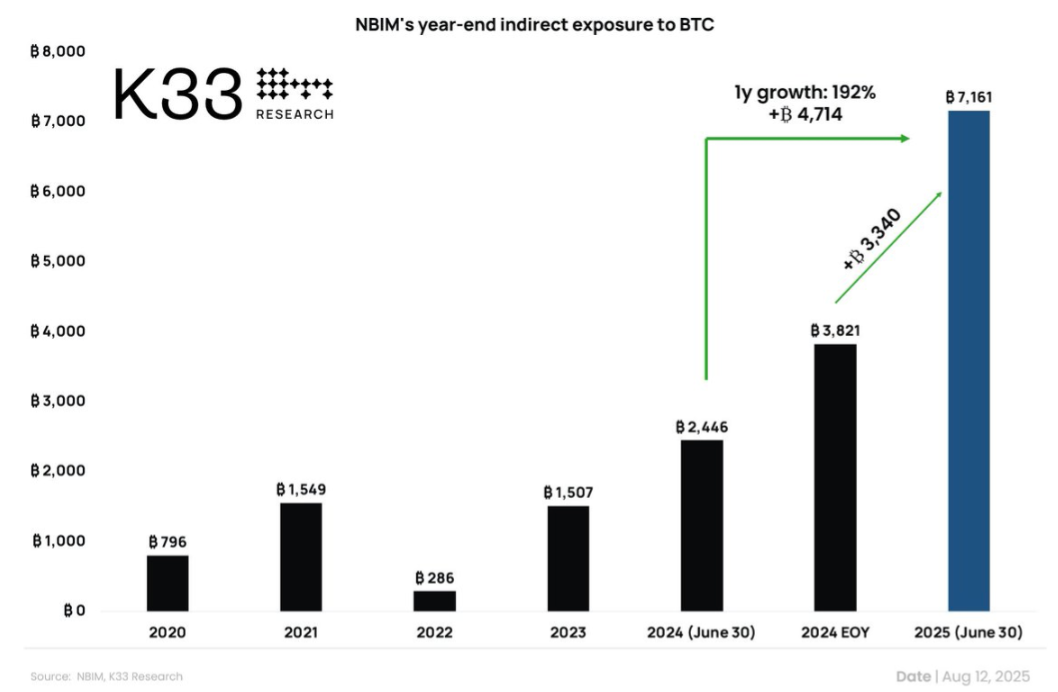

In the second quarter of the year, there has been a noticeable increase in institutional exposure to Bitcoin (BTC) through various investment vehicles, particularly through spot exchange-traded funds (ETFs) such as the Institutional Bitcoin ETF (IBIT) and crypto-linked stocks. This trend indicates a growing level of comfort and acceptance of the cryptocurrency asset class among traditional financial institutions and investors.

Spot ETFs like IBIT provide institutional investors with a way to gain exposure to Bitcoin without needing to directly hold the digital asset themselves. This type of investment vehicle tracks the price of Bitcoin and allows investors to participate in the potential returns of the cryptocurrency market without the complexities of purchasing and storing the digital currency. By investing in spot ETFs, institutions can diversify their portfolios and potentially benefit from the volatility and growth potential of Bitcoin.

In addition to spot ETFs, institutions are also increasing their exposure to the crypto market through investments in crypto-linked stocks. These stocks are tied to the performance of cryptocurrencies or blockchain technology companies, offering indirect exposure to the crypto market. By investing in these stocks, institutions can gain exposure to the growing blockchain and cryptocurrency industry without directly holding digital assets.

The growing interest in Bitcoin and the broader crypto market among institutional investors is a significant development for the industry. It signals a shift towards mainstream acceptance and adoption of cryptocurrencies as a legitimate asset class. Institutions are recognizing the potential benefits of investing in Bitcoin, including portfolio diversification, potential high returns, and exposure to a rapidly evolving and innovative market.

The increased institutional exposure to Bitcoin in the second quarter reflects a broader trend of growing institutional interest in cryptocurrencies. As regulatory clarity improves and infrastructure for institutional investments in the crypto market matures, more traditional financial institutions are likely to enter the space. This influx of institutional capital could further drive the adoption and acceptance of cryptocurrencies, potentially leading to increased market liquidity and stability.

Overall, the growing comfort and interest of institutions in Bitcoin and the crypto market bode well for the future of the industry. As institutional investors continue to ramp up their exposure to cryptocurrencies through spot ETFs like IBIT and crypto-linked stocks, the market is likely to see increased participation, liquidity, and legitimacy. This trend underscores the growing importance of cryptocurrencies as a new asset class that is here to stay in the financial world.

Leave a Reply