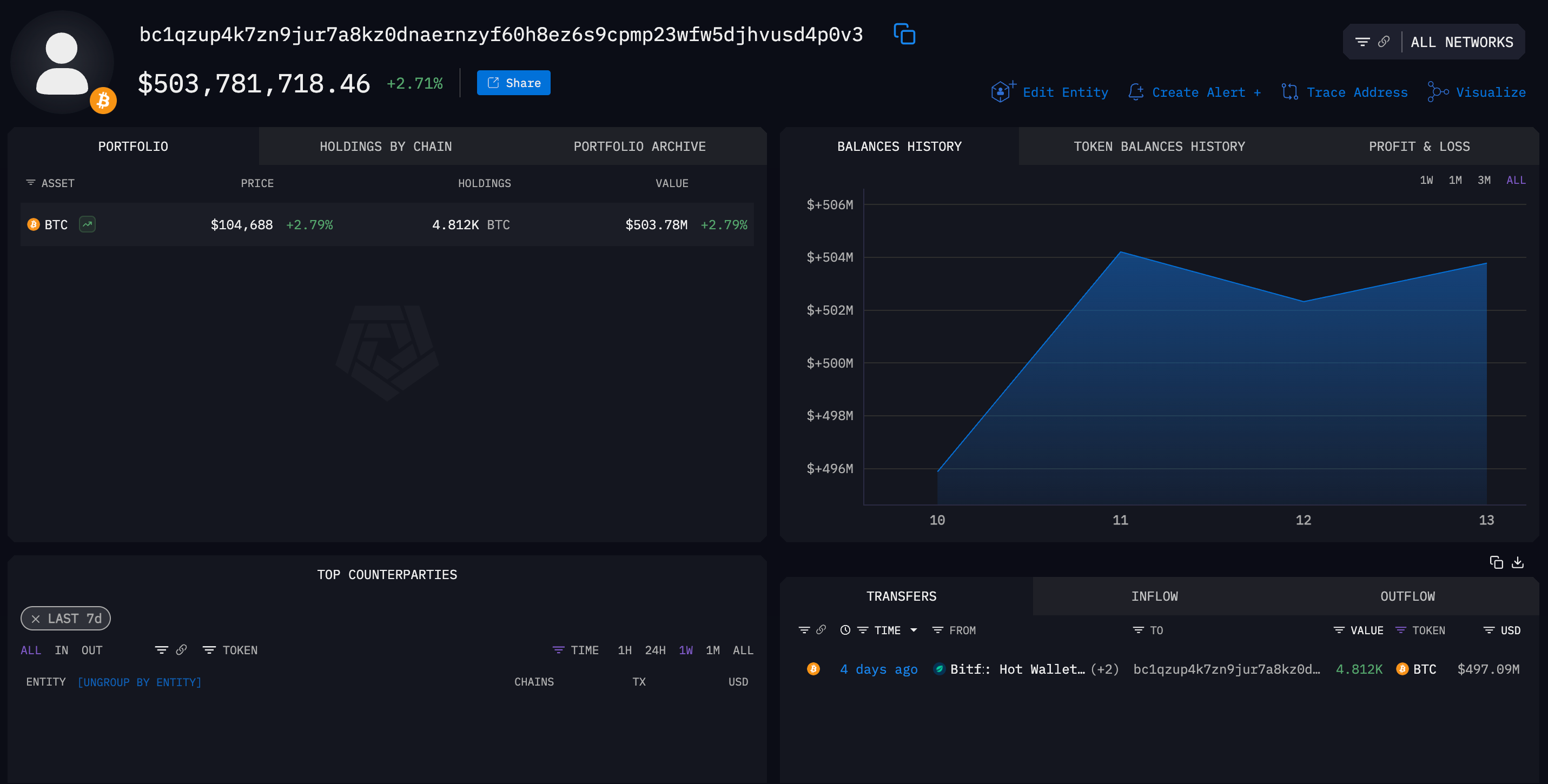

In a significant move in the cryptocurrency market, the Bitcoin treasury company has recently made a substantial purchase using Tether, a popular stablecoin in the digital asset space. The company acquired Bitcoin at an average price of $95,320 per BTC, indicating a strong belief in the long-term value and potential growth of the leading cryptocurrency.

This purchase exemplifies the growing trend of companies and institutional investors diversifying their portfolios by including cryptocurrencies as a hedge against inflation and traditional market volatility. Bitcoin, in particular, has gained traction as a store of value and a digital asset with the potential for significant appreciation over time.

The decision to transact in Tether, a stablecoin pegged to the US dollar, highlights the importance of stablecoins in facilitating transactions within the cryptocurrency ecosystem. Stablecoins offer the benefits of cryptocurrencies, such as fast and secure transactions, while mitigating the price volatility associated with traditional cryptocurrencies like Bitcoin.

The average purchase price of $95,320 per BTC indicates a bullish outlook on the future price trajectory of Bitcoin. Despite recent fluctuations in the cryptocurrency market, many investors and institutions remain optimistic about the long-term growth potential of digital assets. With increasing adoption and mainstream acceptance, cryptocurrencies are becoming an integral part of diversified investment portfolios.

The Bitcoin treasury company's strategic purchase also underscores the growing interest in cryptocurrencies as an alternative asset class. As traditional financial markets face uncertainty and economic challenges, more investors are turning to digital assets as a means of preserving and growing their wealth.

Furthermore, the use of Tether in this transaction highlights the importance of stablecoins in facilitating large-scale transactions in the cryptocurrency market. Stablecoins provide a reliable means of transferring value quickly and securely, without the price volatility commonly associated with cryptocurrencies.

Overall, the Bitcoin treasury company's recent purchase using Tether at an average price of $95,320 per BTC is a testament to the growing acceptance and adoption of cryptocurrencies in the financial world. As digital assets continue to gain momentum and recognition as legitimate investment options, more companies and institutional investors are likely to follow suit and incorporate cryptocurrencies into their portfolios. This move not only diversifies investment strategies but also positions these entities to benefit from the potential growth and innovation in the burgeoning cryptocurrency market.

Leave a Reply