The surge in the price of Bitcoin has been making headlines as it continues to break records and attract more institutional interest. This has sparked discussions about the concept of hyperbitcoinization, a once-theoretical idea that is now gaining traction as a potential macro trend in the world of cryptocurrency.

Hyperbitcoinization refers to a hypothetical scenario in which the use of Bitcoin becomes the dominant form of currency worldwide. In this scenario, Bitcoin would not only be widely accepted for transactions but also serve as a unit of account and store of value. While this idea may have seemed far-fetched in the past, the current momentum behind Bitcoin is leading some to believe that it could become a reality in the future.

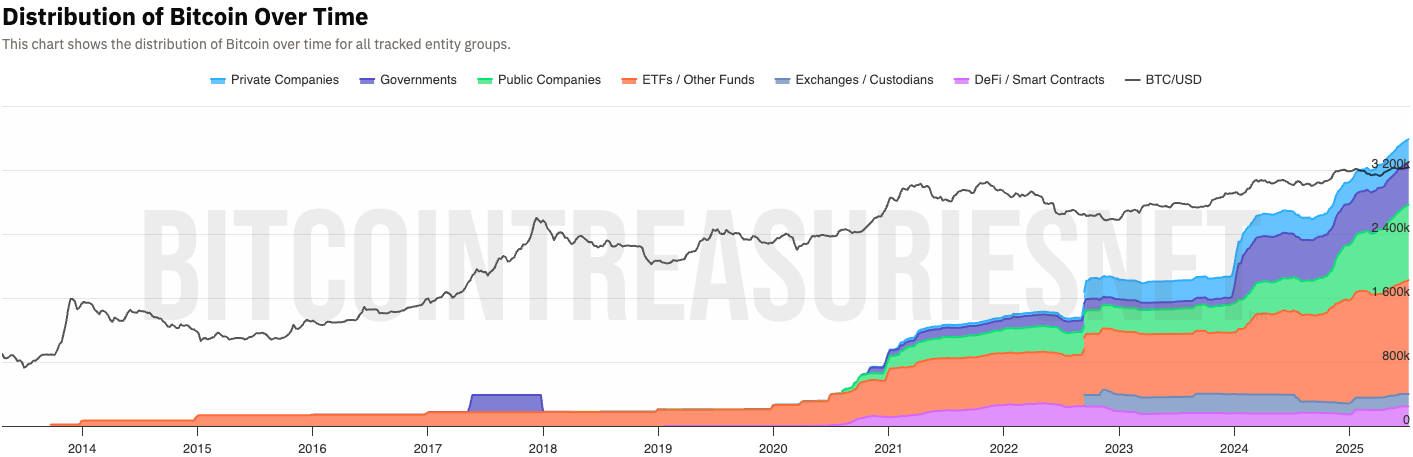

The growing institutional demand for Bitcoin is a key factor driving the idea of hyperbitcoinization. Large companies and financial institutions are increasingly recognizing the value of Bitcoin as a hedge against inflation and economic uncertainty. In recent months, several high-profile companies have announced significant investments in Bitcoin, further legitimizing its role as a store of value.

Moreover, the ongoing mainstream adoption of Bitcoin is also contributing to the potential for hyperbitcoinization. More merchants are accepting Bitcoin as a form of payment, and the infrastructure for using Bitcoin in everyday transactions is continually improving. Additionally, the growing interest in decentralized finance (DeFi) and other blockchain applications is expanding the use cases for Bitcoin and other cryptocurrencies.

While hyperbitcoinization remains a speculative concept, the current trends in the cryptocurrency market are making it a more plausible scenario. As Bitcoin continues to gain mainstream acceptance and institutional support, the idea of a future in which Bitcoin is the dominant form of currency is no longer just a crypto dream but a potential reality.

However, it is important to note that there are still significant hurdles to overcome before hyperbitcoinization can become a widespread phenomenon. Regulatory challenges, scalability issues, and competition from other cryptocurrencies are just a few of the obstacles that Bitcoin would need to address in order to achieve global dominance.

In conclusion, the concept of hyperbitcoinization is gaining traction as Bitcoin's price surges and institutional demand increases. While the idea of a world where Bitcoin is the predominant currency is still speculative, the current trends in the cryptocurrency market suggest that it may not be as far-fetched as it once seemed. As Bitcoin continues to evolve and gain mainstream acceptance, the possibility of hyperbitcoinization becoming a macro trend is becoming more plausible.

Leave a Reply