The trend of publicly traded companies adding Bitcoin to their balance sheets has been gaining momentum in recent months. This move, often seen as a way to hedge against inflation and diversify their portfolios, could potentially have a significant impact on the cryptocurrency market by creating increased buying pressure.

Well-known companies such as Tesla, MicroStrategy, and Square have made headlines for their bold decisions to invest in Bitcoin. Tesla, led by billionaire Elon Musk, made waves earlier this year when it announced a $1.5 billion investment in Bitcoin and that it would start accepting the cryptocurrency as payment for its electric vehicles. MicroStrategy, a business intelligence firm, has been one of the most aggressive institutional buyers of Bitcoin, with CEO Michael Saylor leading the charge to convert the company's cash reserves into the digital asset. Square, led by Twitter CEO Jack Dorsey, also made a significant investment in Bitcoin, further solidifying the trend of mainstream adoption.

These high-profile investments by publicly traded companies have not gone unnoticed by investors and analysts. The idea of corporations holding Bitcoin on their balance sheets is seen as a vote of confidence in the cryptocurrency and a validation of its long-term value proposition. As more companies follow suit and allocate a portion of their reserves to Bitcoin, the overall demand for the digital asset is expected to increase, potentially leading to a surge in its price.

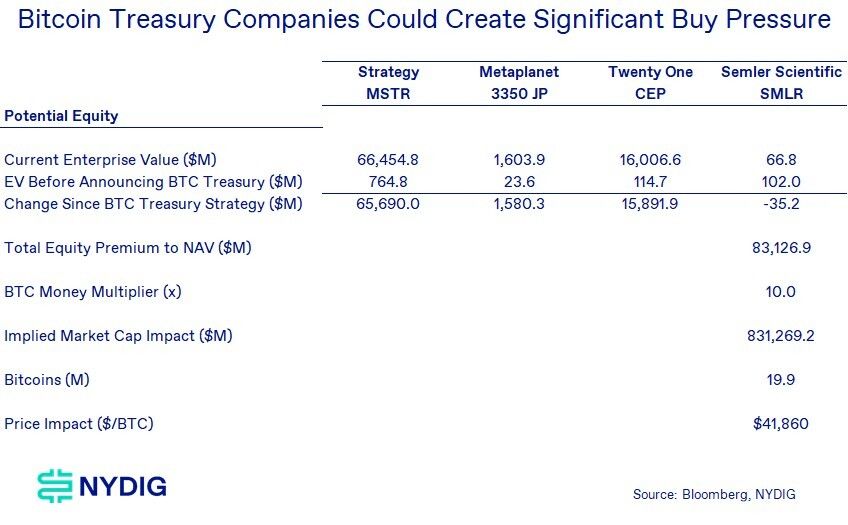

The concept of "buy pressure" refers to the impact that increased buying activity can have on an asset's price. In the case of Bitcoin, large institutional investors and publicly traded companies buying significant amounts of the cryptocurrency could create a scenario where there are more buyers than sellers in the market. This imbalance in supply and demand dynamics could drive up the price of Bitcoin as buyers compete for a limited supply of the asset.

While the idea of publicly traded firms adding Bitcoin to their balance sheets is still relatively new, it has the potential to reshape the cryptocurrency market in significant ways. As more companies recognize the value of holding Bitcoin as a store of value and a hedge against economic uncertainty, we may see a wave of institutional adoption that propels the cryptocurrency to new heights.

In conclusion, the trend of publicly traded companies buying Bitcoin for their balance sheets could indeed result in significant buy pressure in the cryptocurrency market. This influx of institutional capital has the potential to drive up the price of Bitcoin and further cement its status as a mainstream asset class. Investors and analysts will be closely watching how this trend evolves and its impact on the broader financial landscape.

Leave a Reply