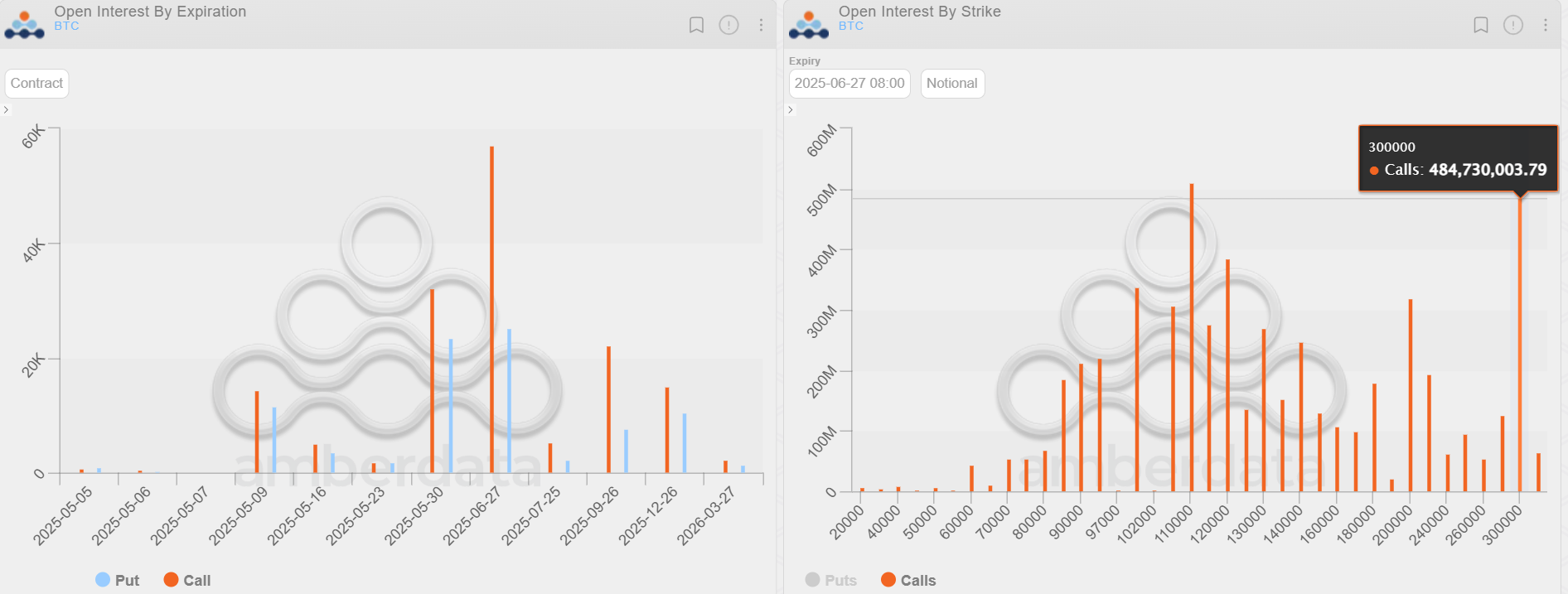

As the cryptocurrency market continues to evolve and attract a diverse range of investors, the appeal of digital assets as a hedge against hyperinflation is becoming increasingly prominent. One observer noted that there is a growing interest in a $300,000 call option set to expire on June 26, indicating a strong belief among some market participants in the potential for significant price appreciation in the near term.

The concept of using cryptocurrencies as a hedge against hyperinflation is not new, but it has gained renewed attention in light of recent economic uncertainty and unprecedented levels of monetary stimulus. With central banks around the world implementing aggressive monetary policies to combat the economic fallout of the COVID-19 pandemic, concerns about inflation and currency devaluation have been on the rise.

Bitcoin, in particular, has been touted as a potential store of value in times of economic turmoil, given its limited supply and decentralized nature. The $300,000 call option represents a significant bet on the cryptocurrency reaching a new all-time high by the end of June, reflecting the confidence of some investors in its long-term growth prospects.

Options trading allows investors to speculate on the price movements of an underlying asset without actually owning it, providing opportunities for leveraged gains or losses. The open interest in the $300,000 call option suggests that there are a significant number of market participants who believe that Bitcoin could experience a sharp upward move in the coming weeks.

While the cryptocurrency market is known for its volatility and unpredictability, the growing interest in options trading indicates a maturing of the market and the increasing sophistication of investors involved. As more traditional financial institutions and institutional investors enter the space, the use of derivatives such as options is likely to become more common, providing new avenues for speculation and risk management.

It is important to note that options trading carries inherent risks, and investors should carefully consider their risk tolerance and investment objectives before engaging in such activities. The $300,000 call option expiring on June 26 is just one example of the diverse range of trading strategies available in the cryptocurrency market, offering both opportunities for profit and potential losses.

Overall, the interest in options trading and the use of cryptocurrencies as a hedge against hyperinflation reflect the dynamic and evolving nature of the digital asset space. As the market continues to mature and attract a broader range of participants, innovative trading strategies and investment opportunities are likely to proliferate, shaping the future of finance in the digital age.

Leave a Reply