Bitcoin is currently experiencing a surge in accumulation by both retail and institutional investors, leading to growing anticipation of a potential major price breakout. As the cryptocurrency market continues to show resilience, Bitcoin's price has been hovering around the $109,000 mark, prompting speculation that a significant rally may be on the horizon.

Retail investors, who are individual traders and small-scale investors, have been increasingly drawn to Bitcoin as a store of value and a potential hedge against inflation. The recent wave of interest from retail investors can be attributed to the growing acceptance of Bitcoin as a legitimate asset class, as well as the ongoing economic uncertainty caused by factors such as the COVID-19 pandemic and inflationary pressures.

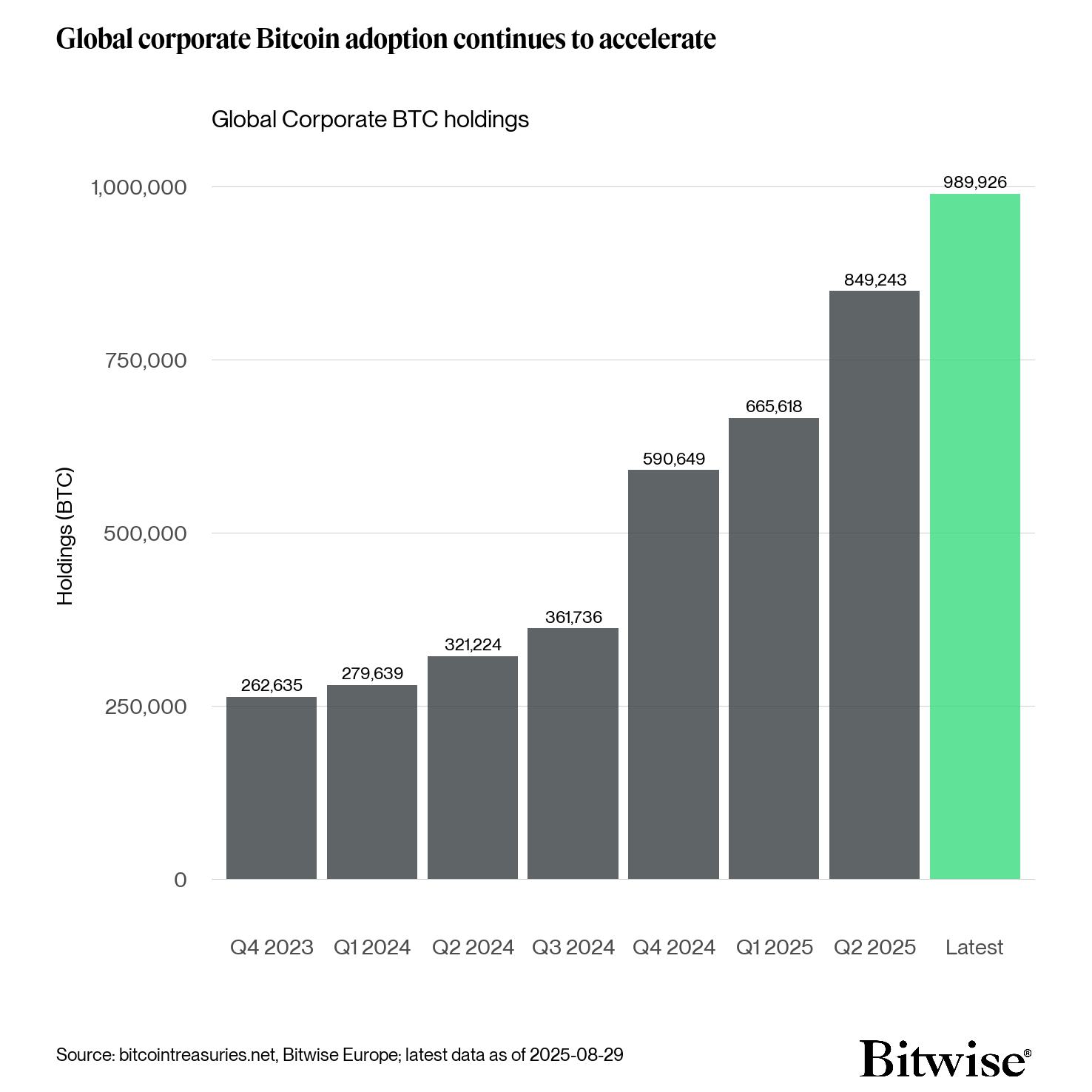

On the other hand, institutional investors, which include hedge funds, family offices, and corporate treasuries, have also been ramping up their Bitcoin holdings. These larger entities are attracted to Bitcoin for its potential for high returns and its ability to diversify their investment portfolios. The entry of institutional players into the cryptocurrency market has been a significant driver of Bitcoin's price appreciation in recent years.

One analyst, who remains optimistic about Bitcoin's future price trajectory, pointed to the current accumulation trend as a potential catalyst for a major breakout. The steady accumulation of Bitcoin by both retail and institutional investors suggests a strong underlying demand for the cryptocurrency, which could lead to a significant price surge in the near future.

While Bitcoin's price has been relatively stable around the $109,000 level, analysts believe that this consolidation phase could be setting the stage for a breakout to new all-time highs. The accumulation of Bitcoin by both retail and institutional investors is seen as a bullish sign, indicating a growing confidence in the long-term potential of the cryptocurrency.

In addition to the accumulation trend, other factors such as increasing adoption of Bitcoin as a payment method, growing interest from traditional financial institutions, and regulatory developments in favor of cryptocurrencies are also contributing to the positive sentiment surrounding Bitcoin.

However, it is important to note that the cryptocurrency market is highly volatile, and price predictions should be taken with caution. While the current accumulation trend may indicate a positive outlook for Bitcoin, market conditions can change rapidly, leading to sudden price fluctuations.

Overall, the growing accumulation of Bitcoin by both retail and institutional investors is a promising sign for the cryptocurrency's future. As Bitcoin continues to establish itself as a mainstream asset class, investors are increasingly recognizing its value and potential for long-term growth. With the stage potentially set for a major breakout, all eyes are on Bitcoin as it navig

Leave a Reply