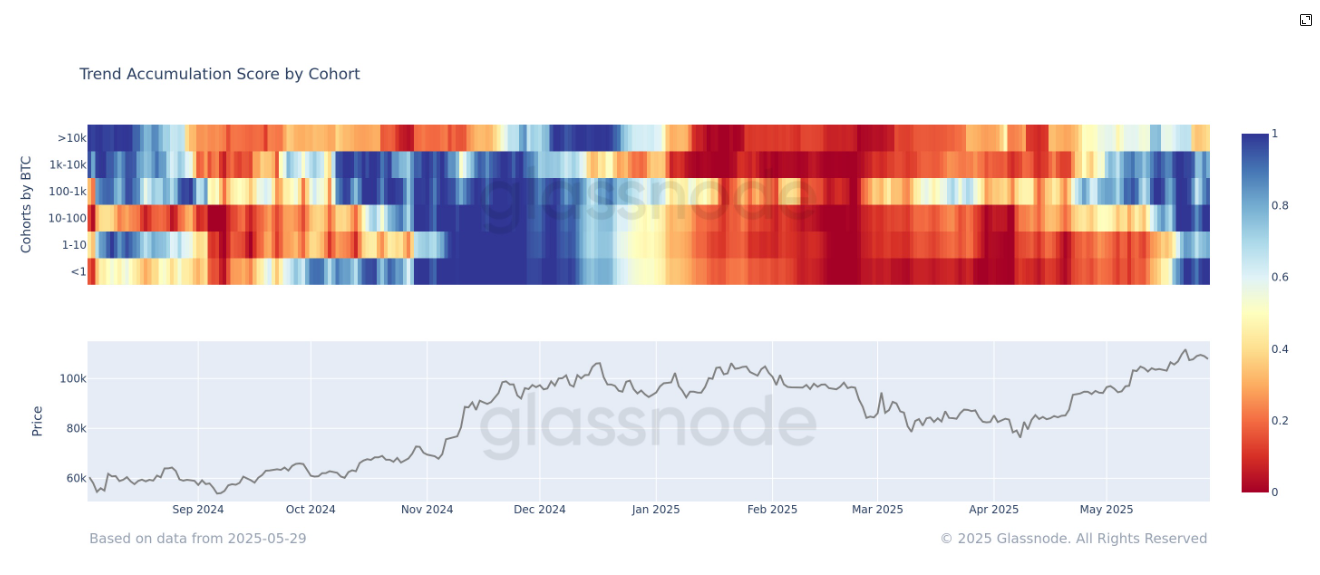

In the world of cryptocurrency, market trends and investor behaviors play a crucial role in shaping the direction of digital assets. Recently, a significant shift has been observed as large holders are transitioning from accumulation to distribution strategies, particularly as the market hovers in rangebound levels.

Accumulation typically refers to the process of investors acquiring a particular asset, such as cryptocurrencies, with the expectation of long-term growth and value appreciation. This strategy often involves buying assets at lower prices and holding onto them for an extended period. On the other hand, distribution entails selling or offloading assets that have been accumulated over time.

The transition from accumulation to distribution among large holders suggests a change in market sentiment and investor behavior. When large holders, sometimes referred to as whales in the crypto world, begin to sell off their holdings, it can have a significant impact on market dynamics. This shift may indicate that these investors believe that the current price levels are favorable for profit-taking or that they anticipate a potential downturn in the market.

The fact that the market is currently in rangebound levels adds another layer of complexity to this situation. Rangebound markets are characterized by price levels that fluctuate within a defined range, often lacking a clear trend in either direction. In such conditions, traders and investors may struggle to identify profitable opportunities, leading to a sense of uncertainty and indecision.

As large holders adjust their strategies in response to market conditions, it is essential for retail investors to stay informed and cautious. Sudden shifts in market dynamics, especially when driven by whale activity, can lead to increased volatility and potential price swings. Traders and investors should carefully monitor market developments and consider implementing risk management strategies to protect their investments.

Additionally, understanding the motivations behind the actions of large holders can provide valuable insights into market trends and potential future price movements. By analyzing patterns of accumulation and distribution among whales, investors can gain a better understanding of market sentiment and make more informed decisions regarding their own portfolios.

In conclusion, the shift from accumulation to distribution among large holders in the cryptocurrency market, combined with the current rangebound levels, highlights the importance of vigilance and careful risk management. As market conditions evolve, staying informed and adapting to changing dynamics will be key for investors looking to navigate the volatile world of digital assets.

Leave a Reply