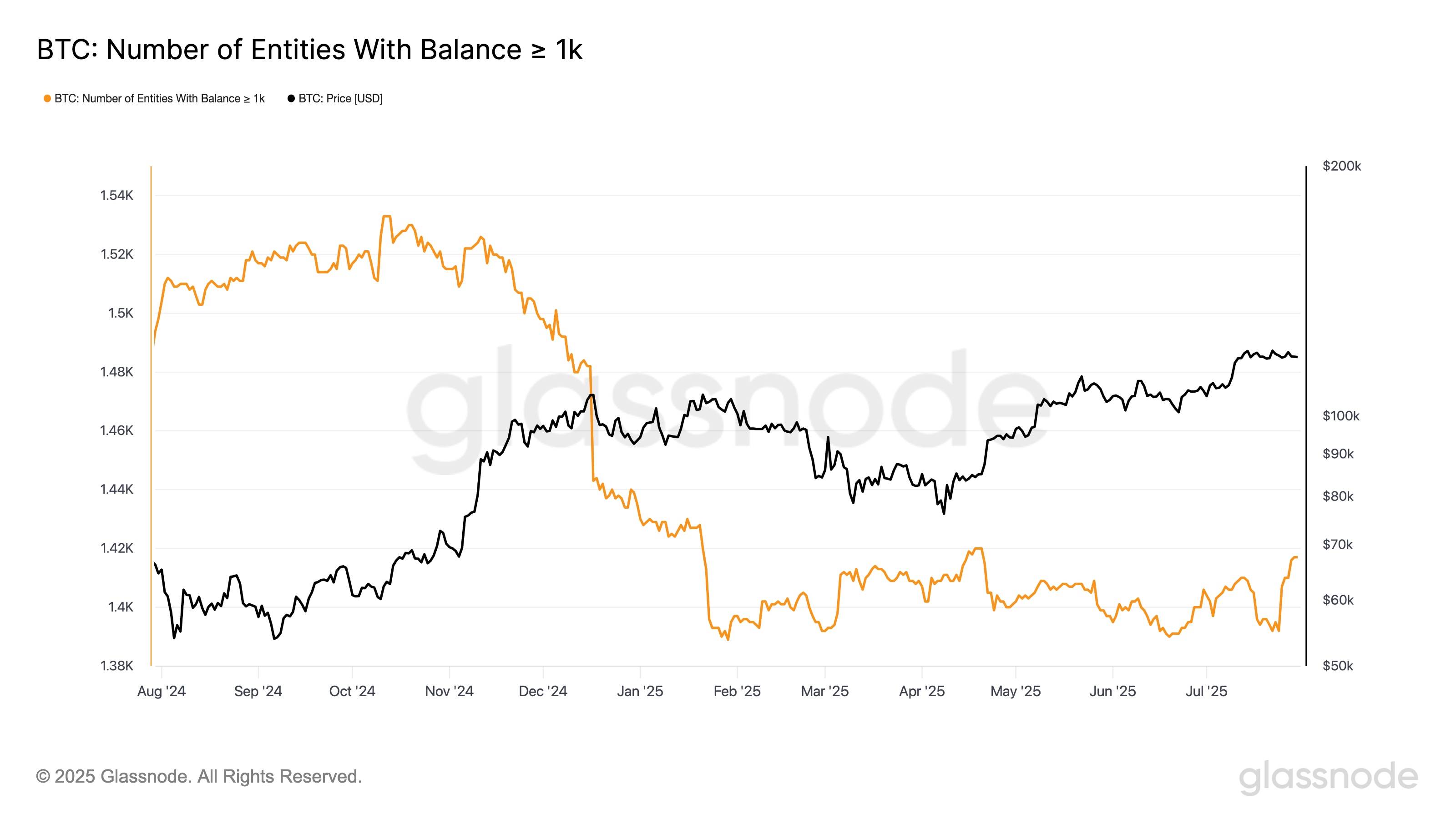

As the cryptocurrency market continues to make headlines, a notable trend has emerged – both retail and institutional investors are actively accumulating Bitcoin (BTC) at a rapid pace. This surge in buying activity is reminiscent of bullish patterns observed during the 2024 U.S. election, signaling a potentially significant shift in market sentiment.

Retail investors, often characterized as individual traders and small-scale investors, have been increasingly drawn to Bitcoin as a store of value and a potential hedge against inflation. The accessibility of cryptocurrencies through various platforms and the growing acceptance of digital assets in mainstream financial markets have contributed to the rising interest among retail investors.

On the other hand, institutional investors, including hedge funds, asset management firms, and corporate treasuries, have also shown a strong appetite for Bitcoin. These sophisticated investors are attracted to the potential for long-term growth and the diversification benefits that Bitcoin can offer to their portfolios. Notable companies like Tesla, MicroStrategy, and Square have publicly disclosed their significant investments in Bitcoin, further fueling institutional interest in the digital asset.

The current accumulation trend in Bitcoin is drawing parallels to the market behavior observed during the 2024 U.S. election. During that period, Bitcoin experienced a surge in demand as investors sought alternative assets amid economic uncertainty and market volatility. The price of Bitcoin surged to new highs, reflecting the growing confidence in the digital currency as a legitimate investment option.

The increased accumulation of Bitcoin by both retail and institutional investors is seen as a positive sign for the cryptocurrency market. It suggests a growing acceptance and adoption of Bitcoin as a mainstream asset class, potentially paving the way for further price appreciation in the future.

Market analysts and experts are closely monitoring these developments, noting that the current accumulation patterns could fuel a sustained upward trend in Bitcoin's price. Factors such as increasing institutional adoption, limited supply, and growing retail interest are all contributing to a positive outlook for Bitcoin in the coming months.

Despite the volatility inherent in the cryptocurrency market, the continued accumulation of Bitcoin by both retail and institutional investors underscores the growing confidence in the digital asset. As Bitcoin cements its position as a viable investment option and a hedge against traditional financial risks, the stage is set for further growth and maturation of the cryptocurrency market.

In conclusion, the aggressive accumulation of Bitcoin by retail and institutional investors is a significant development that could have far-reaching implications for the cryptocurrency market. With parallels drawn to previous bullish patterns, the current trend signals a potential shift in market sentiment and a positive outlook for Bitcoin's future performance.

Leave a Reply