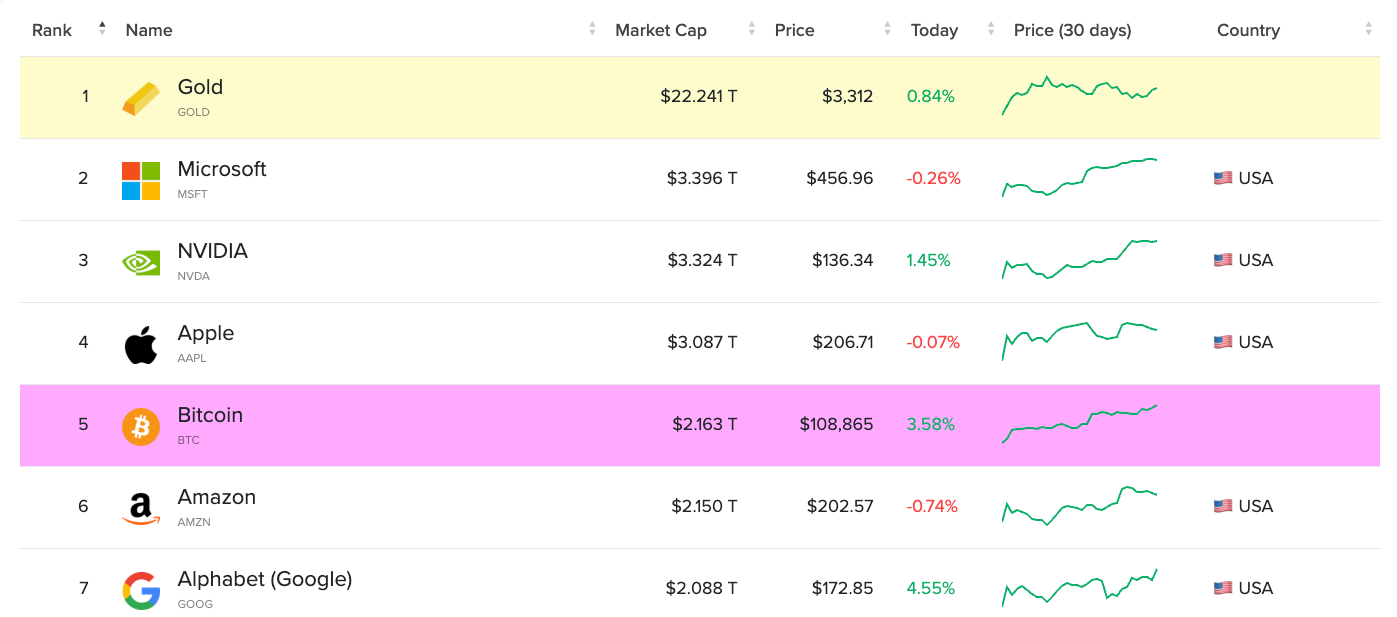

Bitcoin, the world's most popular cryptocurrency, reached a new all-time high of $109,400 on Wednesday. This surge in price came amidst a period of heightened interest and investment in digital currencies, with Bitcoin leading the charge as investors sought a hedge against inflation and economic uncertainty.

The rise to $109,400 represented a significant milestone for Bitcoin, which has experienced a rollercoaster ride of price fluctuations in recent years. The cryptocurrency's previous all-time high was $64,863 in April 2021, meaning that Wednesday's peak marked a substantial increase in value for Bitcoin holders.

While the price of Bitcoin did experience a slight consolidation after reaching this new high, many analysts and investors remain optimistic about its long-term prospects. The cryptocurrency has gained mainstream acceptance in recent years, with major companies and financial institutions starting to embrace Bitcoin as a legitimate asset class.

One of the key factors driving Bitcoin's price surge is the growing institutional interest in the cryptocurrency. Institutional investors, including hedge funds and asset managers, have been increasingly allocating funds to Bitcoin as a way to diversify their portfolios and potentially generate higher returns. This influx of institutional capital has provided a significant boost to Bitcoin's price and credibility as an investment asset.

Furthermore, the ongoing macroeconomic environment, characterized by low interest rates and unprecedented levels of monetary stimulus, has also fueled demand for alternative assets like Bitcoin. Many investors view Bitcoin as a safe haven asset that can protect against the devaluation of fiat currencies and the potential risks of traditional financial markets.

In addition to institutional interest and macroeconomic factors, the growing adoption of Bitcoin as a means of payment and store of value has also contributed to its price appreciation. More merchants and businesses are accepting Bitcoin as a form of payment, and individuals are increasingly using it as a store of value or long-term investment.

Despite its recent price surge, Bitcoin remains a highly volatile asset, and investors should exercise caution when trading or investing in the cryptocurrency. Price fluctuations of several thousand dollars within a short period are not uncommon in the world of Bitcoin, and investors should be prepared for sudden and sharp price swings.

In conclusion, Bitcoin's rise to a new high of $109,400 on Wednesday reflects the growing interest and adoption of the cryptocurrency as a legitimate investment asset. While the price of Bitcoin may experience short-term fluctuations, many investors and analysts remain bullish on its long-term prospects as a store of value and hedge against economic uncertainty.

Leave a Reply