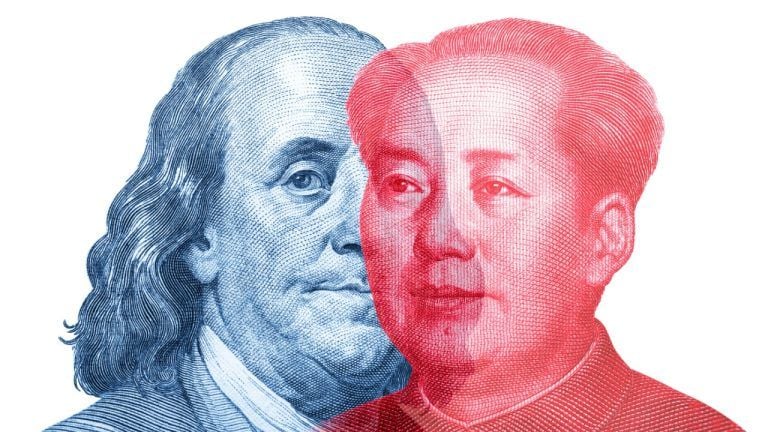

As the rise of stablecoin-based dollarization poses a challenge for China, analysts are suggesting a potential solution – the issuance of a yuan stablecoin. With the looming threat of stablecoin-based dollarization and its potential implications, including losing control over monetary policy and financial stability, China is exploring ways to counter this trend.

One alternative being considered is the creation of a yuan stablecoin, which could be introduced in the market as a digital representation of the Chinese currency. Hong Kong, with its established regulatory framework for digital assets, is being eyed as a potential hub for the issuance of this stablecoin.

By launching a yuan stablecoin, China could potentially mitigate the effects of dollarization and maintain control over its monetary system. This move could also help in promoting the use of the yuan in international trade and finance, reducing reliance on the US dollar.

The idea of a yuan stablecoin comes at a time when central banks around the world are increasingly exploring the concept of central bank digital currencies (CBDCs). These digital currencies, issued and regulated by central banks, offer a modernized form of money that could potentially enhance financial inclusion, efficiency, and transparency.

For China, the issuance of a yuan stablecoin could be a strategic step towards modernizing its financial system and adapting to the changing landscape of digital currencies. By leveraging the technology behind stablecoins, China could enhance cross-border transactions, improve payment systems, and strengthen its position in the global economy.

However, the introduction of a yuan stablecoin would also come with its own set of challenges and considerations. Regulatory compliance, cybersecurity, and monetary policy implications would need to be carefully evaluated to ensure the stability and security of the financial system.

Overall, the potential issuance of a yuan stablecoin represents a bold move by China to address the challenges posed by stablecoin-based dollarization. By embracing digital currencies and exploring innovative solutions, China could position itself as a leader in the digital economy and shape the future of global finance.

Leave a Reply