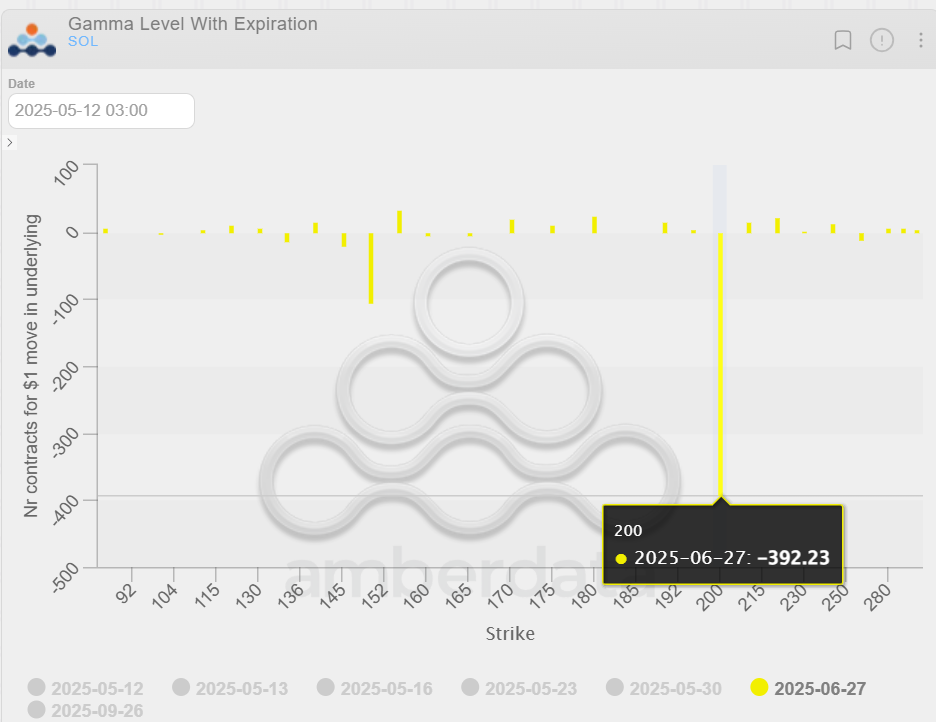

Block traders have recently shown a notable interest in the cryptocurrency market, specifically in the form of call options. In a recent development, there has been a significant surge in block traders focusing on the $200 call option that is set to expire on June 27th.

Call options are financial contracts that give the holder the right, but not the obligation, to purchase an asset at a specified price within a set timeframe. In this case, the $200 call option indicates that traders are betting on the price of a particular cryptocurrency surpassing $200 by the expiration date of June 27th.

The involvement of block traders in the cryptocurrency market is often closely monitored due to the influence they can have on market movements. Block traders are typically large institutional investors or hedge funds that execute substantial trades in the market. When these entities concentrate on a specific option, it can signal a significant interest or belief in the potential price movement of the underlying asset.

The decision to focus on the $200 call option suggests that these block traders anticipate a bullish trend in the cryptocurrency market leading up to the expiration date. This could be driven by a variety of factors, such as positive market sentiment, upcoming developments in the cryptocurrency space, or overall market conditions.

It is essential to note that options trading can be complex and risky, as it involves predicting the price movement of assets within a specific timeframe. While call options offer the potential for significant gains if the price of the underlying asset rises above the specified strike price, there is also the risk of losing the initial investment if the price does not reach the expected level.

The increased interest in the $200 call option expiring on June 27th highlights the growing sophistication of trading strategies within the cryptocurrency market. As institutional investors and hedge funds continue to enter the space, their trading activities can provide valuable insights into market trends and potential price movements.

Traders and investors in the cryptocurrency market should pay attention to developments involving block traders and their trading activities, as they can offer valuable clues about market dynamics and potential future price movements. While options trading can be lucrative, it is crucial to conduct thorough research and risk analysis before engaging in such trading activities to mitigate potential losses.

In conclusion, the recent focus on the $200 call option expiring on June 27th by block traders underscores the evolving nature of the cryptocurrency market and the increasing interest from institutional players. This development serves as a reminder of the importance of staying informed and cautious when navigating the complexities of options trading in the dynamic cryptocurrency landscape.

Leave a Reply