Recently, there has been a notable shift in market sentiment towards Ethereum, the second-largest cryptocurrency by market capitalization, as downside insurance premiums for Ether have surged above those for Bitcoin. This development has caught the attention of crypto investors and analysts alike, sparking discussions about the potential reasons behind this shift and its implications for the broader crypto market.

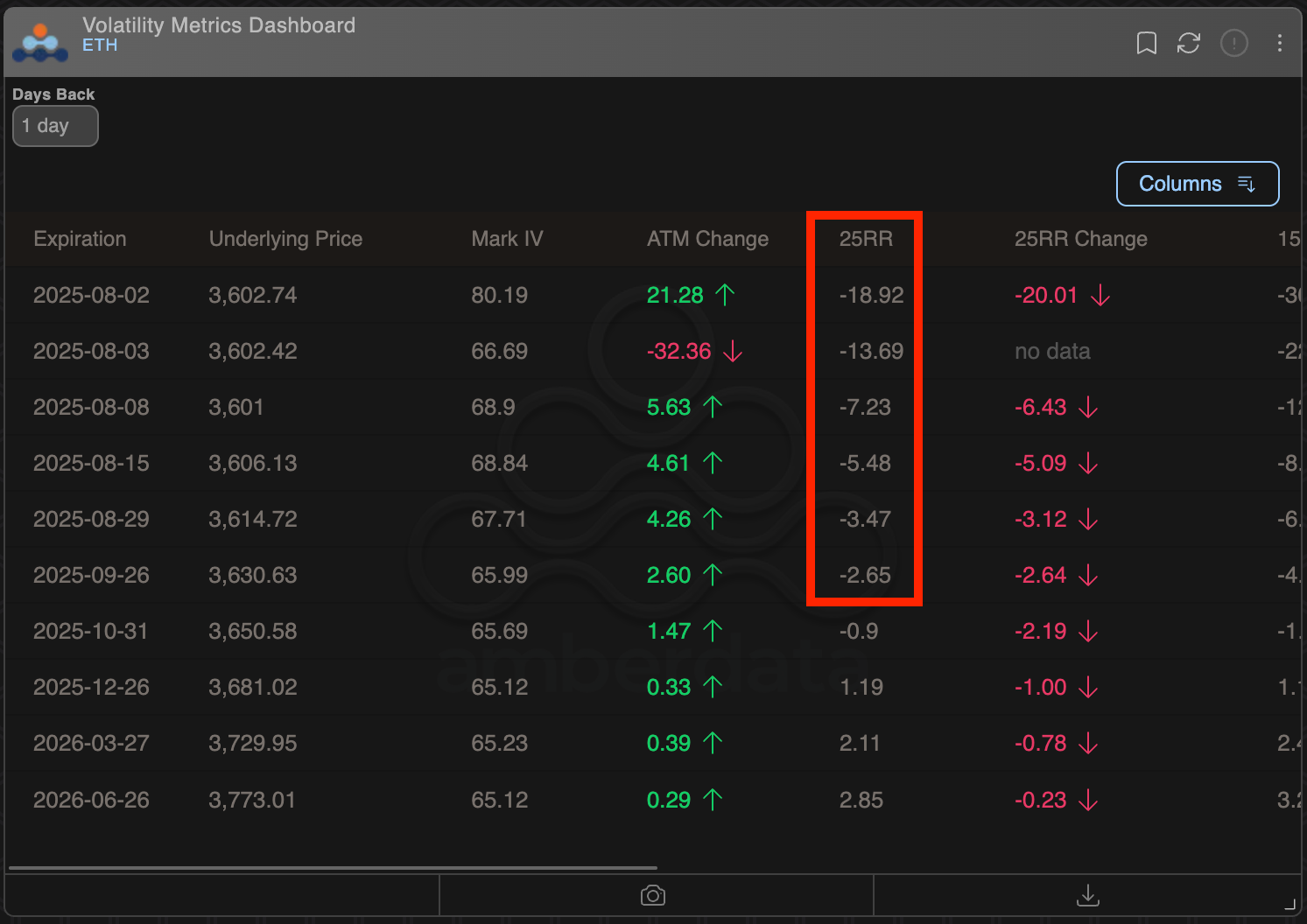

The cost of downside insurance premiums, also known as put options, reflects the market's perception of the likelihood of a significant price decline in a particular asset. When put options for a specific cryptocurrency become more expensive compared to others, it suggests that investors are increasingly bearish on that asset's price outlook.

In the case of Ethereum, the rising cost of downside insurance premiums indicates a growing concern among market participants about the potential for a significant price drop in Ether. This shift in sentiment comes against the backdrop of a series of challenges facing the Ethereum network, including high gas fees, scalability issues, and the delayed transition to Ethereum 2.0.

The surge in downside insurance premiums for Ether relative to Bitcoin is significant as Bitcoin has traditionally been viewed as a leading indicator for the broader cryptocurrency market. Historically, movements in Bitcoin's price have had a strong influence on the direction of other cryptocurrencies, including Ethereum. Therefore, the divergence in insurance costs between the two assets could signal a decoupling of their price movements, with Ethereum facing increased selling pressure compared to Bitcoin.

Analysts point to several factors that may be contributing to the bearish sentiment towards Ethereum. The ongoing regulatory scrutiny of decentralized finance (DeFi) platforms built on the Ethereum network, concerns about the network's ability to handle increasing transaction volumes, and competition from rival smart contract platforms are all potential reasons why investors are becoming more cautious about Ether's price prospects.

However, it is essential to note that market sentiment is just one of many factors that can influence the price dynamics of cryptocurrencies. While rising downside insurance premiums for Ethereum may indicate growing bearish sentiment, it is not a definitive predictor of future price movements. Crypto markets are notoriously volatile and subject to a wide range of factors, including macroeconomic trends, regulatory developments, and technological advancements.

As the crypto market continues to evolve and mature, investors are advised to conduct thorough research and exercise caution when interpreting market signals. While the shift in sentiment against Ethereum may warrant attention, it is essential to approach such developments with a balanced perspective and consider the broader context in which they occur.

Leave a Reply