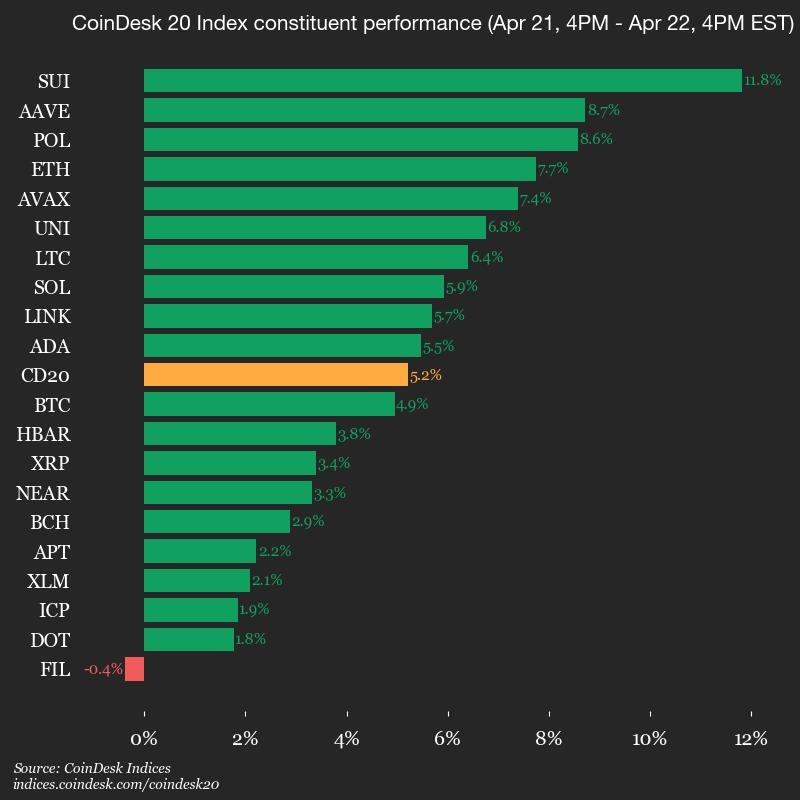

The cryptocurrency market experienced a surge in altcoin prices, with top contenders such as Ethereum (ETH), Dogecoin (DOGE), and Swipe (SUI) leading the rally. This bullish momentum was driven by positive market sentiment following comments made by US Treasury Secretary Janet Yellen regarding US-China trade relations.

Yellen's remarks about the potential for improved trade conditions between the two economic powerhouses boosted investor confidence and risk appetite across various asset classes, including cryptocurrencies. The news acted as a catalyst for altcoins to follow Bitcoin's upward trajectory.

Ethereum, the second-largest cryptocurrency by market capitalization, saw a significant price increase during this period. As a platform that enables smart contracts and decentralized applications, Ethereum's value is closely tied to its utility within the blockchain ecosystem. The positive market sentiment coupled with ongoing developments within the Ethereum network likely contributed to its price surge.

Dogecoin, a meme-inspired cryptocurrency that has gained popularity in recent months, also experienced a notable uptick in its price. Despite its origins as a joke cryptocurrency, Dogecoin has garnered a dedicated community of supporters and has seen increased adoption for various use cases, including charitable donations and online tipping.

Swipe (SUI), a cryptocurrency project focused on providing users with a seamless payment experience through its mobile app and debit card, also recorded gains during this period. The project's emphasis on user-friendly interfaces and integration with traditional financial systems has helped it attract a growing user base.

The correlation between Bitcoin and altcoins is a common phenomenon in the cryptocurrency market. While Bitcoin often sets the tone for the overall market trends, altcoins can experience amplified movements in either direction based on specific catalysts or market conditions.

Overall, the positive momentum in the cryptocurrency market reflects growing interest and adoption of digital assets as viable investment options. As regulatory clarity and institutional involvement continue to evolve, cryptocurrencies are increasingly being viewed as a legitimate asset class with the potential for long-term growth.

Investors and traders in the cryptocurrency market should remain vigilant and conduct thorough research before making any investment decisions, as the market can be volatile and subject to sudden fluctuations. Keeping abreast of market developments, regulatory updates, and project-specific news can help individuals navigate the evolving landscape of digital assets effectively.

Leave a Reply