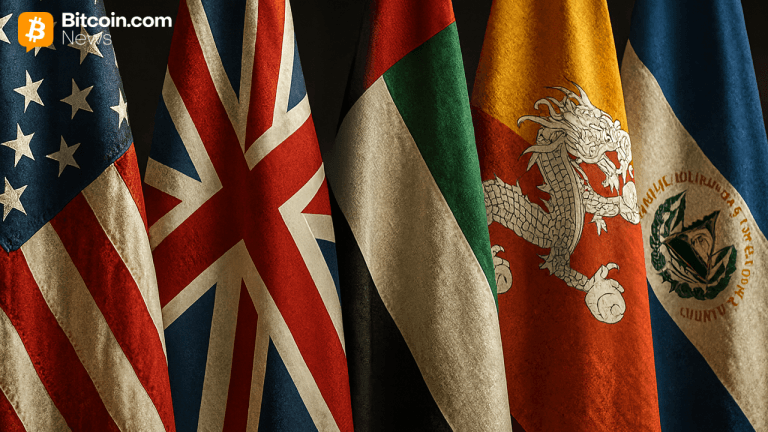

The United States has solidified its position as the largest nation-state holder of bitcoin, with an impressive stash of over 127,000 bitcoins. This substantial holding places the U.S. at the forefront of government entities accumulating the world's leading cryptocurrency. As of October 19, 2025, the U.S. continues to dominate the landscape of government-owned bitcoin reserves.

The growing trend of governments amassing significant amounts of bitcoin is reshaping the traditional financial landscape. While the concept of digital currencies was once viewed with skepticism by governmental bodies, many nations are now actively acquiring and holding bitcoin as part of their strategic reserves.

Beyond the United States, several other countries have also been accumulating substantial amounts of bitcoin. This includes countries like China, Russia, and Germany, which have been steadily increasing their bitcoin holdings in recent years. These nations recognize the potential of bitcoin as a store of value and a hedge against economic uncertainties.

The decision by governments to invest in bitcoin reflects a shifting paradigm in the global financial system. As traditional fiat currencies face challenges such as inflation and geopolitical instability, digital assets like bitcoin offer a decentralized alternative that can potentially provide a more secure store of value.

The transparency of blockchain technology has made it easier to track government-owned bitcoin holdings. While some countries are more open about their bitcoin reserves, others prefer to keep this information confidential. Despite the secrecy surrounding some government-owned bitcoin stashes, it is clear that digital assets have become an integral part of many countries' financial strategies.

The accumulation of bitcoin by governments also raises questions about the future of digital currencies on a global scale. As more nations embrace bitcoin and other cryptocurrencies, the regulatory framework surrounding these assets is likely to evolve. Governments will need to develop clear guidelines and policies to govern the use of digital currencies within their jurisdictions.

In addition to government entities, institutional investors and corporations are also increasing their exposure to bitcoin. This growing interest from institutional players further validates the role of bitcoin as a legitimate asset class with long-term potential.

Overall, the trend of governments amassing bitcoin signifies a broader shift towards digital assets in the global financial landscape. As countries continue to diversify their reserves and adapt to the changing economic environment, bitcoin is likely to play an increasingly significant role in shaping the future of finance.

Source: https://news.bitcoin.com/from-washington-to-the-uk-heres-how-governments-are-stockpiling-bitcoin/

Leave a Reply