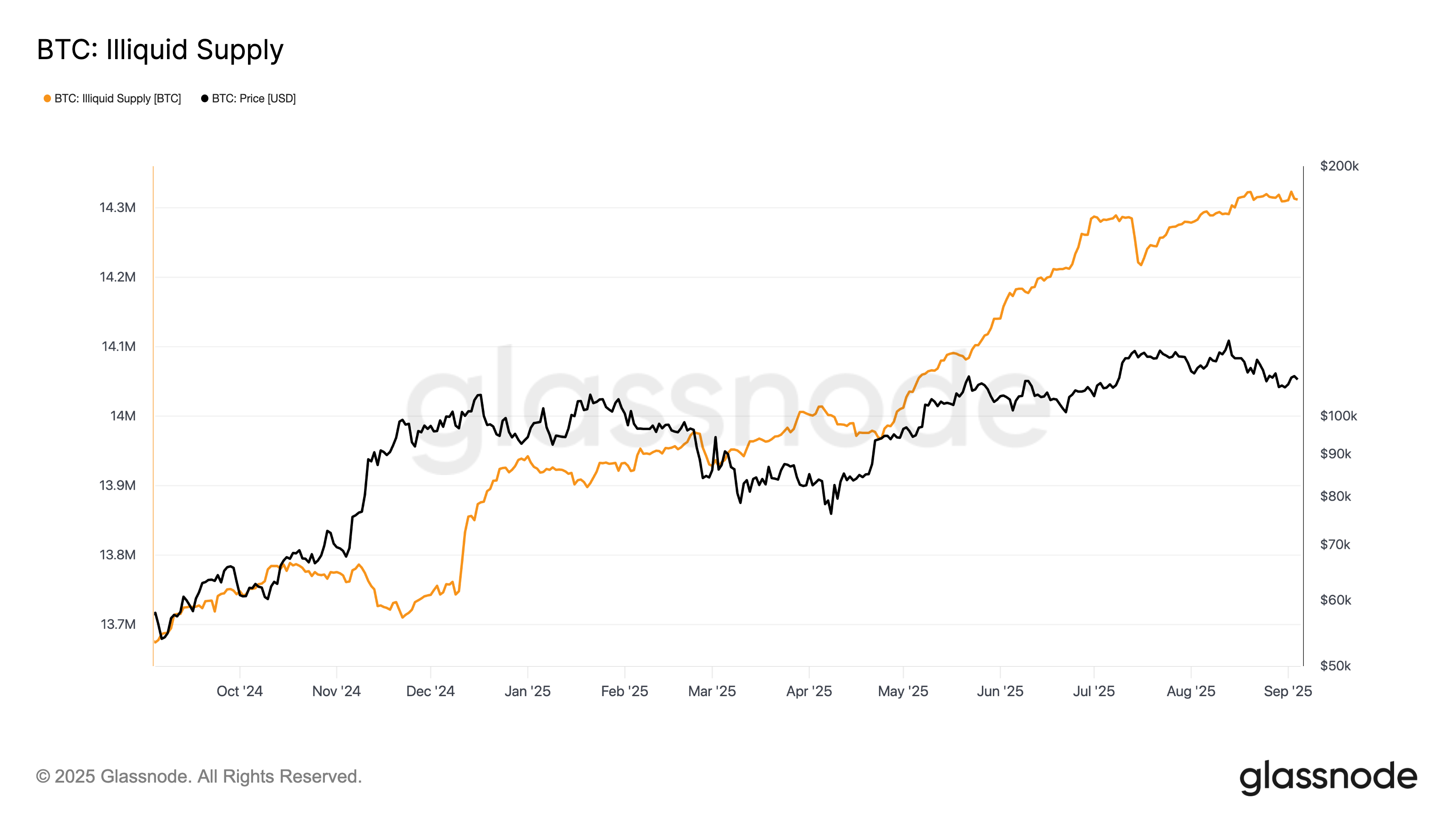

After reaching an all-time high in August, the crypto market has experienced a 15% decline. However, one interesting trend has emerged amidst the market volatility – the growth of illiquid holdings.

Illiquid holdings refer to assets that are not easily converted into cash without a significant loss in value. In the world of cryptocurrency, illiquid holdings can include tokens that are not actively traded on exchanges or are held for long-term investment purposes.

Despite the recent dip in prices, many investors are opting to hold onto their crypto assets rather than selling them off. This has led to a rise in illiquid holdings within the market. While some traders may view this as a risky strategy, others see it as a long-term investment opportunity.

One possible reason for the increase in illiquid holdings could be the growing interest in decentralized finance (DeFi) projects. Many DeFi tokens are not as easily tradable on mainstream exchanges, leading investors to hold onto them in anticipation of future growth.

Another factor contributing to the rise in illiquid holdings is the overall bullish sentiment in the crypto market. Despite short-term fluctuations, many investors remain optimistic about the long-term potential of cryptocurrencies. This optimism has led to a shift towards a more long-term investment approach, with many investors choosing to hold onto their assets rather than engaging in frequent trading.

Additionally, the rise of non-fungible tokens (NFTs) has also played a role in the increase of illiquid holdings. Many NFT collectors are holding onto their digital assets as they believe in the long-term value and potential of the NFT market.

It is important to note that holding illiquid assets comes with its own set of risks. Illiquid assets can be harder to sell in times of market downturns, and investors may struggle to find buyers willing to purchase these assets at a fair price. Additionally, the value of illiquid assets can be more volatile compared to more liquid assets, leading to greater fluctuations in portfolio value.

Overall, the growth of illiquid holdings in the crypto market reflects a shift towards a more long-term investment mindset among investors. While short-term price fluctuations may cause concern, many investors remain confident in the future potential of cryptocurrencies and are willing to hold onto their assets for the long haul. As the crypto market continues to evolve, the trend of increasing illiquid holdings is likely to persist, shaping the investment landscape for years to come.

Leave a Reply