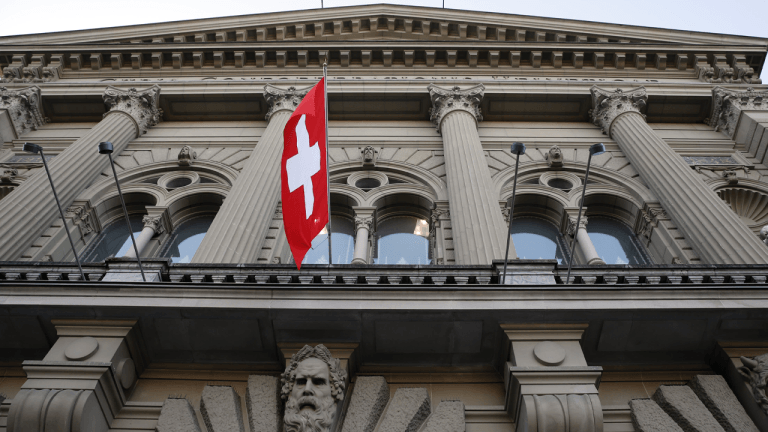

On June 19, 2025, the Swiss National Bank (SNB) made a significant move by cutting its key interest rate to 0%, reintroducing a zero interest rate policy (ZIRP) that came into effect immediately. This decision from the SNB underscores the central bank's efforts to navigate the economic challenges and uncertainties of the times.

The cut in the policy rate by 0.25 percentage points to 0% marks the sixth consecutive reduction by the SNB. This move reflects the bank's commitment to stimulating economic growth, managing inflation, and supporting the country's financial stability.

The SNB's decision to join the Zero-Rate Club aligns with the actions of other central banks around the world that have resorted to similar measures in response to global economic conditions. By setting the interest rate at zero, the SNB aims to encourage borrowing and spending, thereby boosting economic activity and potentially preventing deflation.

The impact of the SNB's zero interest rate policy will be felt across various sectors of the Swiss economy. Lower interest rates can lead to cheaper borrowing costs for businesses and consumers, potentially stimulating investment, consumption, and overall economic growth. However, prolonged periods of low or zero interest rates also raise concerns about their long-term effects on financial markets, asset prices, and the banking sector.

While the SNB's decision may provide a short-term boost to the economy, it also raises questions about the sustainability of such policies and their effectiveness in the face of ongoing economic challenges. Critics of zero interest rate policies argue that they can distort market mechanisms, create asset bubbles, and limit the central bank's ability to respond to future crises.

In addition to lowering the policy rate, the SNB may also consider other unconventional monetary policy tools to support its objectives. These could include interventions in currency markets, asset purchases, or forward guidance to influence market expectations and behavior.

The SNB's decision to implement a zero interest rate policy comes at a time when global economic conditions remain uncertain, with challenges such as geopolitical tensions, trade disputes, and the ongoing impact of the COVID-19 pandemic. As central banks worldwide continue to navigate these challenges, the effectiveness and implications of zero interest rate policies will remain a topic of debate among economists, policymakers, and market participants.

Overall, the SNB's move to join the Zero-Rate Club reflects its commitment to supporting the Swiss economy and ensuring stability in the face of evolving economic conditions. Time will tell how effective these measures will be in achieving

Source: https://news.bitcoin.com/zero-percent-switzerland-reverts-to-0-rates-to-counter-deflation-pressure/

Leave a Reply