The latest economic data has brought about a mix of surprises and concerns in the financial markets. The Consumer Price Index (CPI) has unexpectedly risen, indicating higher inflation than anticipated. At the same time, cracks are appearing in the U.S. labor market, suggesting potential challenges ahead. These developments have had a significant impact on various assets, with bitcoin notably climbing in value as the dollar weakens and bond yields decline.

The unexpected increase in the CPI has raised concerns about inflationary pressures. The CPI measures the average change over time in the prices paid by urban consumers for a basket of goods and services. A higher-than-expected CPI indicates that prices are rising at a faster rate than predicted, which can have implications for consumers, businesses, and investors. Inflation can erode purchasing power and lead to higher costs for goods and services, impacting economic growth and financial markets.

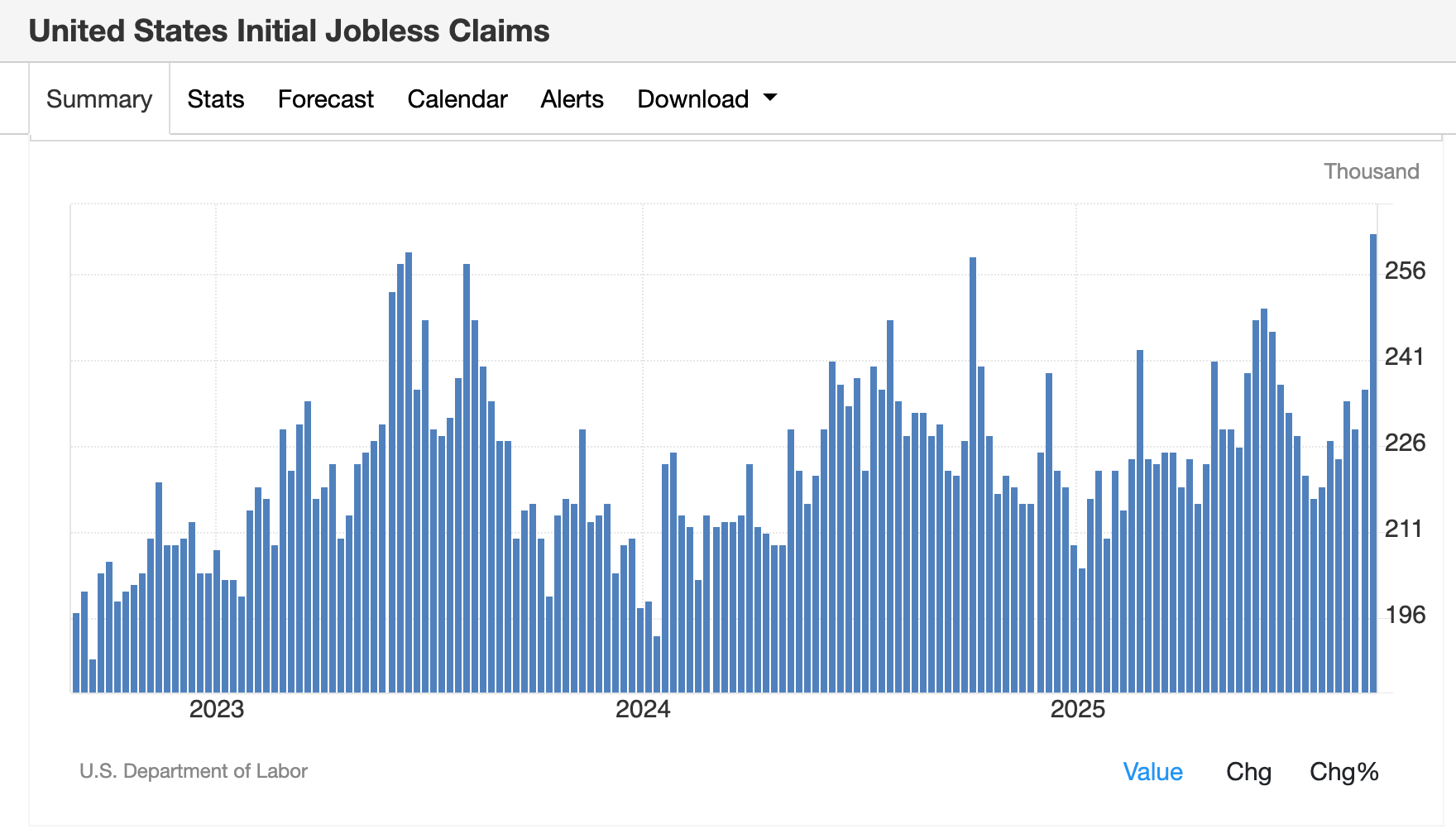

On the other hand, the cracks in the U.S. labor market are a cause for concern. Despite a strong rebound in job creation in recent months, there are signs of weaknesses in the labor market. Factors such as rising jobless claims, sluggish wage growth, and challenges in filling job vacancies point to underlying issues that could hamper the recovery. A weaker labor market can dampen consumer spending, hinder economic growth, and weigh on investor sentiment.

In response to these developments, investors have turned to alternative assets like bitcoin. The cryptocurrency has seen a surge in value as investors seek hedges against inflation and a weakening dollar. Bitcoin is often viewed as a store of value and a potential safe haven asset in times of economic uncertainty. Its finite supply and decentralized nature have attracted investors looking to diversify their portfolios and protect against traditional market risks.

The weakening of the dollar and the fall in bond yields have also played a role in bitcoin's climb. A weaker dollar makes alternative assets like bitcoin more attractive to investors, as they seek to preserve the value of their holdings. Additionally, falling bond yields can push investors towards higher-risk assets like cryptocurrencies in search of better returns.

As the global economy continues to navigate through uncertain times, investors are closely monitoring economic indicators and market trends for insights into the future direction of financial markets. The interplay between inflation, labor market dynamics, currency movements, and asset prices will be key areas to watch in the coming months as investors assess risks and opportunities in a rapidly evolving economic landscape.

Leave a Reply