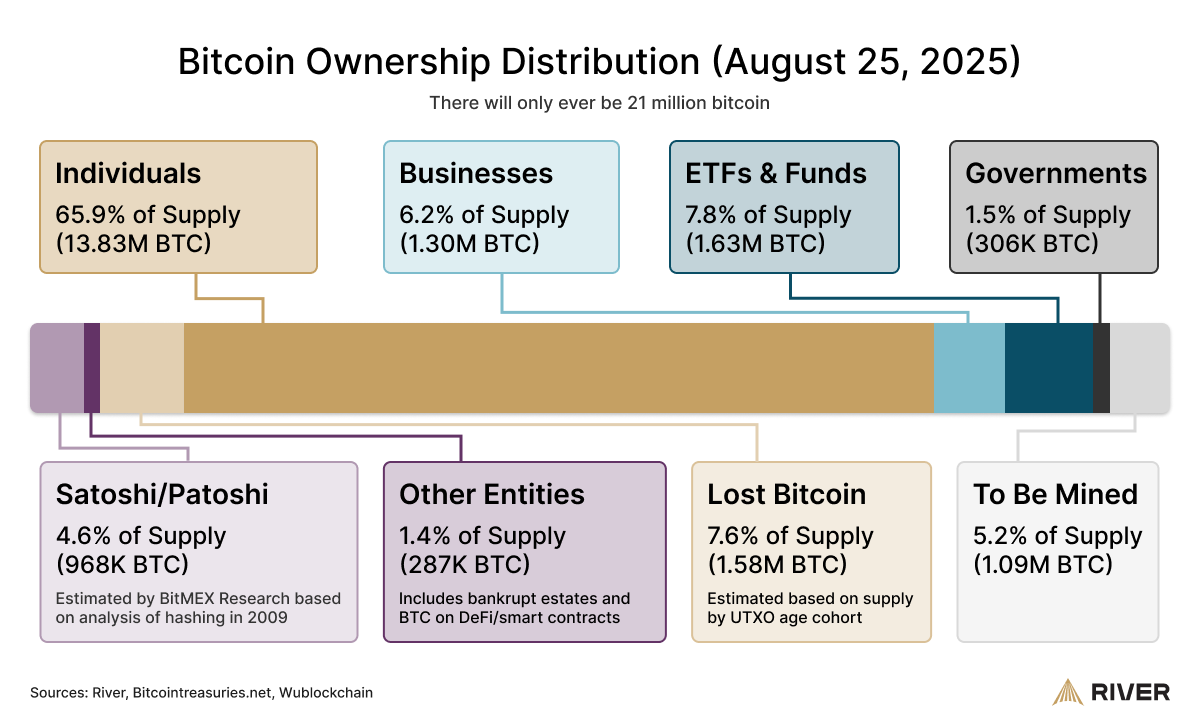

A recent report by River Financial Research has shed light on the distribution of Bitcoin ownership across various entities. According to the research, individuals hold the majority of Bitcoin, accounting for approximately 65.9% of the total supply. This statistic highlights the significant role that retail investors play in the cryptocurrency ecosystem.

In addition to individual investors, the report also found that funds, including hedge funds and other investment vehicles, hold a notable share of Bitcoin, with approximately 7.8% of the total supply. This suggests that institutional interest in Bitcoin continues to grow, as more funds allocate resources to the digital asset.

Businesses also have a stake in Bitcoin ownership, accounting for around 6.2% of the total supply. This figure reflects the increasing trend of businesses integrating Bitcoin into their operations, whether through investments or accepting the cryptocurrency as a form of payment.

Governments, on the other hand, hold a relatively small portion of Bitcoin, estimated at 1.5% of the total supply. While some governments have shown interest in exploring central bank digital currencies (CBDCs) and blockchain technology, the report indicates that government ownership of Bitcoin remains limited.

One striking finding from the research is the percentage of Bitcoin believed to be lost, which stands at about 7.6%. This lost Bitcoin is likely the result of users losing access to their private keys or sending funds to addresses with no known owners. As a finite asset with a capped supply of 21 million coins, the loss of Bitcoin contributes to its scarcity and can impact its price dynamics in the market.

The distribution of Bitcoin ownership across individuals, funds, businesses, and governments provides insights into the diverse range of participants in the cryptocurrency space. Retail investors continue to play a crucial role in driving adoption and usage of Bitcoin, while institutional investors and businesses are increasingly recognizing the value of the digital asset.

As Bitcoin continues to gain mainstream acceptance and adoption, understanding its ownership dynamics can offer valuable insights into market trends and investor behavior. The findings from River Financial Research underscore the evolving landscape of Bitcoin ownership and the various stakeholders contributing to the growth of the cryptocurrency ecosystem.

Leave a Reply