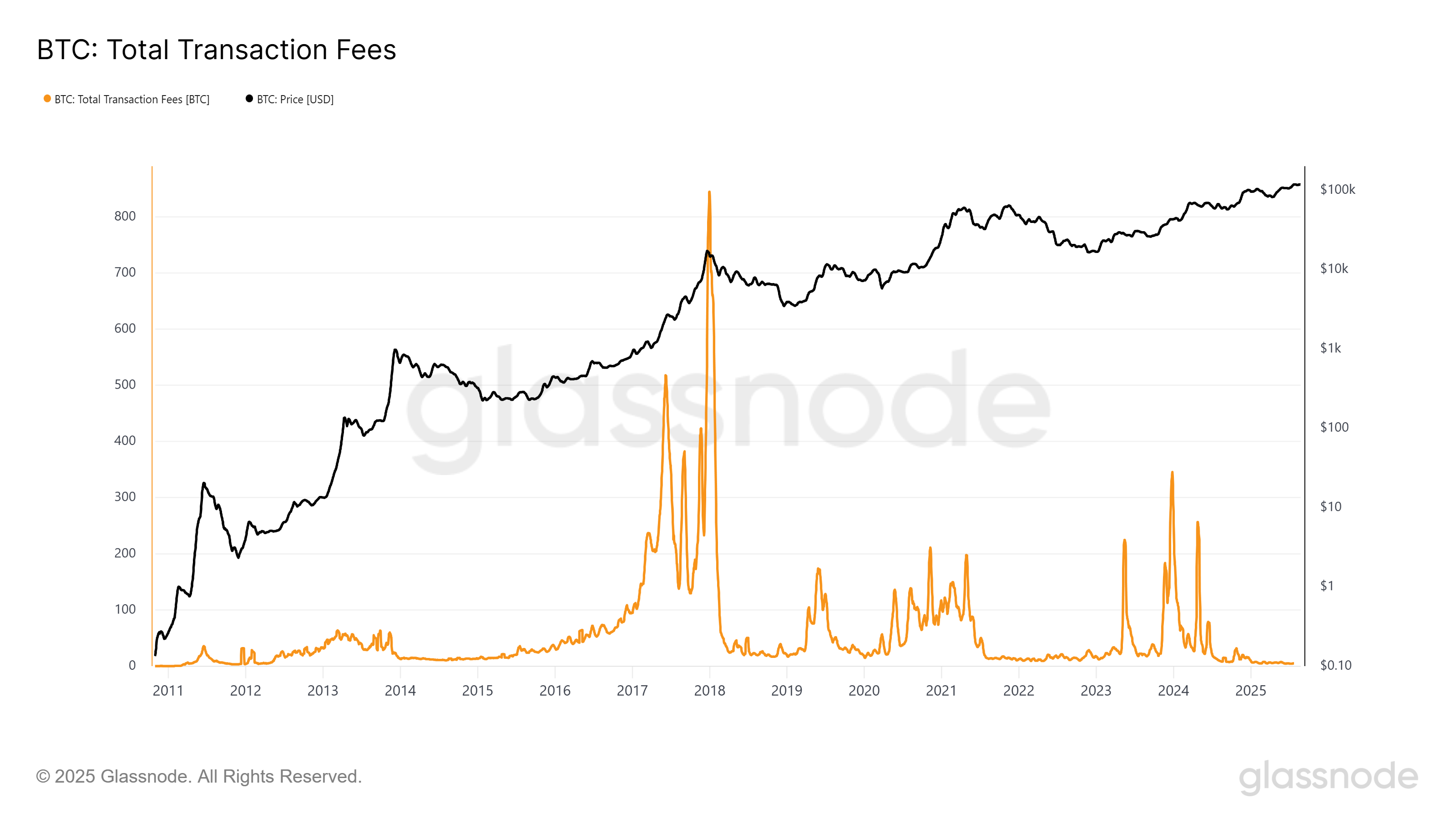

Amidst these positive developments, concerns are deepening over the lackluster on-chain demand for Bitcoin. Despite being the pioneer and most widely recognized cryptocurrency, Bitcoin is experiencing a slowdown in on-chain activity, raising questions about its long-term sustainability. The network's reliance on transaction fees to incentivize miners and secure the blockchain is coming under scrutiny as the demand for on-chain transactions remains stagnant.

The sustainability of the Bitcoin network hinges on miners being adequately incentivized to maintain the security and integrity of the blockchain. With on-chain demand showing signs of stagnation, there are growing concerns about whether miners can sustain the network solely through transaction fees. If the network fails to attract sufficient transaction volume to generate meaningful fees, miners may face challenges in covering their operational costs, potentially leading to centralization and security risks.

As the cryptocurrency market continues to evolve and mature, it is essential for industry participants to closely monitor these trends and developments. While capital inflows into ETFs and custodial services signal growing mainstream adoption, the challenges facing Bitcoin's on-chain demand underscore the importance of addressing scalability and sustainability issues within blockchain networks. In the midst of these dynamics, the rise of Solana as a contender in the DeFi space highlights the ongoing innovation and competition driving the cryptocurrency ecosystem forward.

Leave a Reply