Bitcoin (BTC) surged back above $104,000 on Tuesday, driven by a combination of factors including positive inflation data, President Trump's optimistic remarks on financial markets, and Coinbase's recent inclusion in the S&P 500. The cryptocurrency market saw a boost after April's Consumer Price Index (CPI) came in lower than expected, easing concerns about inflation pressures on the Federal Reserve. Federal Reserve Chair Jerome Powell's upcoming speech on Thursday is anticipated to provide further insight into the central bank's policy direction.

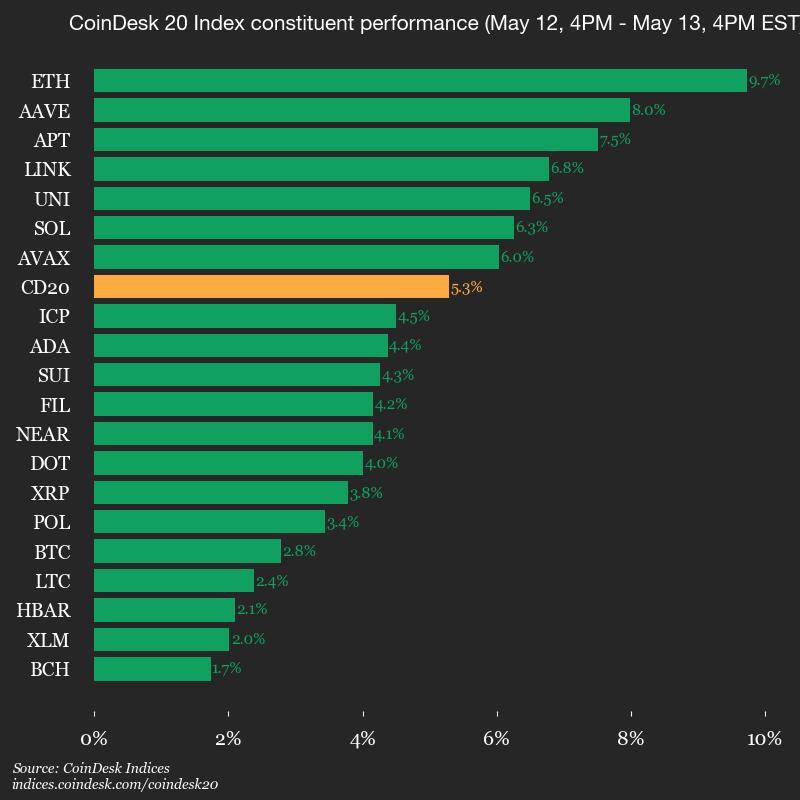

President Trump's comments at the Saudi–U.S. Investment Forum in Riyadh, where he expressed confidence in the potential for markets to rise even higher, added to the positive sentiment. Bitcoin approached the $105,000 mark before retracing slightly, trading at around $104,400 at the time of reporting, marking a 2.4% increase over the past 24 hours. The broader cryptocurrency market also saw gains, with Ethereum's ether (ETH) rising over 9% to reach $2,700, while altcoins like Eigenlayer's governance token EIGEN and EtherFi's native token ETHFI recorded daily gains of over 20-30%.

Stock markets also continued their upward trajectory, with the Nasdaq and S&P 500 closing the session up by 1.6% and 0.75%, respectively. Coinbase (COIN), the Nasdaq-listed crypto exchange, surged 24% during the day following its inclusion in the S&P 500 index. Analysts at Jefferies predicted that this move could lead to $16 billion in buying pressure for Coinbase shares. Joel Kruger, a market strategist at LMAX Group, highlighted that the recent rally in the crypto market shows signs of momentum and room for further growth.

Institutional interest in cryptocurrencies is on the rise, with developments like Coinbase's S&P 500 inclusion and a positive regulatory outlook from SEC Chair Paul Atkins indicating a shift towards broader acceptance of digital assets. Paul Howard, senior director at trading firm Wincent, noted that while altcoins are following the market rally, institutional investors are likely to be more selective in their choices, potentially benefiting stronger projects in the long run.

Looking ahead, Bitfinex analysts suggest that while BTC faces resistance in the $104,000-$106,000 range, a short-term consolidation phase may be imminent, with key support levels around $98,000. Despite short-term fluctuations, the medium and long-term outlook for Bitcoin remains bullish,

Leave a Reply