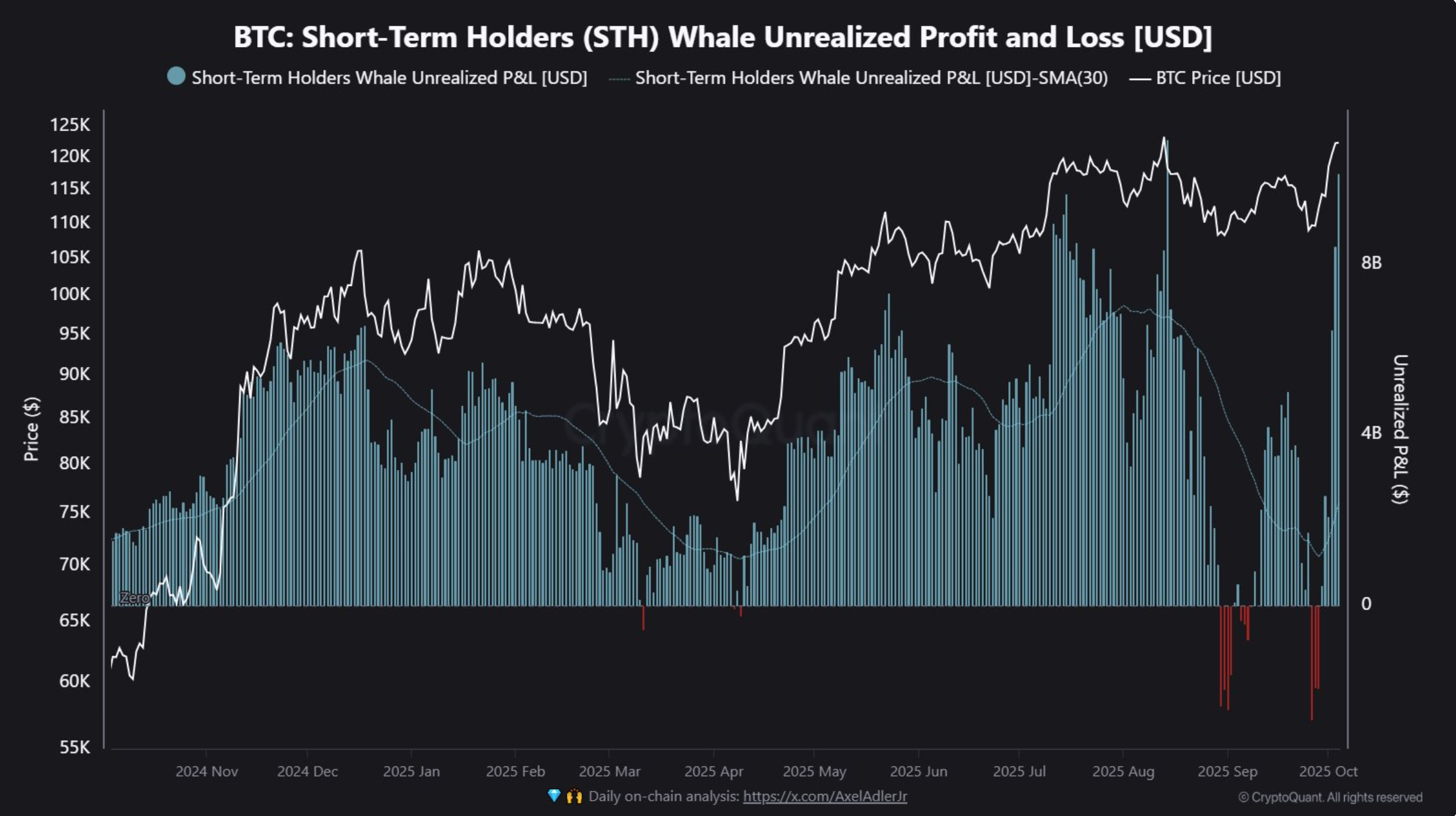

Recent data from cryptocurrency exchanges has revealed a significant movement of $5.7 billion from strong hands (STH) wallets into trading platforms. This transfer of funds is seen as an indication that profit-taking is not just a theoretical concern but a real and active practice among investors in the crypto market.

The term "strong hands" typically refers to long-term holders of cryptocurrencies who are perceived to have a strong belief in the potential of the digital assets they hold. However, the recent influx of funds from these wallets into exchanges suggests that even the most committed investors are not immune to the temptation of realizing profits in a volatile market environment.

This movement of funds from STH wallets to exchanges raises questions about the current sentiment and behavior of crypto investors. It indicates that market participants may be taking advantage of recent price increases to cash out their positions and lock in gains. This behavior is not uncommon in the crypto market, where price fluctuations can be significant and rapid.

The decision to move funds from STH wallets to exchanges can be driven by various factors, including the desire to capitalize on short-term price movements, reduce exposure to market risks, or simply take profits after a period of significant asset appreciation. Regardless of the specific reasons behind these transactions, the data suggests that profit-taking is a prevalent strategy among crypto investors.

The movement of $5.7 billion into exchanges is a substantial sum that could have implications for market dynamics and price trends. When a significant amount of funds is transferred from strong hands to exchanges, it can lead to increased selling pressure and potentially contribute to downward price movements. This influx of funds may also indicate a shift in investor sentiment towards a more cautious or opportunistic approach to managing their crypto holdings.

As the crypto market continues to evolve and mature, understanding investor behavior and market dynamics becomes increasingly important for traders, analysts, and industry observers. The movement of funds from STH wallets to exchanges serves as a reminder that profit-taking is a fundamental aspect of investing in cryptocurrencies and can have a significant impact on market trends.

In conclusion, the recent transfer of $5.7 billion from strong hands wallets into exchanges highlights the active role of profit-taking in the crypto market. This behavior underscores the importance of monitoring market trends, investor sentiment, and trading activity to navigate the dynamic and volatile nature of cryptocurrencies effectively.

Leave a Reply