Greg Cipolaro, the Head of Research at New York Digital Investment Group (NYDIG), has raised concerns about the commonly used metric mNAV for measuring relative valuations in the cryptocurrency space. In a recent statement, Cipolaro argued that mNAV, or market-neutral asset value, may not provide an accurate representation of the true value of digital assets.

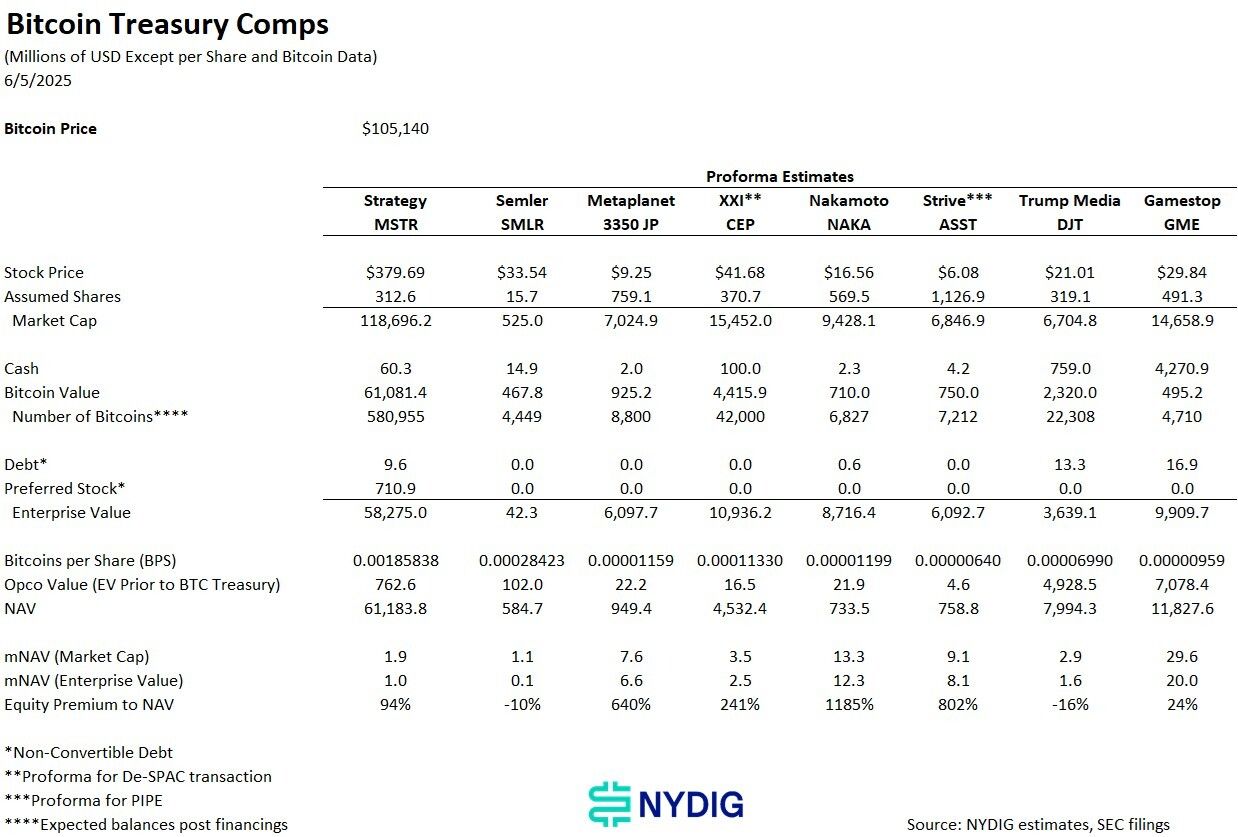

mNAV is a metric used to assess the relative valuation of cryptocurrencies by comparing their market prices to their net asset value. It is often used by investors to determine whether a particular cryptocurrency is overvalued or undervalued in the market. However, Cipolaro believes that mNAV may not be the most reliable indicator due to various factors that can distort its accuracy.

One of the main issues with mNAV, according to Cipolaro, is the lack of transparency in the underlying data used to calculate it. He argues that the data sources and methodologies used to determine the net asset value of cryptocurrencies are often opaque and can be manipulated, leading to inaccuracies in the mNAV calculation. This lack of transparency can make it difficult for investors to make informed decisions based on mNAV alone.

Furthermore, Cipolaro points out that mNAV may not take into account important factors that can influence the valuation of cryptocurrencies, such as market dynamics, investor sentiment, and macroeconomic trends. As a result, relying solely on mNAV to assess the relative valuation of digital assets may not provide a complete picture of their true value.

In light of these concerns, Cipolaro suggests that investors should consider using a more comprehensive approach to evaluating the valuation of cryptocurrencies. This could involve analyzing a wider range of factors, including fundamental analysis, technical analysis, and market trends, to get a more accurate assessment of the value of digital assets.

Despite the criticisms of mNAV, it remains a widely used metric in the cryptocurrency industry due to its simplicity and ease of calculation. However, Cipolaro's comments highlight the importance of taking a more holistic approach to evaluating the valuation of digital assets in order to make informed investment decisions.

In conclusion, Greg Cipolaro's concerns about the limitations of mNAV as a gauge for measuring relative valuations in the cryptocurrency market serve as a reminder for investors to exercise caution and consider multiple factors when assessing the value of digital assets. By taking a more comprehensive approach to valuation, investors can make better-informed decisions and mitigate risks in the volatile world of cryptocurrencies.

Leave a Reply