In the world of cryptocurrency trading, two significant factors contributing to market pressures are cohort selling and the distribution patterns of long-term holders. These elements can have a considerable impact on the price movements of various digital assets.

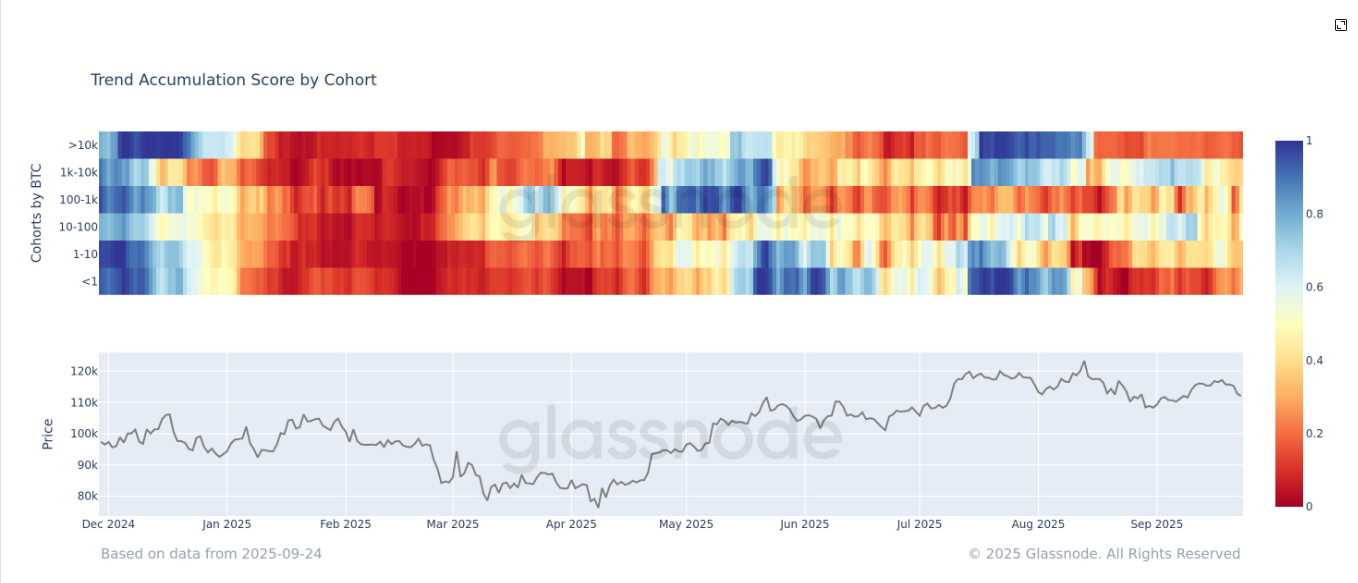

Cohort selling refers to a situation where a group of investors or traders who bought into a particular cryptocurrency at around the same time begin to sell off their holdings simultaneously. This coordinated selling activity can create downward pressure on the price of the asset, as an influx of sell orders can outweigh the buying demand in the market. Cohort selling often occurs when a group of investors decides to take profits or cut their losses at the same time, leading to a cascade of sell orders that can drive the price down.

On the other hand, the distribution patterns of long-term holders can also influence market dynamics. Long-term holders are investors who have held onto their cryptocurrency assets for an extended period, often with the belief that the value of the asset will increase over time. When these long-term holders decide to sell off a portion of their holdings, it can impact market sentiment and contribute to selling pressure.

The distribution of holdings among long-term holders is crucial because it can indicate the level of confidence or uncertainty in the market. If a large number of long-term holders start to sell off their assets, it may signal a lack of confidence in the future price potential of the cryptocurrency, leading to increased selling pressure.

Both cohort selling and the distribution patterns of long-term holders are important factors to consider when analyzing market trends and making trading decisions. Traders and investors need to be aware of these dynamics and how they can impact the price movements of cryptocurrencies.

Furthermore, understanding the motivations behind cohort selling and long-term holder distribution can provide valuable insights into market sentiment and potential price movements. For example, if a group of investors is selling off their holdings due to external factors such as regulatory concerns or negative news, it could signal a short-term bearish trend in the market.

In conclusion, cohort selling and long-term holder distribution are two key elements that can contribute to ongoing pressure in the cryptocurrency market. By monitoring these factors and staying informed about market trends, traders and investors can make more informed decisions and navigate the volatility of the crypto market more effectively.

Leave a Reply